Navigating the world of investing can feel like walking through a minefield, especially when it comes to fees. You hear stories of people’s returns being eaten up by hidden costs, and it’s enough to make anyone hesitant. But what if there was a way to invest without these hefty price tags? What if you could build your wealth over the long term, knowing that every dollar you put in is working for you, not for a bunch of a fund managers or brokers?

The good news is that the investment landscape has changed dramatically. Thanks to technology and increased competition, a new generation of low-fee investment platforms has emerged, democratizing access to the stock market and making it possible for everyday people to invest affordably. This article will be your comprehensive guide to understanding these platforms, what to look for, and how to get started on your own low-cost investment journey.

We’re going to dive deep into the world of low-fee investing, breaking down the jargon and giving you a clear picture of how to make your money work harder for you. We’ll look at the different types of fees you might encounter, why they matter so much in the long run, and then we’ll explore some of the best platforms that are leading the charge in making investing accessible to everyone. We’ll also cover important topics like fractional shares, tax-efficient accounts, and how to build a portfolio that fits your goals without breaking the bank. So, if you’re ready to take control of your financial future and learn how to invest smarter, stick around—this is the article for you.

The Real Cost of Investing: Why Fees Matter More Than You Think

Before we get into the platforms themselves, it’s crucial to understand why fees are such a big deal. When you’re just starting out, a 1% or 2% fee might not seem like much. You might think, “It’s just a small slice of my small investment, no big deal.” But the truth is, these seemingly small percentages have a massive, compounding effect over time.

Imagine you’re 25 years old and you invest $1,000 every year until you’re 65, and your investments grow at an average rate of 7% per year.

This is the tyranny of compounding fees. They don’t just take a bite out of your principal; they take a bite out of your potential returns. The money that could have been earning you more money is instead lining someone else’s pocket. This is why the primary goal for any long-term investor, especially a beginner, should be to minimize fees as much as humanly possible. The lower your fees, the more of your money stays invested, and the more it has a chance to grow.

The Fee Landscape: What Are You Actually Paying For?

To find the best low-fee platforms, you first need to know what kinds of fees to look out for. They can come in different shapes and sizes, and some are more obvious than others.

1. Commission Fees: These are the most traditional type of fee. It’s a fee you pay every time you buy or sell a stock, ETF (Exchange Traded Fund), or other investment. In the old days, these could be quite high, sometimes $10 or more per trade. The rise of modern platforms has made “commission-free” trading a standard feature for many popular investments, which is a huge win for investors.

2. Management Fees (Expense Ratios): If you’re investing in mutual funds or ETFs, you’ll encounter a management fee, also known as an expense ratio. This is a percentage of your total investment that the fund manager takes each year to cover their operating costs. For actively managed funds, this can be 1% or higher. For passively managed index funds or ETFs, which simply track a market index, this fee can be incredibly low, often just a fraction of a percent (e.g., 0.03% or 0.05%). This is where the real savings begin for most long-term investors.

3. Platform Fees / Account Fees: Some platforms charge a monthly or annual fee just for having an account with them. This is often a flat fee, like $5 or $10 a month, but can also be a percentage of your total portfolio. Many of the newer, low-cost platforms have eliminated these fees entirely to attract new investors.

4. Deposit/Withdrawal Fees: Less common but still something to watch for. Some platforms might charge you to add money to your account or to take it out. This is a definite red flag for a beginner-friendly platform.

5. Foreign Exchange (FX) Fees: If you’re buying stocks or ETFs in a currency different from your own (e.g., a UK investor buying US stocks), there’s often a fee for converting your money. This is a charge to be aware of, but it’s often a small percentage and can be minimized by choosing platforms that offer competitive FX rates.

The Contenders: Your Low-Fee Investment Platforms

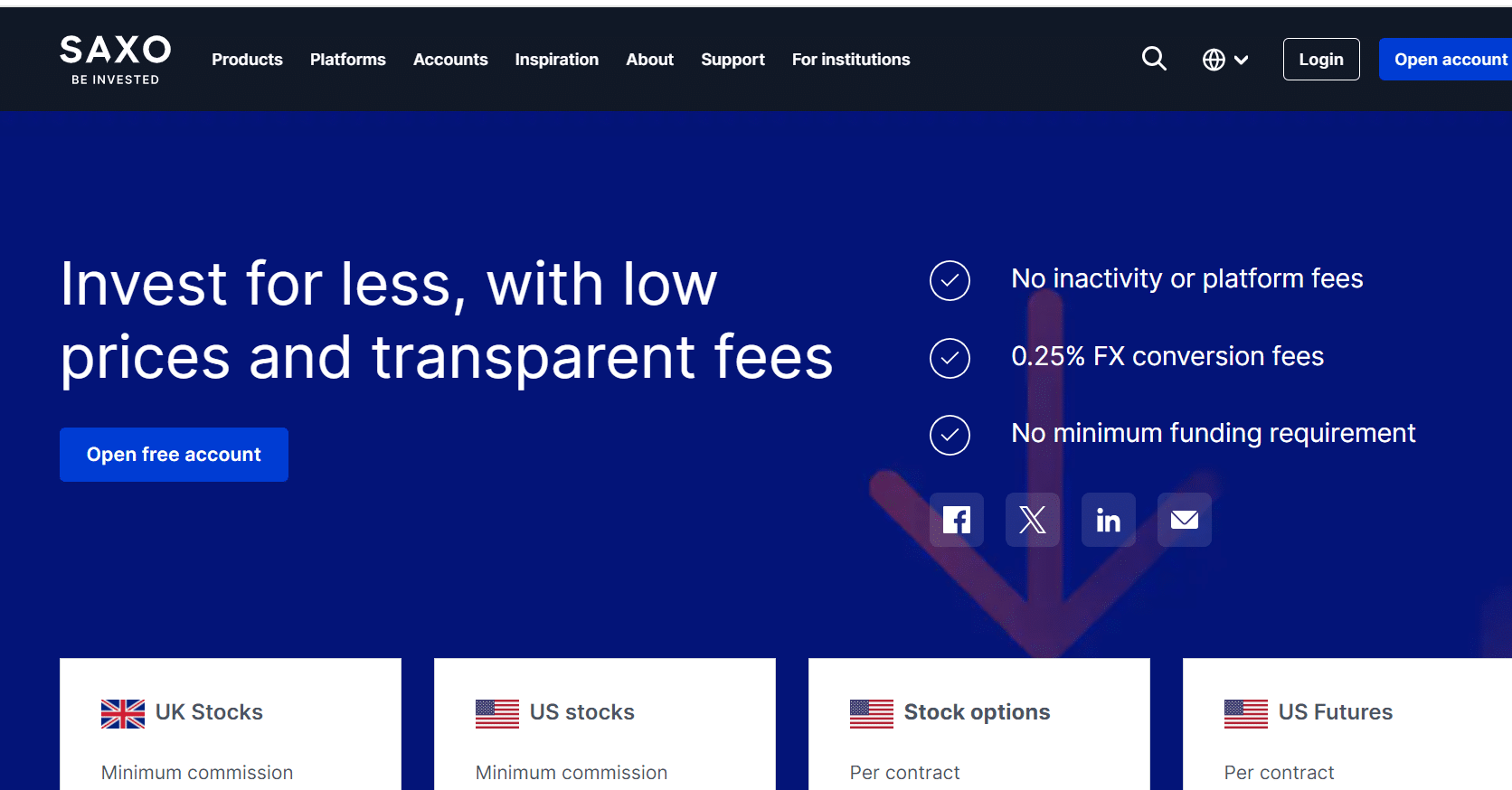

Now that you know what you’re looking for, let’s get to the good stuff. Here are some of the platforms that are celebrated for their low-cost, beginner-friendly approach to investing.

# 1. Trading 212

Trading 212 has become a major player in the UK and European markets, and for good reason. It’s an ideal choice for new investors because of its truly low-fee structure.

# 2. Freetrade

As the name suggests, Freetrade is all about making investing free and accessible. It’s a UK-based platform that has a simple, sleek mobile app and a clear, transparent fee model.

# 3. Vanguard

While Vanguard might not have the flashy interface of a modern app-based platform, it is the king of low-cost investing. Founded by the legendary John C. Bogle, the company’s entire philosophy is built around minimizing costs for investors.

# 4. AJ Bell Dodl

AJ Bell is a well-established name in the investment world, but its Dodl app is a newer offering designed specifically for beginners. The name “Dodl” is a play on the idea of making investing a “doddle,” or very easy.

Building Your Low-Fee Portfolio: A Beginner’s Game Plan

You’ve found your platform. Now what? Building a low-cost, long-term portfolio doesn’t have to be complicated. In fact, for a beginner, a simple, diversified approach is often the best.

1. Start with a Goal: Before you invest a single penny, think about what you’re investing for. Is it a down payment on a house in five years? Is it your retirement in 30 years? Your timeline and goals will determine how much risk you should take.

2. Focus on Funds: For most people, especially beginners, investing in individual stocks can be risky and time-consuming. Instead, consider starting with low-cost ETFs or index funds. These funds hold hundreds or even thousands of different stocks or bonds, giving you instant diversification. For example, by buying a single S&P 500 ETF, you’re instantly invested in the 500 largest companies in the US.

3. Use Tax-Efficient Accounts: If you’re eligible, always prioritize an ISA or a pension account. The tax benefits are a powerful way to supercharge your long-term returns. Imagine all the gains you make on your investments not being taxed—that’s a huge amount of extra money you get to keep.

4. Automate Your Investments: The best way to build wealth is to be consistent. Set up a standing order to invest a fixed amount of money every month. This practice is known as “dollar-cost averaging” and it takes the emotion out of investing. You’ll buy more shares when prices are low and fewer when prices are high, averaging out your cost over time.

5. Rebalance Your Portfolio: Your portfolio will naturally drift over time. For example, if you have 60% in stocks and 40% in bonds, and stocks have a great year, your portfolio might shift to 70/30. Once a year, you should rebalance it back to your original allocation. This means you’ll be selling some of your winners and buying some of your losers, which is a disciplined way to invest and manage risk.

The Bottom Line: Your Money, Your Future

The message is simple: fees matter. They are the single biggest drag on your long-term investment performance. By choosing a low-fee investment platform and focusing on low-cost funds, you are giving yourself the best possible chance to succeed. You’re not trying to beat the market; you’re trying to participate in the market and let the incredible power of compounding do the heavy lifting for you.

Investing is a marathon, not a sprint. The real winners aren’t the ones who make a quick buck, but the ones who consistently invest over decades, keep their costs low, and stay the course through thick and thin. Thanks to platforms like Trading 212, Freetrade, Vanguard, and Dodl, this has never been easier. So take the first step today, choose a platform that works for you, and start building the financial future you deserve.

:max_bytes(150000):strip_icc()/dotdash_Final_Technical_Analysis_Strategies_for_Beginners_Sep_2020-01-412a1ba6af834a74a852cbc32e5d6f7c.jpg?resize=200,135&ssl=1)