Unearthing Hidden Gems: A Deep Dive into Undervalued Telecommunications Stocks for Savvy investors

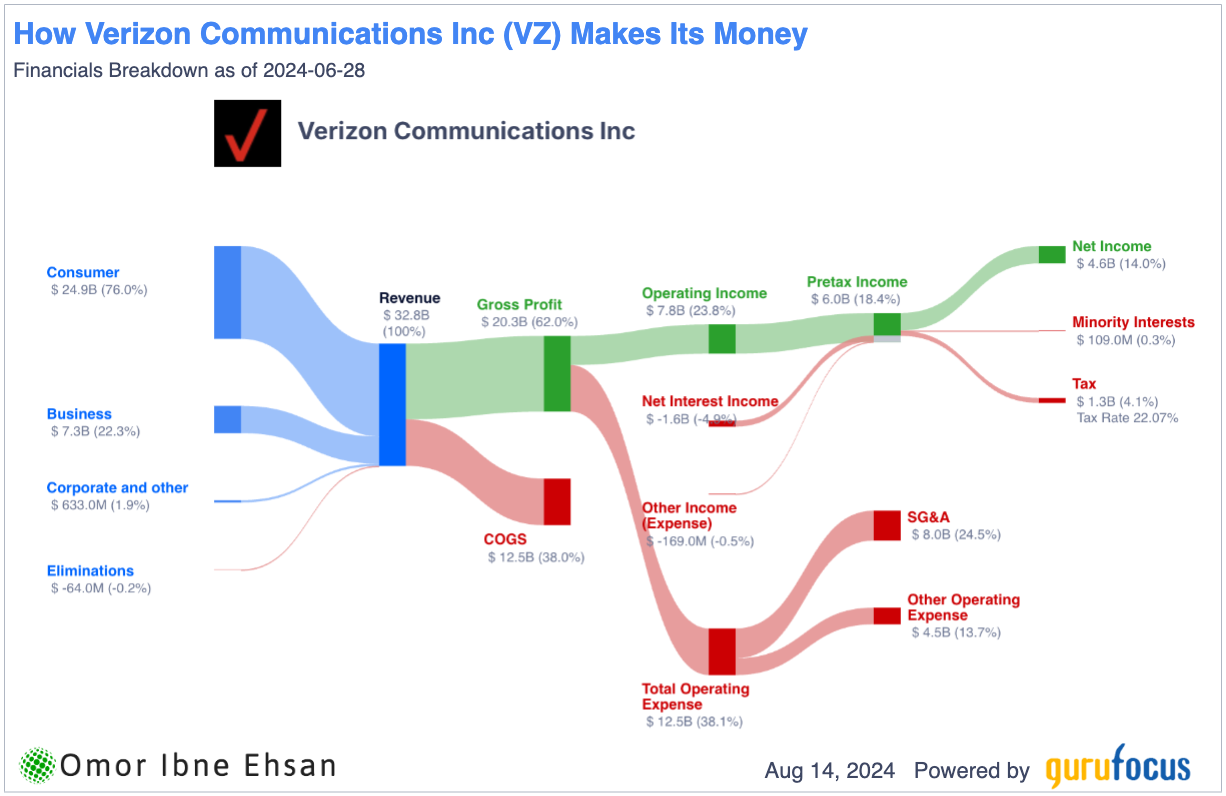

The telecommunications sector, often seen as a bedrock of modern society, is constantly evolving. From the rollout of 5G to the burgeoning demand for fibre optic broadband and satellite internet, the industry is in a state of perpetual transformation. While giants like Verizon and AT&T dominate headlines, there’s a fascinating world of undervalued telecommunications stocks waiting to be discovered by investors with a keen eye and a long-term perspective. These are companies whose current market price doesn’t fully reflect their true potential, offering a compelling opportunity for those looking to buy low and benefit from future growth.

