Powering Up Your Portfolio: Unearthing Micro Cap Wind Turbine Parts Stocks

Hey there, savvy investor! Ever thought about where wind turbines get their oomph from, beyond those massive blades spinning majestically against the sky? It’s easy to get caught up in the big names of renewable energy, the companies making headlines with enormous wind farms and cutting-edge turbine designs. But what about the unsung heroes, the small but mighty businesses churning out the nuts, bolts, gears, and composites that make those giants turn? We’re talking about micro cap wind turbine parts stocks, and they could be a fascinating, albeit higher-risk, area to explore for those looking for potential growth in the booming clean energy sector.

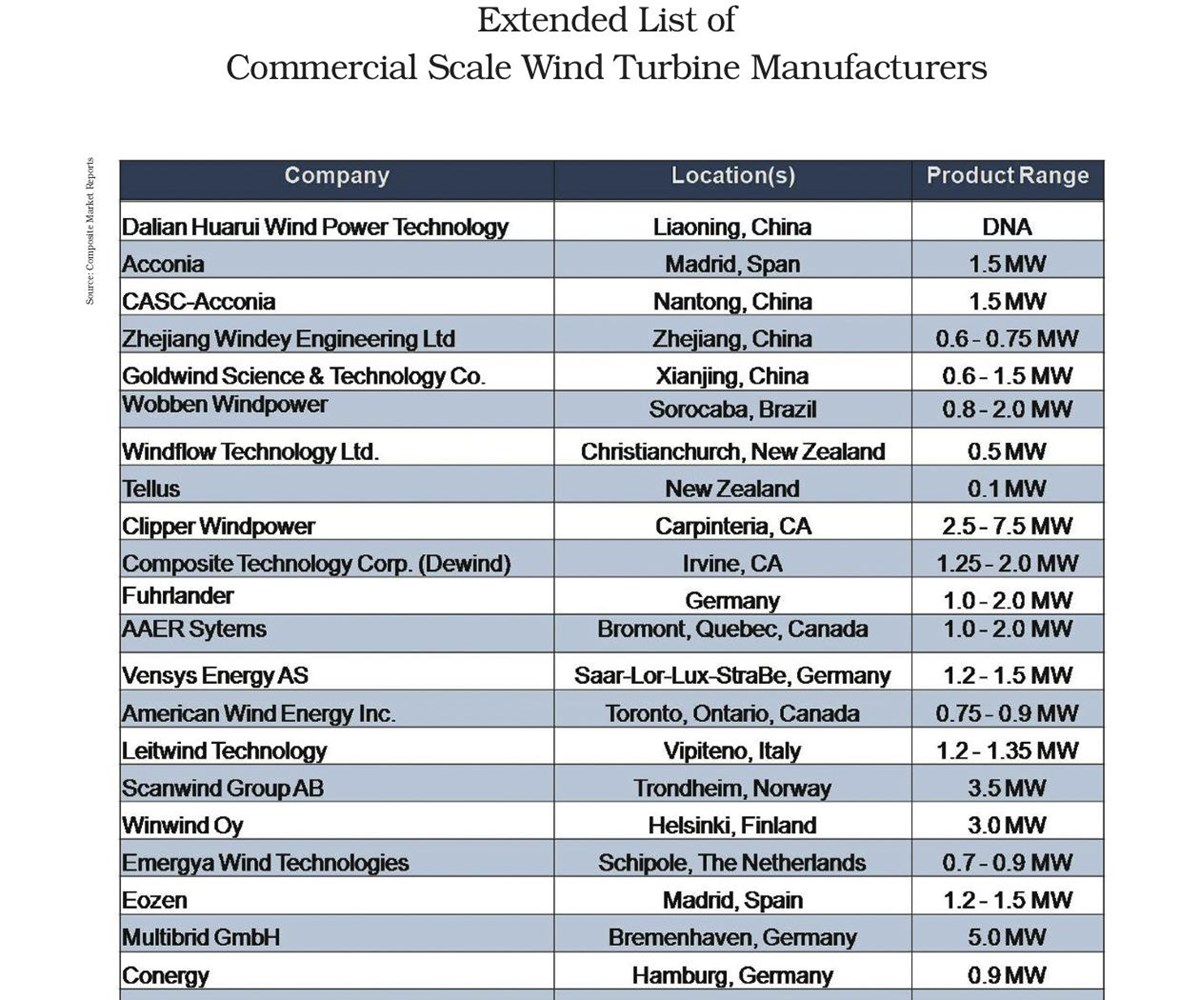

The global push towards decarbonization and sustainable energy sources has created an unprecedented demand for wind power. This isn’t just about building more turbines; it’s about the entire ecosystem, from the raw materials to the highly specialized components that ensure efficient and reliable operation. While the massive turbine manufacturers like Vestas or Siemens Gamesa are well-known, the intricate supply chain supporting them is a rich tapestry of smaller companies, many of which operate under the radar of mainstream investors. These are the micro caps – companies with market capitalizations typically under $300 million, often much smaller.

Why Focus on Micro Cap Wind Turbine Parts?

You might be thinking, “Micro caps? Isn’t that super risky?” And you’d be right, to an extent. They can be more volatile and less liquid than their larger counterparts. However, with higher risk often comes the potential for higher reward. Here’s why diving into the micro cap world of wind turbine parts could be an intriguing prospect:

The Growth Story of Renewables

First off, let’s just acknowledge the undeniable trajectory of renewable energy. Wind power is a cornerstone of this transition. Governments globally are setting ambitious targets for clean energy generation, leading to substantial investment in new wind projects, both onshore and offshore. This long-term growth trend acts as a powerful tailwind for the entire wind energy supply chain, including the companies making critical components. Even if the big turbine makers capture most of the spotlight, they rely heavily on a network of specialized suppliers. As the demand for turbines increases, so too does the demand for their constituent parts.

Niche Specialization and Essential Components

Wind turbines are incredibly complex machines, and they require a vast array of specialized parts to function optimally. We’re talking about everything from the bearings that allow the blades to pitch and yaw, to the intricate gearboxes that convert slow blade rotations into high-speed energy, to the sophisticated power electronics that manage electricity flow, and the advanced composite materials that form the blades themselves. Many micro cap companies specialize in producing just one or a few of these critical components. This niche specialization can be a strength, as it allows them to develop deep expertise, proprietary technologies, and strong relationships with larger turbine manufacturers who depend on their unique offerings. Think about it: a small company that has perfected a specific type of bearing, or a super-durable composite, can become an indispensable part of the supply chain.

Potential for Innovation

Smaller companies often have a greater agility when it comes to innovation. They can adapt more quickly to new technologies, materials, or manufacturing processes. In a rapidly evolving industry like wind energy, where efficiency, durability, and cost-effectiveness are constantly being improved, this ability to innovate can give micro cap parts manufacturers a competitive edge. They might be developing next-generation sensors for predictive maintenance, more efficient aerodynamic components, or novel materials that reduce weight and increase power output. These innovations, even if seemingly small, can have a significant impact on the performance and cost of a wind turbine, making these companies attractive acquisition targets for larger players or enabling them to capture a larger market share.

Overlooked by Larger Funds

Because of their smaller size and often lower liquidity, micro cap stocks are frequently overlooked by institutional investors and large mutual funds. This can create opportunities for individual investors who are willing to do their homework. When a company is not on the radar of these big players, its stock price might not fully reflect its growth potential or intrinsic value. This “inefficiency” in the market is where astute individual investors can potentially find undervalued gems. Of course, this also means less analyst coverage and often less readily available information, requiring more in-depth research on your part.

The Replacement and Maintenance Market

It’s not just about building new turbines. Existing wind farms require ongoing maintenance, repairs, and component replacements. This creates a steady, recurring revenue stream for parts manufacturers. As the global installed base of wind turbines continues to grow and age, the demand for spare parts will only increase. A micro cap company specializing in a durable, high-demand replacement part could have a very stable and predictable business model, even if new turbine installations slow down. This provides a level of resilience that purely new-build focused companies might not have.

How to Approach Micro Cap Wind Turbine Parts Stocks

So, if you’re intrigued by this niche, how do you even begin to find these companies? It’s definitely not as straightforward as looking up the biggest names in renewable energy.

Deep Dive Research is Key

This is where your inner detective needs to shine. You’ll need to go beyond the typical stock screeners. Look into the supply chains of the major wind turbine manufacturers. Often, their investor presentations or annual reports will list key suppliers, sometimes even highlighting specific component innovations. Industry trade publications, specialized renewable energy conferences (even virtual ones!), and niche market research reports can also be valuable sources of information. You’re looking for companies that are mentioned as key suppliers for critical components.

Focus on Specific Components

Instead of just “wind turbine parts,” narrow your focus. Are you interested in companies that make bearings, gearboxes, blades, towers, electrical components, or something else entirely? Each of these areas will have its own set of specialized manufacturers. Researching specific component types will help you identify the smaller players that are experts in those fields. For example, some companies might specialize in advanced composite materials for lighter, stronger blades, while others might focus on high-precision machining for gearbox components.

Financial Health and Management

Even with the exciting growth potential, the fundamentals matter. Scrutinize the financial statements. Look for consistent revenue growth, healthy profit margins, and manageable debt levels. Micro caps can be more vulnerable to economic downturns or industry-specific headwinds, so a strong balance sheet is crucial. Also, pay close attention to the management team. Do they have a proven track record in the industry? Do they have a clear vision for the company’s future? In smaller companies, the quality of leadership can have an outsized impact.

Competitive Landscape

Understand the competitive landscape for the specific components they produce. Are there many competitors, or is it a more specialized market with higher barriers to entry? Companies with unique intellectual property, strong customer relationships, or highly specialized manufacturing capabilities will have a better chance of long-term success. A company with a patented technology or a strong reputation for quality in a particular component segment will be more resilient.

