The hydrogen fuel cell sector is a fascinating area, brimming with potential for those looking to invest in the future of clean energy. While big names like Plug Power and Ballard Power Systems often dominate the headlines, there’s a whole world of smaller, less-talked-about companies that could offer compelling opportunities for long-term growth. These “low competition” stocks, as you put it, are often overlooked but could be poised for significant upside as the hydrogen economy truly takes off.

It’s crucial to understand that investing in any emerging technology, especially one as capital-intensive as hydrogen, comes with its own set of risks. Many companies in this space are still in early stages, focusing heavily on research, development, and scaling up production. This means they might not be profitable yet, and their stock prices can be quite volatile. However, for the adventurous investor with a long-term horizon, these hidden gems could offer a chance to get in on the ground floor of what many believe will be a revolutionary energy shift.

So, let’s dive into the exciting world of hydrogen fuel cell stocks, exploring some of the lesser-known players that might just be the quiet giants of tomorrow.

The Promise of Hydrogen: Why It Matters

Before we talk about specific companies, let’s briefly touch upon why hydrogen is such a big deal. We’re living in a world that’s increasingly urgent about decarbonization. Governments and industries globally are scrambling to reduce carbon emissions and transition away from fossil fuels. This is where hydrogen steps in as a powerful, clean energy carrier.

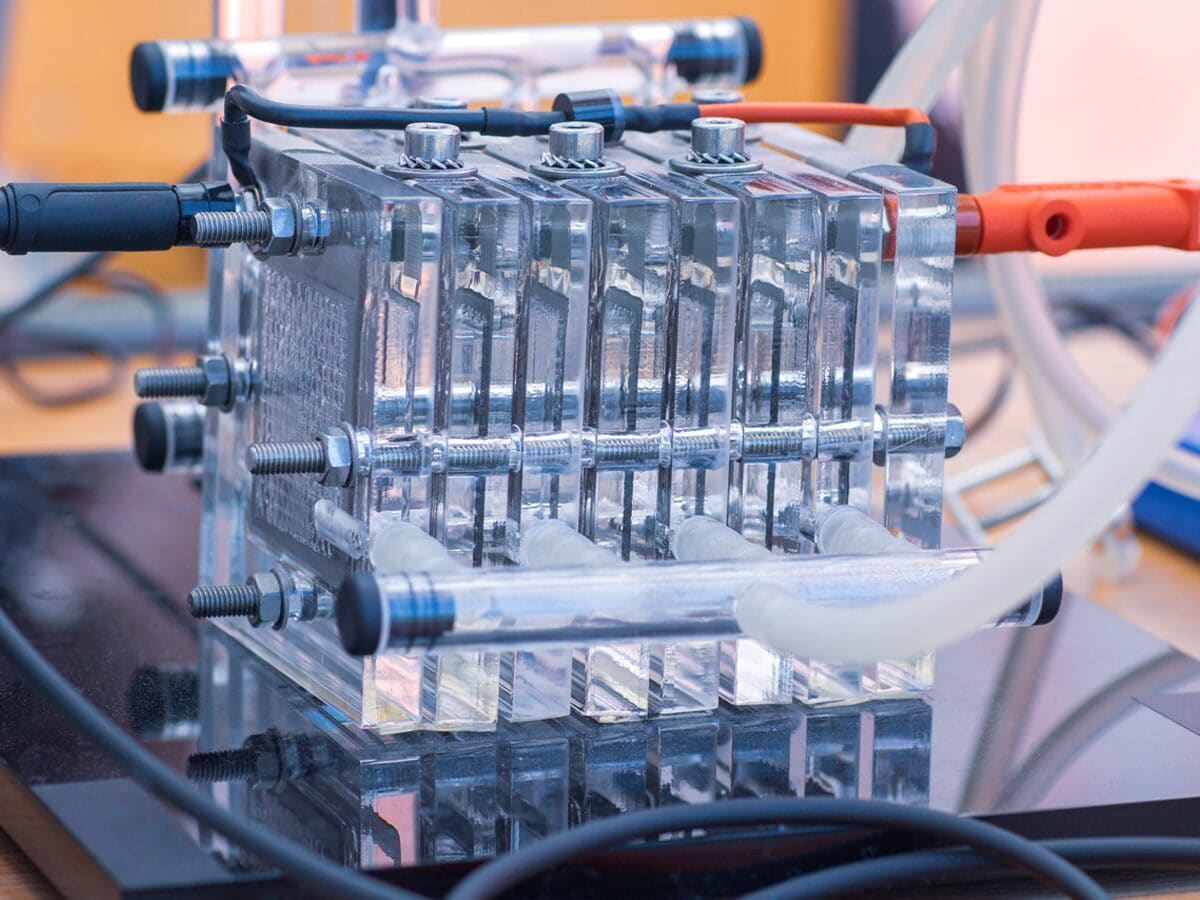

Hydrogen fuel cells produce electricity through an electrochemical reaction between hydrogen and oxygen, with the only byproduct being water. This makes them incredibly attractive for various applications, from powering vehicles like cars, buses, and heavy-duty trucks, to providing stationary power for buildings, and even enabling long-duration energy storage. The versatility of hydrogen, combined with its zero-emission profile at the point of use, positions it as a key player in the global energy transition.