But how exactly do you spot these hidden gems in a sector that can seem complex and heavily regulated? It’s not about jumping on the latest trend or following the crowd. Instead, it’s about understanding the fundamental drivers of value, analysing key metrics, and identifying companies that are poised for a comeback or consistent, under-the-radar growth. This article will explore what makes a telecommunications stock undervalued, delve into the current landscape, and highlight some areas where you might find these promising investments.

The Dynamics of the Telecommunications Landscape

The telecommunications industry is a vast ecosystem, encompassing everything from traditional mobile and landline services to internet service providers, satellite communication, infrastructure companies, and even content delivery networks. This diversity means that different segments will experience varying levels of growth, competition, and technological disruption. Understanding these dynamics is crucial for identifying potential undervaluation.

For instance, the global push for 5G connectivity continues to be a significant driver. While the initial build-out costs have been substantial for many carriers, the long-term benefits in terms of new services, increased data consumption, and the enablement of emerging technologies like the Internet of Things (IoT) are immense. Companies that have invested wisely in their 5G infrastructure and are positioned to leverage these new opportunities might be undervalued if the market is overly focused on short-term debt or competitive pressures.

Similarly, the demand for high-speed fibre optic broadband remains robust. As more people work from home, stream high-definition content, and engage in online gaming, reliable and fast internet access becomes a necessity. Companies with extensive fibre networks or those actively expanding their reach could be offering services that are increasingly in demand, yet their stock prices may not fully reflect this consistent and growing revenue stream.

The satellite communication sector is another area seeing a resurgence, particularly with advancements in low-earth orbit (LEO) constellations. These technologies promise to bring internet connectivity to remote areas and offer new solutions for global communication. While often capital-intensive, successful ventures in this space could see significant long-term appreciation, making some of these companies potentially undervalued if their future earnings potential is underestimated.

What Makes a Telecommunications Stock Undervalued?

Identifying an undervalued stock isn’t about simply finding a low share price. It’s about discerning whether the company’s intrinsic value – its true worth based on its assets, earnings, and future prospects – is higher than its current market price. Several factors can contribute to a telecommunications stock becoming undervalued.

Market Sentiment and Overreactions

Sometimes, a company’s stock price can be driven down by negative news or general market pessimism, even if the underlying business remains sound. A missed earnings target, a regulatory hurdle, or even broader economic concerns can lead to investors selling off shares in a panic, pushing the price below its true value. For the savvy investor, these moments of fear can be opportunities to acquire quality assets at a discount. It’s about looking beyond the short-term noise and focusing on the long-term fundamentals.

Industry Cycles and Shifting Trends

The telecommunications industry experiences cycles. Periods of heavy investment in new infrastructure might depress profits in the short term, but pave the way for future revenue growth. Similarly, shifts in consumer behaviour or technological preferences can temporarily disadvantage certain companies. An undervalued stock might be one that is currently out of favour due to these cyclical or trend-based factors, but possesses the adaptability and strategic vision to thrive in the evolving landscape.

Strong Fundamentals Despite Low Valuation

This is the holy grail of undervalued investing. A company might have a low stock price, but strong underlying financials. Look for companies with consistent revenue growth, healthy profit margins, manageable debt levels, and strong cash flow. If a company is generating solid profits and cash but its stock isn’t reflecting that, it could be a sign of undervaluation. Key financial ratios, which we’ll discuss shortly, can help uncover these situations.

Under-the-Radar Niche Players

While the major telecom companies get a lot of attention, smaller, more specialized players can often be overlooked. These could be companies focusing on specific niche technologies, regional markets, or unique service offerings. Their smaller size might mean less analyst coverage and therefore less efficient pricing by the market, creating opportunities for discovery by diligent investors.

Key Metrics to Look For When Hunting Undervalued Telecom Stocks

To move beyond gut feelings and identify truly undervalued telecommunications stocks, it’s essential to dig into the numbers. Here are some key financial metrics and considerations:

Price-to-Earnings (P/E) Ratio

The P/E ratio compares a company’s current share price to its earnings per share. A lower P/E ratio compared to industry averages or the company’s historical P/E can suggest undervaluation. However, it’s important to consider why the P/E is low – is it due to temporary issues or a fundamental problem?

