In the often-turbulent world of stock markets, finding investments that offer a blend of stability and consistent returns can feel like searching for a needle in a haystack. But what if we told you there’s a strategy that aims to deliver just that? Enter the realm of low volatility dividend stocks – a fascinating corner of the market that could offer a smoother ride for your investment journey while still delivering a nice stream of income.

What’s the Big Idea Behind Low Volatility Dividend Stocks?

Imagine a calm sea compared to a stormy ocean. That’s essentially the difference between a low volatility stock and a high volatility one. Volatility simply refers to how much a stock’s price bounces around. A low volatility stock tends to move less dramatically, both up and down, than the overall market.

Now, add dividends to the mix. Dividends are essentially a slice of a company’s profits paid out to its shareholders, usually on a regular basis (like quarterly). Think of it as a thank-you note from the company for being an investor, often arriving as a cash payment.

So, when we talk about “low volatility dividend stocks,” we’re looking at companies that not only pay out a portion of their earnings to you but also tend to have relatively stable stock prices. These aren’t the flashy, fast-growing tech companies that might double in value overnight (or halve just as quickly). Instead, they’re often the more established, mature businesses that generate consistent cash flow and have a proven track record.

Why Should You Even Bother with These “Boring” Stocks?

It’s easy to get caught up in the excitement of high-growth stocks, but there are some compelling reasons why low volatility dividend stocks deserve a place in your portfolio, especially if you’re looking for a more predictable and less stressful investment experience.

Steady Income Stream

One of the most appealing aspects of dividend stocks is the regular income they provide. This can be particularly attractive for those who are retired or looking to supplement their income. Instead of having to sell off parts of your investment to get cash, you receive regular payments directly. It’s like getting a consistent rental income from a property, but without the landlord headaches! This consistent cash flow can provide a cushion during market downturns, as you’re still receiving payments even if the stock price dips a bit.

Reduced Risk and Smoother Ride

Nobody likes to see their investments plummet. Low volatility stocks, by their very nature, tend to be less prone to drastic price swings. This means less emotional rollercoaster for you as an investor. While they might not shoot up as dramatically during bull markets, they also tend to fall less severely during bear markets. This “lose less to win more” philosophy can be incredibly powerful over the long term. If your portfolio experiences smaller dips, it needs less ground to cover to get back to its original value, making it easier to keep pace with the market over time.

Potential for Long-Term Growth (Yes, Really!)

It’s a common misconception that low volatility stocks don’t offer growth. While they might not be the rocket ships of the stock market, many low volatility dividend companies are well-established businesses with strong fundamentals. They’ve often been around for a long time, operate in essential industries, and consistently generate profits. This financial stability often translates into steady, albeit perhaps slower, capital appreciation over time. Plus, if you reinvest those dividends, you’re essentially buying more shares at potentially lower prices, supercharging the compounding effect.

A Hedge Against Inflation

Inflation, the silent thief of purchasing power, is a constant concern for investors. Dividend stocks, especially those from companies that consistently increase their dividends, can offer a degree of protection against inflation. As these businesses grow and generate higher profits, they may raise their dividend payouts, helping your income keep pace with rising costs.

The Power of Compounding

This is where the magic really happens with dividend investing. When you reinvest your dividends – meaning you use the cash payments to buy more shares of the same stock – you unlock the power of compounding. Those newly purchased shares then generate their own dividends, which you can reinvest again, and so on. Over time, this snowball effect can significantly boost your overall returns and accelerate your wealth accumulation. It’s like planting a small tree that keeps growing and sprouting new, dividend-paying branches.

How Do You Spot These Elusive Low Volatility Dividend Gems?

Finding these stocks isn’t about guesswork; it’s about looking at specific characteristics and metrics.

Companies with Stable Earnings and Strong Balance Sheets

Think of businesses that provide essential goods and services – things people need regardless of the economic climate. These often include utility companies (electricity, gas, water), consumer staples (food, household products), and healthcare providers. These sectors tend to be less affected by economic downturns, leading to more predictable earnings. Companies with low debt levels and plenty of cash on hand are also better positioned to continue paying dividends, even if times get a little tough.

A History of Consistent Dividend Payments and Growth

A company that has been paying dividends for decades, and better yet, consistently increasing them, is a strong indicator of its financial health and commitment to shareholders. Look for “Dividend Aristocrats” or “Dividend Kings” – companies that have raised their dividends for 25 or even 50 consecutive years, respectively. This demonstrates a deep-rooted stability and a shareholder-friendly mindset.

Low Beta Value

Beta is a measure of a stock’s volatility relative to the overall market. A beta of 1 means the stock tends to move in line with the market. A beta less than 1 suggests lower volatility. So, if a stock has a beta of 0.7, it means it’s historically been 30% less volatile than the market. Screening for stocks with a beta below 1 (and ideally even lower) is a good starting point for identifying low volatility candidates.

Healthy Payout Ratio

The dividend payout ratio tells you what percentage of a company’s earnings are being paid out as dividends. While a high dividend yield might look attractive, a payout ratio that’s too high (say, over 70-80% for many industries, or even over 100%) could be a red flag. It might mean the company is paying out more than it can sustainably afford, potentially leading to a dividend cut down the line. A healthy payout ratio indicates that the dividend is well-covered by earnings and leaves room for future growth or reinvestment back into the business.

Reasonable Dividend Yield

While a good dividend yield is desirable, chasing the absolute highest yield can be risky. Sometimes, an unusually high yield can signal that the stock price has fallen significantly, indicating underlying problems with the company. This is what’s known as a “dividend trap.” It’s better to focus on a sustainable yield from a healthy company rather than just the highest percentage.

Putting It All Together: A Strategy for Low Volatility Dividend Investing

Investing in low volatility dividend stocks isn’t about getting rich quick; it’s about building long-term wealth with a focus on stability and income.

Diversification is Key

Even within the low volatility dividend space, it’s crucial to diversify your investments. Don’t put all your eggs in one basket. Spread your capital across different companies and sectors to reduce your overall risk.

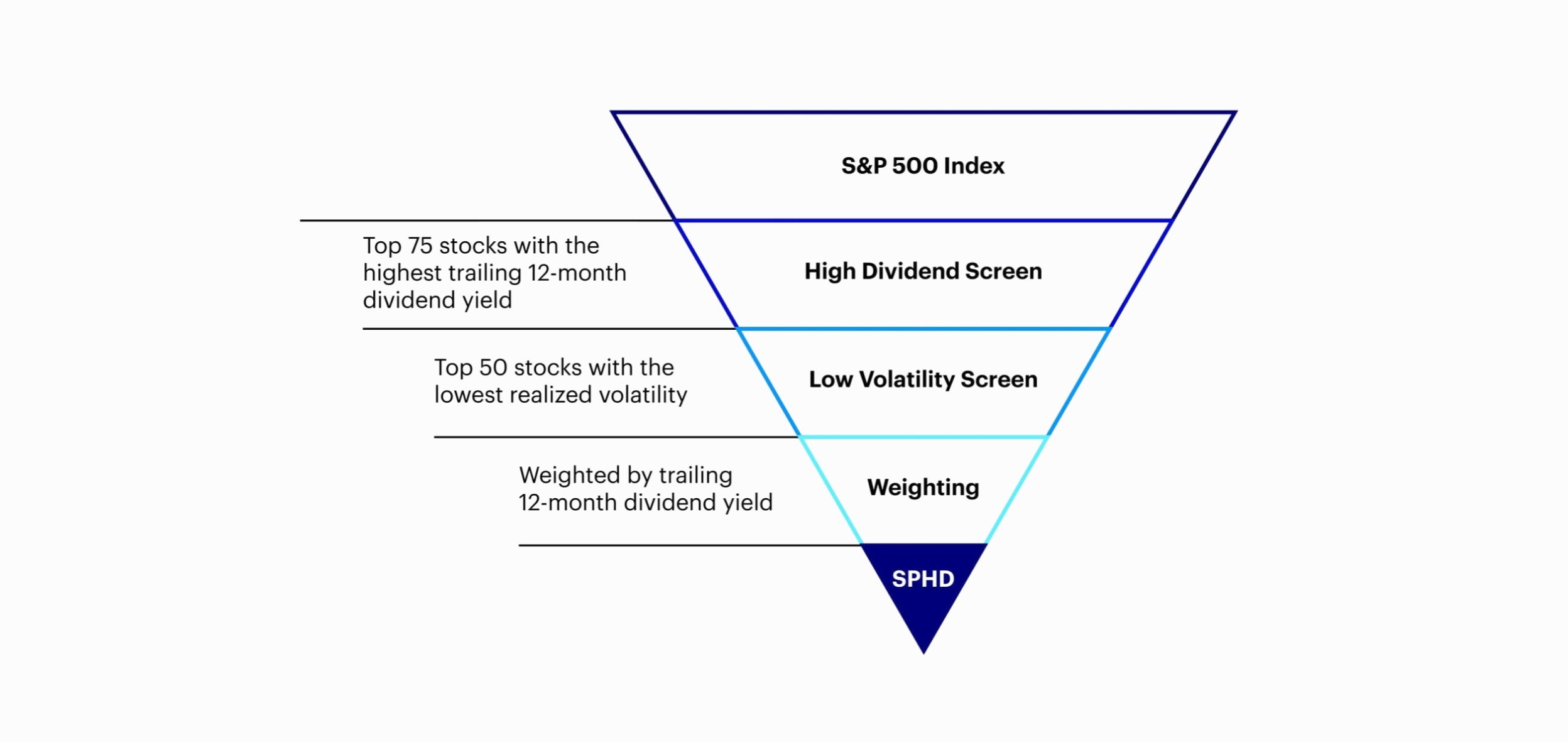

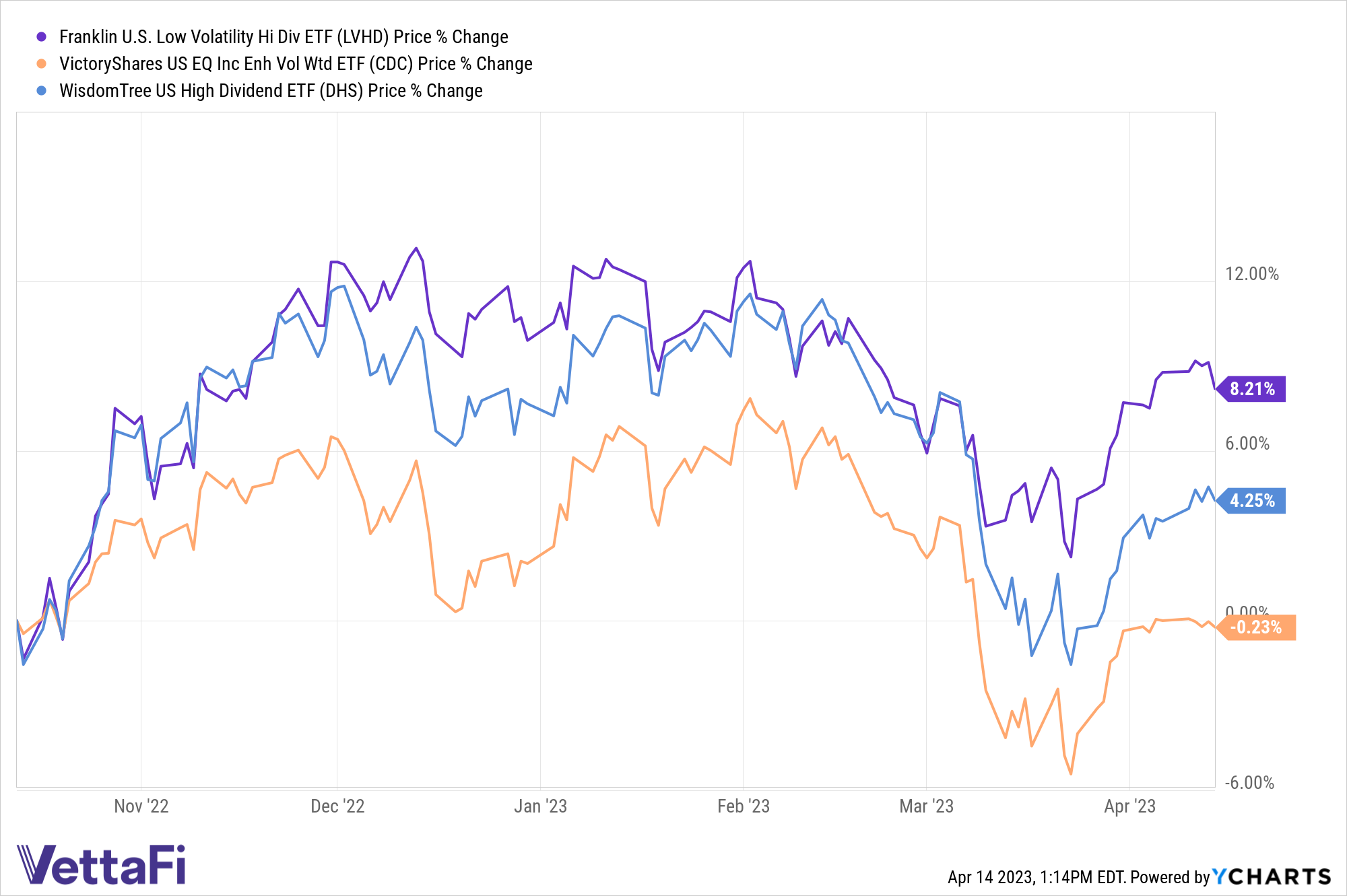

Consider ETFs for Broader Exposure

If picking individual stocks feels a bit daunting, Exchange Traded Funds (ETFs) can be a great option. There are many ETFs specifically designed to track indices of low volatility dividend stocks. These funds automatically give you exposure to a diversified basket of such companies, managed by professionals, often with lower fees than actively managed funds.

Reinvest Your Dividends

To truly harness the power of compounding, make sure you set up a dividend reinvestment plan (DRIP) if your broker offers one. This automatically uses your dividend payments to buy more shares, accelerating your wealth growth over time.

Be Patient

Investing, especially with a strategy focused on stability and income, requires patience. The real benefits of compounding and consistent dividend income reveal themselves over years, not months. Avoid the temptation to constantly check your portfolio and react to short-term market fluctuations.

Stay Informed

While these stocks are generally less volatile, it’s still important to keep an eye on the companies you invest in. Understand their business models, monitor their financial health, and be aware of any major industry changes that could impact their ability to continue paying dividends.

Potential Pitfalls to Watch Out For

Even the most stable investments have their quirks and risks. Low volatility dividend stocks aren’t immune to these.

Slower Growth Potential

By their very nature, these companies are mature and established, meaning their potential for explosive capital appreciation might be limited compared to high-growth stocks. If your primary goal is aggressive capital growth, this strategy might not be for you.

Interest Rate Sensitivity

Some low volatility dividend stocks, particularly those in sectors like utilities, can be sensitive to changes in interest rates. When interest rates rise, bonds become more attractive, and the steady income from dividend stocks might seem less appealing in comparison, potentially leading to some price pressure.

“Dividend Traps”

As mentioned earlier, a high dividend yield isn’t always a good thing. Sometimes, a company’s stock price might have fallen significantly due to underlying financial problems, artificially inflating the yield. