investing for a Rainy Day: Why Utility Stocks Can Be Your Steady Income Stream

When it comes to investing, many of us dream of hitting the jackpot with some high-flying tech stock. We see headlines about massive gains and get swept up in the excitement. But for those looking for a more grounded, dependable approach to growing their wealth and generating regular income, there’s a less glamorous but often far more reliable option: utility stocks.

Think about it: who doesn’t use electricity, water, or natural gas? These aren’t luxury items; they’re essential services that people and businesses rely on every single day, no matter what the economy is doing. This inherent demand is what makes utility companies, and by extension their stocks, so attractive to income-focused investors. They’re often considered “defensive” investments because their performance tends to be less affected by economic ups and downs compared to other sectors. When times are tough, people might cut back on discretionary spending, but they still need to keep the lights on and the water running.

What Exactly Are Utility Stocks?

At its core, a utility stock represents ownership in a company that provides fundamental public services. We’re talking about companies that generate and distribute electricity, manage water and wastewater systems, or supply natural gas. These businesses operate in a somewhat unique environment.

The Regulated Nature of Utilities

Unlike many industries where companies battle it out fiercely for market share, utility companies often operate as regulated monopolies or oligopolies in their service areas. This means that in a given region, there might only be one or a handful of companies providing these essential services. To ensure fair pricing and reliable service for consumers, these companies are typically overseen by government regulatory bodies. These regulators approve the rates that utilities can charge, which in turn helps create a predictable revenue stream for the companies. While this regulation limits their explosive growth potential, it also significantly reduces their risk. They’re not going to be undercut by a new competitor popping up overnight.

The Allure of Dividends

One of the biggest draws of utility stocks for income investors is their consistent dividend payments. Because these companies have such stable and predictable cash flows, they are often able to distribute a significant portion of their earnings back to shareholders in the form of dividends. For many, these regular dividend payments can act like a steady stream of income, almost like getting a regular paycheck from your investments.

Imagine being able to cover some of your monthly expenses, or even just reinvest those dividends to buy more shares, thereby compounding your returns over time. This makes utility stocks a popular choice for retirees or anyone looking to build a passive income portfolio. Some utility companies have a long history of increasing their dividends year after year, which is a big plus for investors seeking growing income.