Price-to-Book (P/B) Ratio

The P/B ratio compares a company’s market value to its book value (assets minus liabilities). A P/B ratio below 1 can indicate that the market is valuing the company at less than its net asset value, which could be a sign of undervaluation, especially for companies with significant physical assets like telecom infrastructure.

Enterprise Value to EBITDA (EV/EBITDA)

This ratio is particularly useful in the telecom sector because it accounts for debt, which is common in capital-intensive industries. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) gives a clearer picture of a company’s operational profitability. A lower EV/EBITDA ratio compared to peers might suggest undervaluation.

Dividend Yield and Sustainability

Many telecommunications companies are known for paying dividends. A high dividend yield can be attractive, but it’s crucial to assess if the dividend is sustainable. Look at the company’s payout ratio (dividends per share divided by earnings per share) and its cash flow to ensure it can comfortably continue paying dividends. A stable and growing dividend can be a sign of a financially healthy company that might be overlooked.

Debt-to-Equity (D/E) Ratio

Given the substantial capital expenditure in the telecom industry, a company’s debt levels are important. A high D/E ratio can indicate financial risk, but a company with a manageable debt load and a clear plan to service it could still be a good investment if other factors point to undervaluation.

Free Cash Flow (FCF)

Free cash flow is the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Strong and consistent free cash flow is a positive sign, as it indicates a company has enough money to pay down debt, invest in growth, and return value to shareholders through dividends or buybacks.

Growth Prospects and Innovation

While looking at current undervaluation, it’s equally important to consider future growth. Is the company investing in new technologies like 5G, fibre, or cloud services? Does it have a clear strategy to expand its customer base or enter new markets? A company with solid growth prospects, even if currently overlooked, has the potential for significant long-term appreciation.

Management Quality and Strategic Vision

Experienced and competent management can navigate challenges, adapt to market changes, and execute growth strategies effectively. Look for management teams with a proven track record, a clear strategic vision, and a focus on creating long-term shareholder value.

Potential Undervalued Areas in Telecommunications

While individual stock picks require in-depth research, here are some broad areas within the telecommunications sector where you might find undervalued opportunities:

Regional or Niche Broadband Providers

Beyond the national giants, many smaller, regional broadband providers are quietly expanding their fibre networks and serving underserved communities. These companies often face less direct competition and can have strong local customer relationships, leading to consistent, albeit slower, growth. Their smaller scale can sometimes lead to them being overlooked by large institutional investors, creating a potential for undervaluation.

Telecom Infrastructure Companies

These are the backbone of the telecom industry, owning and operating assets like cell towers, data centers, and fibre optic cables. Their revenue often comes from long-term contracts with various carriers, providing stable and predictable cash flows. While some are well-known, others, particularly those with strong growth in specific geographic areas or emerging technologies, could be trading below their intrinsic value.

Companies with Strong Intellectual Property in Emerging Technologies

The future of telecom will be driven by innovation. Companies holding key patents or developing cutting-edge solutions in areas like edge computing, network slicing, or advanced wireless technologies might be undervalued if the market hasn’t fully grasped the potential impact of their intellectual property. These are often smaller, more speculative investments, but with higher potential rewards.