Regulatory and Policy Tailwinds

Keep an eye on government policies and regulations related to renewable energy. Favorable policies, tax incentives, and carbon pricing mechanisms can significantly boost the demand for wind energy and, by extension, the demand for wind turbine parts. These broader macroeconomic and policy trends can act as powerful catalysts for even the smallest companies in the sector. Conversely, policy changes can also introduce risks, so staying informed is paramount.

Risks to Consider

While the opportunities are compelling, it’s crucial to be aware of the inherent risks when investing in micro cap stocks, especially in a specialized industry like wind turbine parts.

Volatility and Liquidity

Micro cap stocks are inherently more volatile than larger, more established companies. Their prices can swing dramatically on relatively small trading volumes. This also means they can be less liquid, making it harder to buy or sell shares quickly without impacting the price. If you need to exit your position in a hurry, you might find it challenging.

Concentration Risk

Many micro cap companies are highly dependent on a small number of customers, often the large turbine manufacturers. If one of those key customers reduces orders or goes through financial difficulties, it can have a significant negative impact on the micro cap supplier. Diversifying your investments across several micro caps, and across different components, can help mitigate this.

Competition and Technological Disruption

The wind energy industry is dynamic, with continuous technological advancements. A micro cap company’s specialized component could become obsolete if a new, more efficient, or cheaper alternative emerges. Furthermore, larger players might decide to bring certain component manufacturing in-house, reducing their reliance on external suppliers.

Lack of Information and Analyst Coverage

As mentioned, micro caps often receive limited attention from financial analysts and the media. This means less publicly available information, making your own due diligence even more critical. It also means that positive developments might not be widely known, hindering price appreciation, but it also creates the opportunity for you to uncover value before the broader market.

Economic Sensitivity

While the long-term trend for renewables is strong, the pace of new wind farm development can be sensitive to economic cycles, interest rates, and commodity prices. A slowdown in global economic growth or an increase in the cost of raw materials can impact the profitability of wind turbine parts manufacturers.

Conclusion

Investing in micro cap wind turbine parts stocks isn’t for the faint of heart, and it certainly isn’t a “set it and forget it” strategy. It demands thorough research, a strong understanding of the wind energy supply chain, and a tolerance for higher risk. However, for those willing to put in the work, this niche offers a fascinating avenue to potentially participate in the explosive growth of the renewable energy sector from a less-traveled path. The companies that quietly, efficiently, and innovatively produce the critical components powering our transition to a cleaner future might just be the next hidden gems in your portfolio. Keep an eye on the smaller players, the specialists, and the innovators – they could be making big waves in the future of wind power.

5 Unique FAQs After The Conclusion

How do I identify genuine micro cap wind turbine parts manufacturers versus speculative ventures?

Identifying genuine manufacturers requires looking for companies with established supply agreements with major turbine makers, a history of consistent production and delivery, and transparent financial reporting, even if it’s limited. Look for their presence at industry trade shows, press releases announcing new contracts, and any mention of specific product innovations or quality certifications. A strong focus on R&D for a specialized component is also a good sign.

What are the specific types of wind turbine components that micro cap companies typically specialize in?

Micro cap companies often specialize in highly engineered components like specialized bearings (pitch, yaw, main shaft), precision-machined gearbox parts, advanced composite materials for blade manufacturing or repair, small-scale power electronics for specific turbine subsystems, sensor technology for condition monitoring, and various fasteners and seals designed for extreme conditions. They usually don’t produce the entire turbine or even major subsystems like a complete nacelle.

How does the rise of offshore wind farms specifically impact micro cap component manufacturers?

The growth of offshore wind farms creates demand for even more robust, durable, and specialized components due to the harsh marine environment. This can benefit micro caps that innovate in areas like corrosion-resistant materials, advanced coatings, and highly reliable monitoring systems. The larger scale of offshore turbines also necessitates larger and more precisely engineered versions of existing components, often requiring specialized manufacturing capabilities that smaller, nimble companies can excel at.

Are there any specific regions or countries where micro cap wind turbine parts manufacturers are more concentrated?

Yes, you’ll often find concentrations of these manufacturers in regions with strong established wind energy industries and robust manufacturing bases. This includes parts of Europe (especially Germany, Denmark, and Spain), North America (particularly the Midwest US), and increasingly, Asia (China and India), where local supply chains are rapidly developing to support their own growing wind power ambitions. Proximity to major turbine assembly plants can also be a factor.

What are some non-financial indicators that suggest a micro cap wind turbine parts company has strong potential?

Beyond financial statements, look for indicators such as a high rate of customer retention among major turbine manufacturers, repeat orders, strategic partnerships with larger industry players, patents or intellectual property related to their components, and active participation in industry consortiums or research initiatives focused on wind energy technology. Also, a focus on sustainable manufacturing practices or materials can be an appealing non-financial indicator for long-term relevance.