Alright, let’s dive into the fascinating world of micro-cap software stocks! This article will be structured to be highly scannable and rich in relevant keywords to help it rank well in search engines, all without using a single image.

—–

# Unearthing Hidden Gems: A Deep Dive into Niche Software Micro-Cap Stocks for Savvy investors

The investment landscape is vast, often dominated by headlines about tech giants and established blue-chip companies. But for those with a keen eye for potential and a stomach for higher risk, a different, often overlooked segment offers intriguing opportunities: niche software micro-cap stocks. These aren’t your everyday household names; they’re smaller, agile companies operating in very specific corners of the software market, and they can offer explosive growth potential for the well-informed investor.

What Exactly Are Micro-Cap Software Stocks?

Before we jump into the “why” and “how,” let’s clarify what we’re talking about. “Micro-cap” refers to companies with a relatively small market capitalization, typically ranging from $50 million to $300 million. When we add “niche software” to that, we’re zeroing in on companies that develop specialized software solutions for a very particular industry, problem, or customer segment.

These aren’t companies aiming to conquer the entire software world. Instead, they focus on solving a specific pain point for a defined audience. Think software for niche manufacturing processes, specialized medical billing systems, highly specific compliance tools, or unique data analytics platforms for a particular industry. Their smaller size often means they’re under the radar of major institutional investors and Wall Street analysts, creating a potential mispricing opportunity for retail investors willing to do their homework.

Why the Buzz Around Niche Software Micro-Caps?

So, why should you even bother looking at these tiny players when there are so many larger, seemingly safer options? The answer lies in their unique characteristics, which can translate into significant upside for investors.

Disproportionate Growth Potential

One of the most compelling reasons to consider niche software micro-caps is their potential for disproportionate growth. A small company, even with modest new client wins or product enhancements, can see its revenue and profits jump by a much larger percentage than a sprawling, multi-billion-dollar enterprise. Imagine a company with $50 million in revenue securing a new contract worth $5 million – that’s a 10% jump! For a large-cap company, such a contract would barely register. This ability to generate substantial percentage growth from relatively small absolute gains is a key driver of their appeal.

Agility and Innovation in Focused Markets

Niche software companies, by their very nature, are often more agile and innovative within their specific domains. They don’t have the bureaucratic hurdles or legacy systems that larger companies might face. This allows them to quickly adapt to changing market needs, integrate new technologies, and respond to customer feedback with greater speed. In a rapidly evolving software landscape, this agility can be a significant competitive advantage. They can often outmaneuver larger, slower-moving competitors in their specialized areas.

Potential for Acquisition by Larger Players

Another attractive aspect is their potential as acquisition targets. Larger software companies are constantly looking to expand their offerings or acquire specialized technology to fill a gap in their portfolio. A successful, profitable niche software micro-cap with a sticky customer base and proprietary technology can be an attractive acquisition target, often leading to a significant premium for shareholders. This “exit strategy” for the founders can also be a lucrative one for early investors.