Stability in a Volatile World

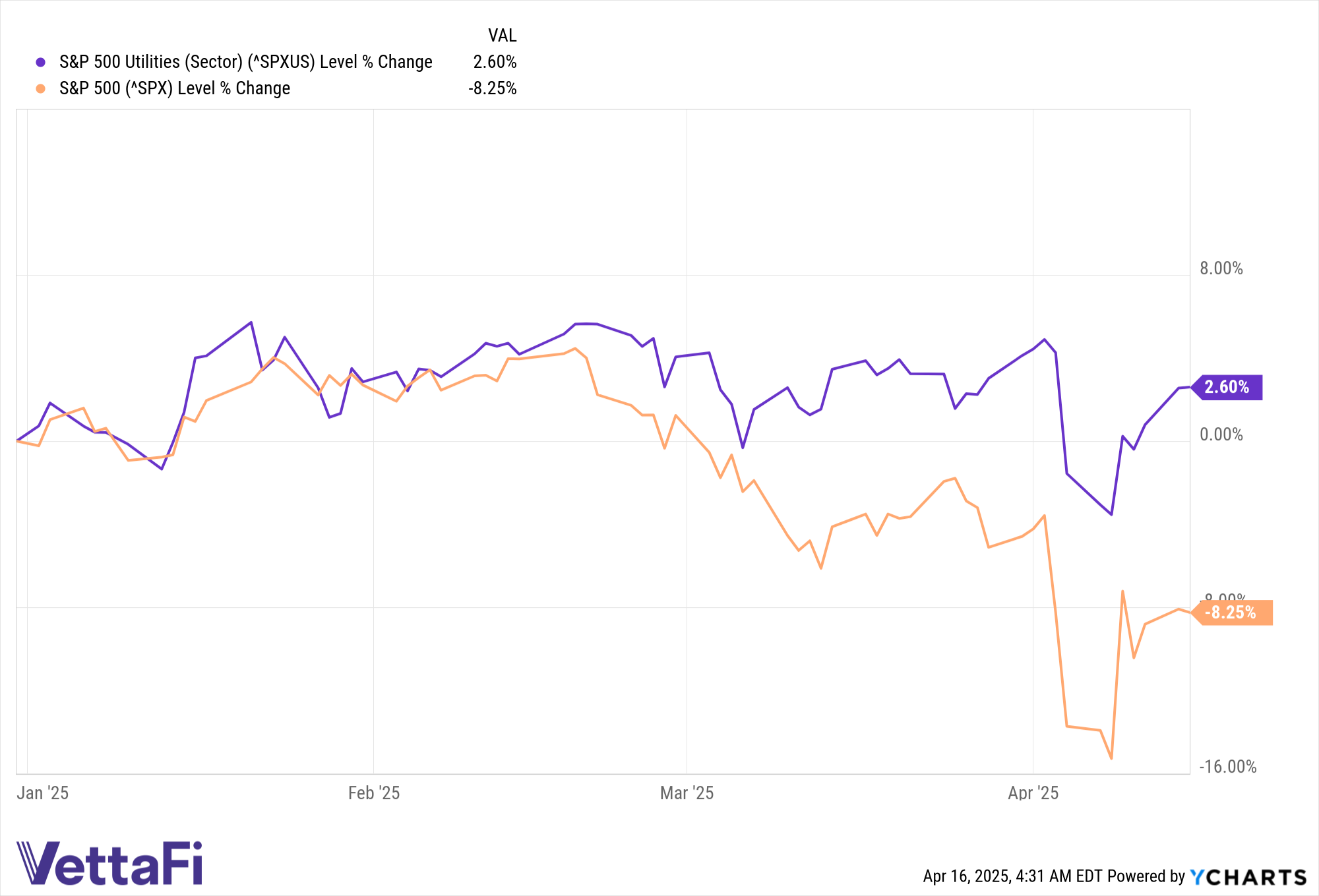

The stock market can be a rollercoaster, with sudden drops and sharp rises. While no investment is completely immune to market fluctuations, utility stocks tend to be less volatile than many other sectors. This lower price volatility can provide a sense of calm for investors who are uncomfortable with big swings in their portfolio’s value. During economic downturns, when other industries might be struggling, utility companies often remain relatively stable, making them a safe haven for capital. This defensive characteristic can help cushion your portfolio against broader market declines.

Capital-Intensive but Essential

It’s true that the utility industry requires massive investments in infrastructure – think power plants, transmission lines, water treatment facilities, and gas pipelines. This makes them very capital-intensive businesses. However, this also creates high barriers to entry for new competitors. Building out a comprehensive utility network isn’t something just anyone can do, requiring enormous financial resources and regulatory approvals. This further solidifies the position of existing utility companies, ensuring their long-term viability.

Interest Rate Sensitivity: A Small Caveat

While utility stocks are generally stable, it’s worth noting that they can be somewhat sensitive to changes in interest rates. When interest rates are low, the attractive dividends offered by utility stocks become even more appealing compared to the lower returns from bonds or savings accounts. However, when interest rates rise, bonds might start offering more competitive yields, which could make utility stocks seem relatively less attractive, potentially putting some downward pressure on their prices. It’s a factor to consider, but typically not a deal-breaker for long-term income investors.

Beyond the Traditional: The Rise of Renewable Utilities

The utility landscape is evolving. While traditional fossil fuel-based generation still plays a significant role, there’s a growing shift towards cleaner, more sustainable energy sources. Many utility companies are heavily investing in renewable energy projects like solar and wind farms. This transition not only aligns with global environmental goals but also opens up new avenues for growth and stability for these companies. Investing in utilities that are actively embracing renewable energy can offer a compelling blend of steady income and participation in the clean energy revolution.

How to Find Them

So, if you’re thinking about adding some steady income utility stocks to your portfolio, where do you start? You can look at large, well-established utility companies that have a history of consistent earnings and dividend payments. Many financial websites and investment platforms offer screeners that allow you to filter stocks by sector, dividend yield, and other financial metrics.