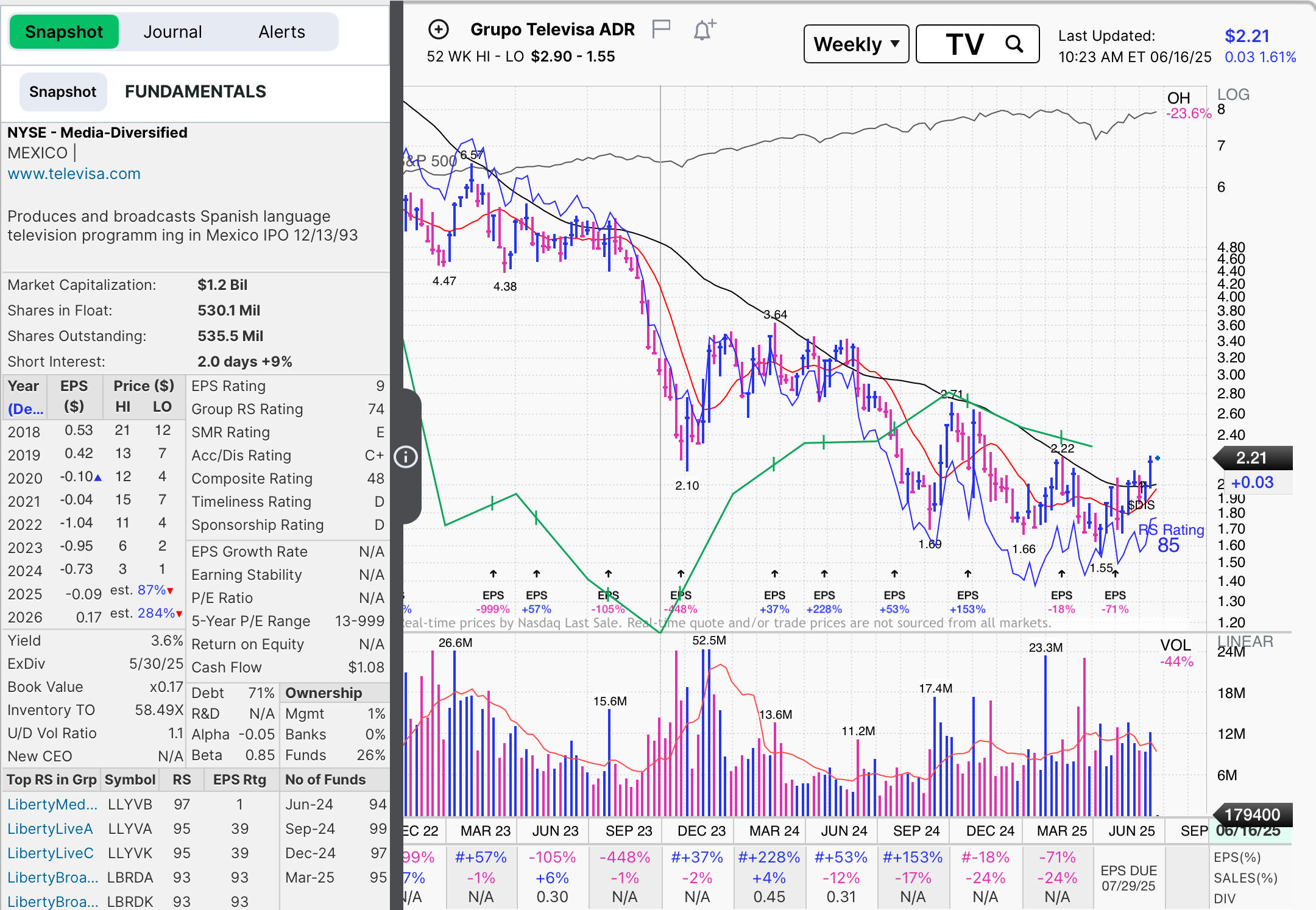

Operators in Developing Markets

Telecommunications penetration is still growing in many developing economies. Companies operating in these markets, while potentially facing higher risks, also have significant long-term growth runways. If their current valuations are depressed due to perceived political or economic instability, but the underlying demographic and technological trends are strong, they could represent undervalued opportunities.

Legacy Carriers Undergoing Transformation

Some traditional telecom companies, often burdened by legacy infrastructure or debt, are actively undergoing significant transformations. This might involve divesting non-core assets, investing heavily in new technologies, or streamlining operations. While the process can be challenging, successful transformations can lead to a re-rating of the stock and significant upside for investors who got in during the undervalued phase.