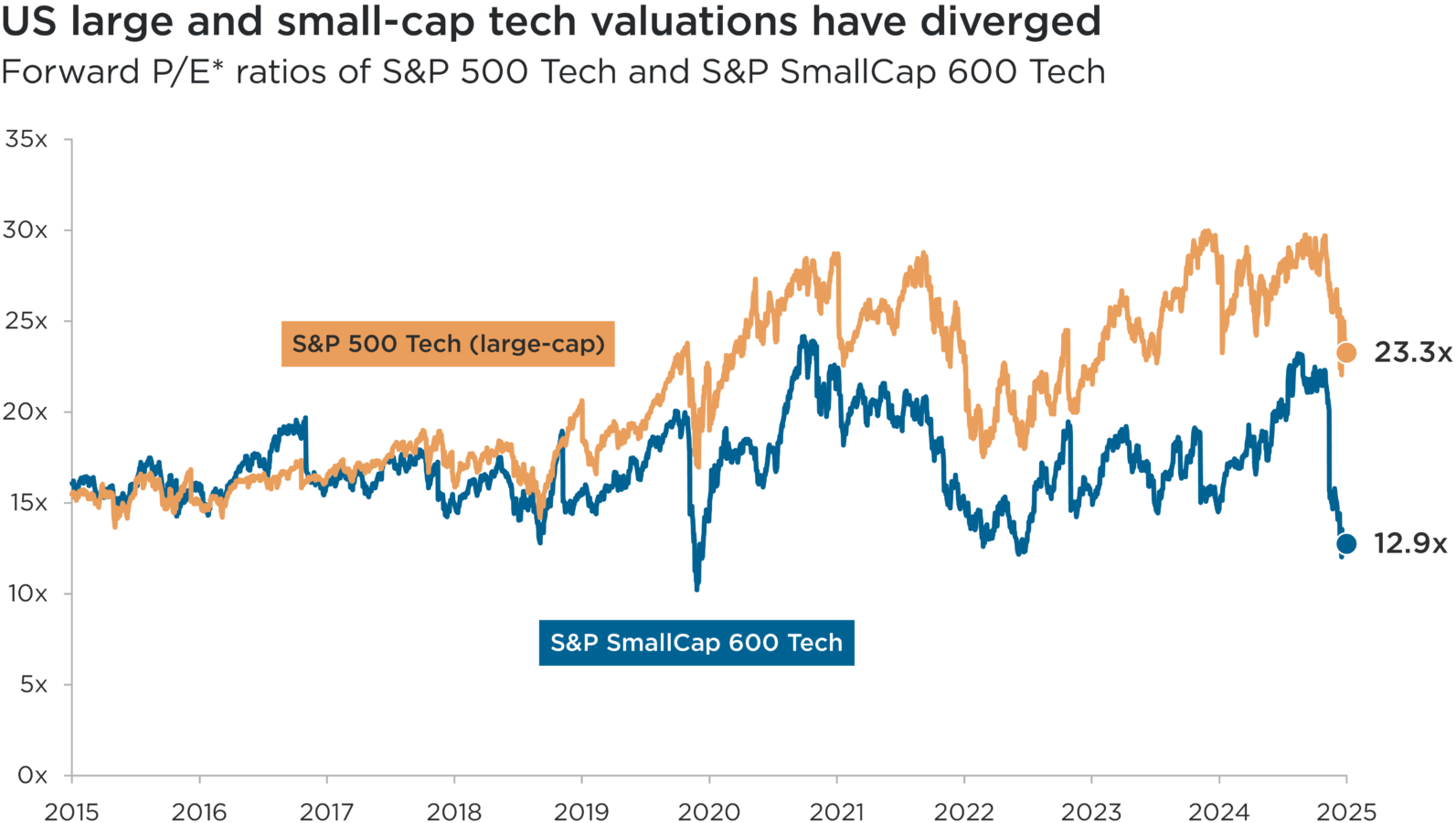

Undervaluation Due to Lack of Coverage

As mentioned, many micro-cap companies, especially those in niche sectors, receive limited or no coverage from major financial analysts. This lack of attention can lead to inefficiencies in pricing, meaning their stock may be undervalued relative to their true potential. For diligent investors who conduct thorough research, this presents an opportunity to buy into promising companies at a discount before the wider market recognizes their value.

The Risks: A Sobering Reality Check

While the allure of high returns is strong, it’s crucial to understand that investing in niche software micro-caps comes with significant risks. This isn’t a “set it and forget it” strategy; it requires careful due diligence and a high tolerance for volatility.

Higher Volatility and Liquidity Issues

Micro-cap stocks, across the board, are generally more volatile than their larger counterparts. Their smaller market capitalization means that even relatively small trading volumes can cause significant price swings. Furthermore, they often suffer from lower liquidity, meaning it can be challenging to buy or sell shares quickly without impacting the price. This illiquidity can trap investors during market downturns or if they need to exit a position rapidly.

Limited Financial Transparency and Information

Unlike large, well-established companies, many micro-cap software firms may not have the same level of financial reporting or analyst coverage. This can make it difficult to get a complete and clear picture of their financial health, operations, and competitive landscape. Less transparency increases the risk of hidden problems or an inability to accurately assess their true value. Investors often need to dig deeper into financial filings, company presentations, and industry reports to piece together the full story.

“Unproven” Business Models and Execution Risk

Many niche software micro-caps are still in the early stages of their development. Their business models, while potentially innovative, may not be fully proven or scalable. There’s a higher risk of failure if they can’t execute their business plan effectively, secure enough customers, or adapt to market changes. The success often hinges on a small team of individuals, and a departure of key personnel can have a disproportionate impact.

Susceptibility to Market Manipulation

The micro-cap space is unfortunately more susceptible to fraudulent schemes like “pump and dump” operations. In these schemes, a stock’s price is artificially inflated through misleading promotions, only for the promoters to sell off their shares, causing the price to plummet and leaving unsuspecting investors with significant losses. It’s crucial to be highly skeptical of unsolicited tips or overly enthusiastic promotions, especially for thinly traded stocks.

Dependence on a Niche Market

While specializing in a niche can be a strength, it can also be a vulnerability. If the specific industry or problem they cater to experiences a downturn, or if a larger competitor decides to enter their niche, the micro-cap software company can be disproportionately affected. Their lack of diversification can amplify the impact of adverse market conditions within their specific segment.

How to Approach Investing in Niche Software Micro-Caps (Without Pictures!)

Given the risks, how can you responsibly explore this intriguing segment of the market? It all boils down to rigorous research, a long-term perspective, and a healthy dose of skepticism.