It’s also a good idea to research individual companies to understand their specific operations, regulatory environment, and future growth plans, especially in the renewable energy space. Look for companies with strong balance sheets and a track record of effective management. While it’s great to find undervalued stocks, remember that the primary goal here is steady income and capital preservation, not necessarily explosive growth.

A Long-Term Perspective

Investing in utility stocks is often about playing the long game. It’s about patience, enjoying those regular dividend payments, and letting the power of compounding work its magic over years, even decades. They might not be the most exciting investments, but for those who value stability, predictability, and consistent income, utility stocks can be a cornerstone of a well-diversified portfolio. They provide the essential services that society can’t do without, and that makes them a timeless investment for those seeking a steady financial foundation.

Conclusion

In a world filled with investment hype and fleeting trends, utility stocks stand as a testament to the enduring power of essential services. Their regulated nature, predictable cash flows, and commitment to consistent dividends make them an ideal choice for anyone looking to build a portfolio focused on steady income and long-term stability. While they may not offer the flashy returns of some high-growth sectors, their reliability and defensive qualities provide a valuable ballast, especially during turbulent economic times. For the shrewd investor seeking a dependable financial bedrock, utility stocks truly offer a consistent and reassuring path to wealth accumulation and passive income.

5 Unique FAQs About Steady Income Utility Stocks

1. How do utility stocks typically perform during economic recessions compared to other sectors?

Utility stocks are often considered “defensive” investments, meaning they tend to perform relatively well during economic recessions. This is because the demand for essential services like electricity, water, and gas remains relatively constant regardless of economic conditions. While other sectors might see significant declines in revenue and profits as consumer spending drops, utility companies continue to collect fees for services that people and businesses cannot do without. This stability makes them a preferred choice for investors seeking refuge from market volatility during downturns.

2. Can investing in utility stocks help me achieve early retirement?

While utility stocks are known for providing a steady income stream through dividends, which can certainly contribute to retirement planning, whether they can facilitate “early” retirement depends on a multitude of factors, including your investment capital, living expenses, desired retirement age, and overall portfolio diversification. Utility dividends can cover a portion of your living costs in retirement, but relying solely on them for early retirement might require a substantial initial investment. It’s generally recommended to diversify your portfolio across various asset classes and growth-oriented investments alongside utilities to accelerate wealth accumulation, and then gradually shift towards income-generating assets as retirement approaches.

3. Are there any specific types of utility stocks that are considered “greener” or more environmentally friendly?

Absolutely! The utility sector is undergoing a significant transformation towards renewable energy. “Greener” utility stocks typically belong to companies that are heavily investing in and generating power from sustainable sources like solar, wind, hydropower, and geothermal energy. Many traditional utility companies are also transitioning by phasing out fossil fuel plants and expanding their renewable energy portfolios. When researching, look for companies with clear commitments to decarbonization, significant investments in renewable infrastructure, and a growing percentage of their energy mix coming from clean sources. This can allow you to align your investments with environmental values while still enjoying the benefits of utility stock stability.

4. What’s the difference between a regulated utility and an unregulated utility, and which is better for steady income?

The main difference lies in how their rates are determined. Regulated utilities have their prices and operations overseen by government bodies. This regulation aims to ensure fair pricing for consumers and a reasonable, predictable rate of return for the company. This predictability makes regulated utilities generally better for steady income, as their revenue streams are more stable and less subject to competitive pressures. Unregulated utilities, also known as independent power producers or competitive generators, operate in more open markets where prices are determined by supply and demand. While they might offer higher growth potential, they also come with more volatility and risk, making them less ideal for a consistent, steady income focus.

5. Is it always a good time to invest in utility stocks, or are there periods when they are less attractive?

While utility stocks are generally considered a stable long-term investment, there are periods when they might be less attractive. As mentioned earlier, their sensitivity to interest rates is a key factor. When interest rates are rising rapidly, the fixed income nature of utility dividends can become less appealing compared to the increasingly competitive yields offered by bonds and other fixed-income investments. This can lead to some downward pressure on utility stock prices. Conversely, during periods of economic uncertainty or falling interest rates, utility stocks often become more attractive as investors seek safety and consistent income. Therefore, while always a consideration for income, it’s beneficial to be aware of the prevailing interest rate environment when making investment decisions in the utility sector.