The Importance of Due Diligence

It’s crucial to stress that identifying undervalued stocks requires thorough due diligence. Don’t just rely on a low P/E ratio. Dig into the company’s financial statements, read their annual reports, understand their competitive landscape, and assess their management team’s capabilities. Consider industry trends, regulatory changes, and potential disruptive technologies. For long-term success, patience is key. Undervalued stocks don’t always rebound overnight, but a solid fundamental analysis increases the likelihood of a positive outcome over time.

Conclusion

The telecommunications sector, with its constant evolution and critical role in modern life, offers intriguing opportunities for investors seeking undervalued stocks. By looking beyond the obvious, understanding the industry’s intricate dynamics, and meticulously analysing key financial metrics, you can uncover hidden gems that the broader market might be overlooking. Whether it’s a regional broadband provider expanding its fiber footprint, an infrastructure company with stable revenue streams, or a legacy carrier successfully transforming its business, the potential for long-term growth and capital appreciation exists. Remember, successful investing in undervalued stocks is a marathon, not a sprint. It demands patience, thorough research, and a conviction in the underlying business fundamentals, allowing you to capitalise on moments of market inefficiency and ultimately build a stronger portfolio.

5 Unique FAQs After The Conclusion

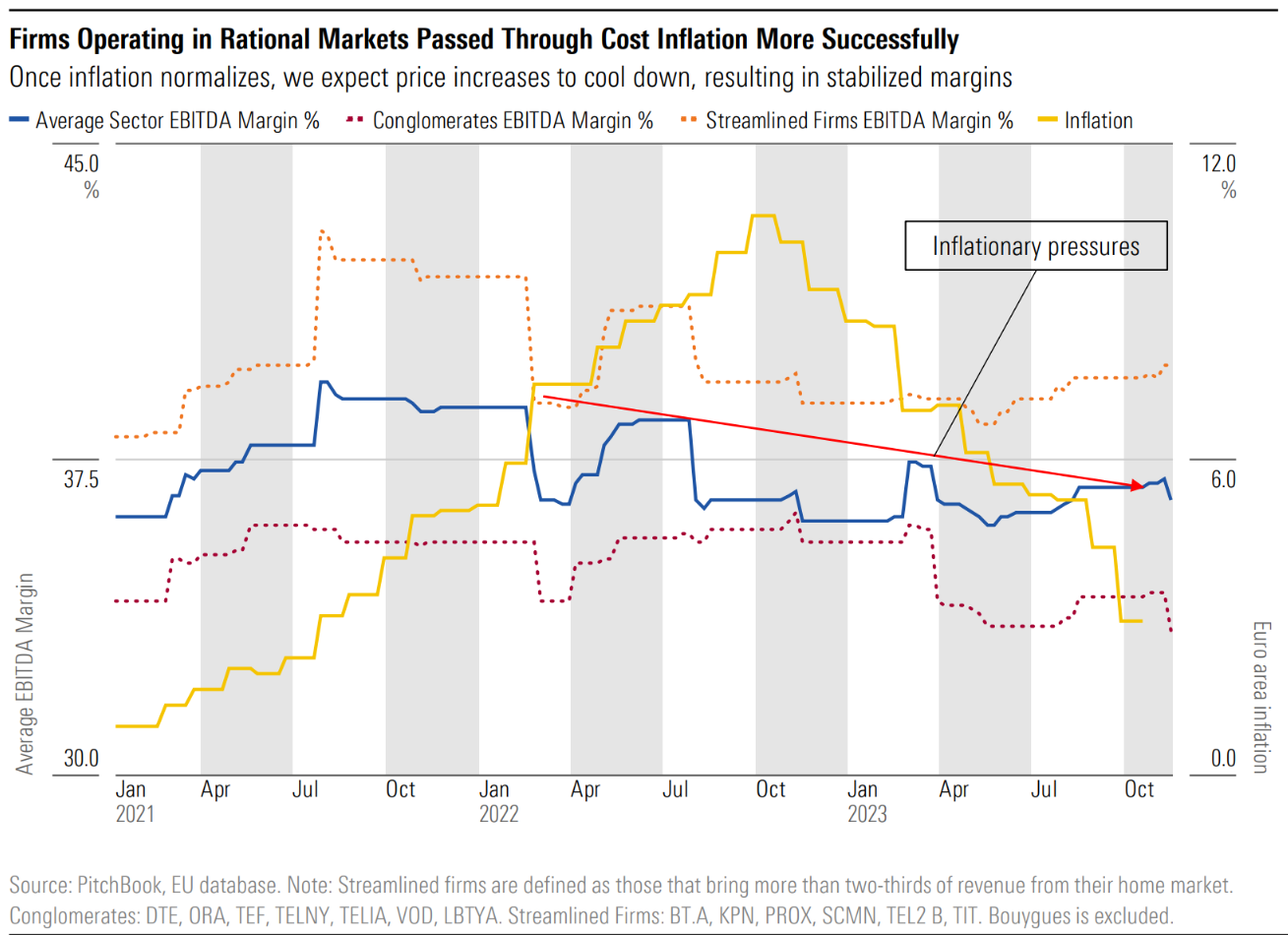

1. How does inflation impact the valuation of telecommunications stocks, especially when looking for undervalued opportunities?

Inflation can have a mixed impact. On one hand, rising costs for equipment, labor, and energy can squeeze profit margins for telecom companies, potentially leading to lower valuations. On the other hand, telecom services are often seen as essential, allowing companies some pricing power to pass on increased costs to consumers. When looking for undervalued stocks during inflationary periods, it’s crucial to find companies with strong pricing power, efficient operations, and manageable debt levels, as these will be better positioned to weather inflationary pressures and potentially see their stock rebound as the market recognises their resilience.

2. Are there specific regulatory changes in 2025 or beyond that could significantly affect the undervaluation or overvaluation of telecom stocks?