Deep Dive Research is Non-Negotiable

This is not a space for passive investing. You need to become a detective. Start by identifying niche software sectors that are experiencing growth or have significant unmet needs. Then, pinpoint companies within those sectors.

Focus on Strong Fundamentals (Even for Small Companies)

Even micro-caps should exhibit some fundamental strength to be considered a viable investment.

Think Long-Term and Diversify Smartly

Given the volatility, a short-term trading approach with micro-caps is often a recipe for disaster. Invest with a long-term horizon, allowing the company time to execute its strategy and for its value to be recognized by the market.

Furthermore, even if you find several promising niche software micro-caps, diversification is absolutely critical. Don’t put all your eggs in one tiny basket. Spread your investment across several different companies in different niches to mitigate the impact of any single company’s underperformance. Due to the inherent risks, a small allocation of your overall portfolio to micro-caps is generally advisable.

Stay Updated and Vigilant

The micro-cap world can change quickly. Once you’ve invested, stay updated on the company’s progress, industry trends, and any news that might affect its prospects. Be prepared to reassess your investment thesis regularly and adjust your position if circumstances change fundamentally. This isn’t a “buy and hold forever” without monitoring; it’s an active holding strategy.

The Future of Niche Software Micro-Caps

The demand for specialized software solutions is only likely to grow. As industries become more complex and data-driven, companies will continue to seek tailored tools to address their unique needs. This trend bodes well for agile, innovative niche software providers. Emerging technologies like artificial intelligence, machine learning, and blockchain will likely create entirely new niche software opportunities, providing fertile ground for new micro-cap entrants. The key will be identifying those companies that can effectively leverage these technologies to create compelling, sticky solutions for their target markets.

It’s a high-risk, high-reward arena, but for those who are prepared to do the hard work and embrace the volatility, niche software micro-cap stocks can potentially deliver truly exceptional returns, turning small initial investments into significant wealth. It’s about finding those hidden gems before the rest of the world catches on.

—–

Conclusion

Investing in niche software micro-cap stocks is not for the faint of heart. It demands extensive research, a deep understanding of specific market segments, and a high tolerance for risk and volatility. However, for the discerning investor willing to put in the effort, these under-the-radar companies can offer unparalleled growth opportunities and the chance to participate in the early stages of truly innovative software solutions. By focusing on strong fundamentals, recurring revenue models, scalable operations, and a robust management team, and by diversifying appropriately, investors can potentially unearth hidden gems that the broader market has yet to discover, leading to outsized returns in the long run.

—–

5 Unique FAQs After The Conclusion

1. How do I find specific niche software micro-cap companies?

Finding these companies requires dedicated research beyond mainstream financial news. Start by identifying industries or business problems that are underserved by large software providers. Then, use stock screeners with filters for market capitalization and industry/sector (e.g., “software – specialized,” “enterprise software,” “industry-specific software”). Look for companies traded on exchanges like the OTC Bulletin Board (OTCBB) or OTC Markets Group, but be aware of the increased risks associated with these less regulated markets. Industry reports, specialized investment forums, and even looking at the technology stacks of smaller businesses can sometimes reveal these niche players.

2. What kind of metrics should I prioritize when analyzing niche software micro-caps?

Beyond traditional metrics like revenue growth and profitability, pay close attention to customer acquisition costs (CAC) and customer lifetime value (CLTV). For SaaS companies, look at recurring revenue percentage, churn rates, and net retention rates. Evaluate their cash burn, as many are still in growth phases. Strong gross margins often indicate a defensible product. For niche players, market share within their specific niche is also very important, even if that niche is small overall.

3. Is it better to invest in a basket of niche software micro-caps, or pick individual stocks?

Given the high-risk nature and potential for individual company failure, investing in a diversified basket of niche software micro-caps is generally a more prudent strategy. This allows you to mitigate the impact of any single investment performing poorly while still capturing the upside potential from the few that succeed. While individual stock picking can yield higher returns if you’re right, it also magnifies the risk of significant loss.

4. How long should I expect to hold niche software micro-cap stocks?

These are typically long-term investments, often requiring a holding period of 3-5 years or even longer. It takes time for small companies to execute their growth strategies, achieve scale, and for their value to be recognized by the wider market. Short-term price fluctuations are common and should generally be ignored if the underlying business fundamentals remain strong.

5. What are some red flags to watch out for when researching niche software micro-caps?

Be wary of companies with excessive debt, inconsistent revenue, high customer churn, or a constantly negative cash flow without a clear path to profitability. Overly promotional language, frequent stock splits without fundamental business growth, or management teams with a history of past failures are also significant red flags. Lack of transparency in financial reporting or a business model that is difficult to understand should also raise concerns.