The market is still relatively nascent, meaning there’s significant room for expansion. As technologies mature, production costs decrease, and infrastructure develops, the adoption of hydrogen solutions is expected to accelerate. This anticipated growth is precisely what makes the sector so appealing to investors looking for substantial returns.

Navigating the “Low Competition” Landscape

Finding “low competition” stocks in any sector means looking beyond the obvious choices. In the hydrogen fuel cell space, this often translates to companies that might be smaller in market capitalization, perhaps not yet widely covered by mainstream financial media, or those focusing on niche applications within the broader hydrogen ecosystem.

These companies might be innovators in specific components of fuel cell technology, developers of unique hydrogen production methods, or those targeting specialized industrial or transportation segments. The key is to identify businesses with a strong technological edge, promising partnerships, and a clear path to commercialization, even if their current revenue figures aren’t as eye-catching as the industry leaders.

It’s also worth noting that “low competition” doesn’t necessarily mean zero risk. These companies often face challenges like securing adequate funding, navigating complex regulatory environments, and competing with established energy players. Diligent research is absolutely essential to understand their business models, financial health, and growth prospects.

Under-the-Radar Hydrogen Fuel Cell Contenders

Let’s explore some companies that might fit the bill for those seeking less-talked-about opportunities in the hydrogen fuel cell space. Keep in mind that “low competition” is a dynamic concept, and the market is constantly evolving.

AFC Energy (AFC.L)

AFC Energy is a UK-based company that designs and manufactures alkaline fuel cell systems. What makes them interesting is their focus on high-efficiency, cost-effective solutions for off-grid power generation, electric vehicle charging, and other industrial applications. They’ve been making strides in developing ammonia-to-hydrogen technology, which could be a game-changer for hydrogen transport and storage.

Unlike some companies focusing on the highly competitive automotive sector, AFC Energy is carving out a niche in providing robust, scalable power solutions where grid infrastructure is limited or emissions need to be drastically reduced. Their partnerships with major industrial players suggest a growing recognition of their technology’s potential. They’re not a household name, but their specialized approach could lead to significant market penetration in specific areas.

ITM Power (ITM.L)

While perhaps more recognized than some truly “under-the-radar” players, ITM Power, another UK-based company, still flies somewhat under the radar compared to its North American counterparts. They are a leading manufacturer of electrolysers, which are crucial for producing green hydrogen – hydrogen generated using renewable electricity to split water.

As the world shifts towards green hydrogen production, the demand for efficient and scalable electrolysers is set to skyrocket. ITM Power’s expertise in Proton Exchange Membrane (PEM) electrolyser technology positions them well to capitalize on this trend. Their pipeline of projects and collaborations with large industrial clients indicate a strong commitment to expanding their manufacturing capacity and market reach. Investing in ITM Power is essentially a bet on the widespread adoption of green hydrogen, a foundational element of the future hydrogen economy.

Ceres Power (CWR.L)

Ceres Power, yet another UK-based company, is focused on Solid Oxide Fuel Cell (SOFC) technology. Unlike PEM fuel cells, SOFCs operate at higher temperatures and can use a wider range of fuels, including natural gas, biogas, and even hydrogen directly. This versatility makes them attractive for various applications, from residential power generation to large-scale industrial power.

Ceres Power’s business model revolves around licensing its technology to global manufacturing partners, rather than manufacturing the fuel cells themselves. This asset-light approach could potentially offer higher margins and less capital expenditure, making it an interesting proposition. Their partnerships with established industrial giants like Bosch and Weichai Power suggest significant validation of their technology and a pathway to widespread commercial deployment. They’re not just selling a product; they’re selling the core intellectual property behind a potentially transformative technology.

Proton Power Systems (PPS.L)

Proton Power Systems, a German company listed in London, specializes in developing and manufacturing hydrogen fuel cell systems for stationary, mobile, and maritime applications. They have a particular focus on robust, heavy-duty applications, which is a segment with significant growth potential as industries look to decarbonize their operations.

Their offerings range from compact fuel cell systems for small vehicles to larger modules for trucks, buses, and even ferries. This diversification across different mobility and power solutions could provide multiple avenues for revenue growth. Like many smaller players, they are still working towards consistent profitability, but their niche focus and demonstrated technological capabilities make them a company to watch for those interested in the broader adoption of hydrogen in various transport and industrial segments.

Clean Power Hydrogen (CPH2.L)

Clean Power Hydrogen (CPH2) is another UK-based company that has developed a unique membrane-free electrolyser technology for producing green hydrogen and oxygen. Their patented technology aims to be more efficient and cost-effective than traditional electrolysers, potentially lowering the overall cost of green hydrogen production.

The ability to produce high-purity hydrogen and oxygen simultaneously, without the need for expensive membranes, could be a significant differentiator. As the push for cheaper green hydrogen intensifies, innovative production methods like CPH2’s could gain substantial traction. They are still relatively early in their commercialization journey, but their disruptive technology warrants attention for those looking for potential high-growth opportunities in the hydrogen production space.

The Investment Thesis: Why These Stocks?

Investing in these less-known hydrogen fuel cell stocks isn’t about chasing the biggest names; it’s about identifying companies with strong foundational technology, strategic market positioning, and the potential for substantial growth as the hydrogen economy expands.

Niche Focus and Specialization

Many of these companies aren’t trying to be everything to everyone. Instead, they’re specializing in particular aspects of the hydrogen value chain – be it electrolysers, specific fuel cell types, or niche applications. This focused approach can allow them to become experts in their chosen field and develop competitive advantages.

Disruptive Technology

Some of these companies are developing truly innovative technologies that could fundamentally change how hydrogen is produced, stored, or utilized. If these technologies prove successful and scalable, they could lead to significant market share gains and provide a strong competitive edge.

Potential for Partnerships and Licensing

The hydrogen sector is highly collaborative. Smaller companies with valuable intellectual property can attract partnerships or licensing agreements with larger industrial players. This can provide much-needed funding, manufacturing capabilities, and access to wider markets, accelerating their growth without the need for massive capital outlays themselves.

Early-Stage Growth Potential

While established companies might offer more stability, smaller, emerging companies often have greater upside potential. If they succeed in commercializing their technologies and gaining market traction, their stock prices could see exponential growth. This is the classic “high risk, high reward” scenario that attracts some investors.

Global Decarbonization Trends

The overarching driver for the hydrogen sector is the global commitment to decarbonization. As more countries and industries set ambitious net-zero targets, the demand for clean energy solutions like hydrogen will only grow. This macro trend provides a strong tailwind for the entire sector, benefiting even smaller players who are well-positioned.

Challenges and Considerations

It’s important to be realistic about the challenges associated with investing in this space, especially in smaller companies.

Volatility and Risk

Emerging technology stocks are inherently volatile. They can be susceptible to market sentiment, news about technological breakthroughs or setbacks, and changes in government policies or funding. Be prepared for price swings.

Capital Intensity

Developing and scaling hydrogen technology requires significant capital investment. Many of these companies may need to raise additional funds through equity offerings, which can dilute existing shareholder value.

Regulatory and Policy Dependence

The growth of the hydrogen economy is heavily reliant on government support, subsidies, and favorable regulations. Changes in these policies could impact the profitability and growth prospects of companies in the sector.

Competition from Established Players

Even within niche segments, smaller companies face competition from larger, well-funded players who might decide to enter their specialized areas.

Time Horizon

The transition to a full-fledged hydrogen economy will take time. Investors in this sector should have a long-term investment horizon, understanding that significant returns may not materialize overnight. Patience is a virtue here.

Due Diligence is Key

Before considering any investment, thorough due diligence is paramount. Don’t just rely on online chatter or a single article. Look into:

Company Financials: Understand their revenue, expenses, cash burn rate, and how much cash they have on hand. Are they generating any revenue, or are they still heavily in the R&D phase?

Remember, the goal isn’t just to find a “low competition” stock, but a “low competition” stock with genuine potential and a solid underlying business.

Conclusion

The hydrogen fuel cell sector is undeniably exciting, offering a compelling narrative for a cleaner, more sustainable future. While the industry’s heavyweights often grab the most attention, the real potential for outsized returns might lie within the less-discussed, low-competition companies that are quietly innovating and carving out valuable niches. These firms, often specializing in critical components or unique applications, could be the backbone of the burgeoning hydrogen economy.

However, the journey for these emerging players is not without its hurdles. They navigate a landscape of significant capital requirements, evolving regulatory frameworks, and intense competition. For the discerning investor with a high-risk tolerance and a long-term perspective, these under-the-radar hydrogen fuel cell stocks represent an opportunity to be part of a transformative global shift. Thorough research, an understanding of their specific technological advantages, and a keen eye on their commercialization pathways are crucial to identifying the true potential within this dynamic and promising sector. The future is hydrogen-powered, and the seeds of that future might just be hidden in plain sight.