Regulatory landscapes are always evolving in the telecom sector. In 2025 and beyond, we could see continued focus on net neutrality, privacy regulations, and policies related to spectrum allocation for 5G and future wireless technologies. Stricter regulations on data privacy, for example, could increase operational costs for some companies, potentially impacting their valuation. Conversely, favorable government policies encouraging rural broadband expansion or infrastructure sharing could create growth opportunities. It’s vital to stay informed about regulatory developments, as they can directly influence a company’s business model and profitability, and thus its intrinsic value.

3. How do global geopolitical tensions influence the perceived value of international telecommunications stocks?

Global geopolitical tensions can significantly impact the perceived value of international telecom stocks. Issues like trade disputes, sanctions, or political instability in specific regions can introduce uncertainty and risk, leading investors to demand a higher risk premium, thus depressing stock prices. This can create undervaluation if the underlying business operations remain strong and the market is overreacting to short-term geopolitical noise. However, it also introduces higher risk, so thorough analysis of a company’s exposure to such tensions and its resilience strategies is crucial.

4. Given the rise of satellite internet providers, how should traditional terrestrial telecom companies be re-evaluated for undervaluation?

The rise of satellite internet, particularly LEO constellations, presents both a challenge and an opportunity for traditional terrestrial telecom companies. While satellite internet could increase competition in certain markets, especially rural and remote areas, it also opens up possibilities for partnerships or wholesale agreements. Traditional telecom companies with extensive fibre backbones or those investing in hybrid connectivity solutions (combining terrestrial and satellite) might actually see their long-term value enhanced. Undervalued opportunities might exist in terrestrial companies that are strategically adapting to this new landscape rather than simply being disrupted by it.

5. What role does cybersecurity play in assessing the true value of a telecommunications company in today’s digital age?

Cybersecurity plays an increasingly critical role in assessing the true value of any telecommunications company. With vast amounts of sensitive customer data and critical infrastructure under their purview, a major cybersecurity breach can lead to massive financial penalties, reputational damage, and a significant loss of customer trust. Therefore, companies with robust cybersecurity measures, a strong track record of protecting data, and a proactive approach to evolving threats are inherently more valuable. A company that appears undervalued but has a weak cybersecurity posture might carry hidden risks that could ultimately erode its long-term value.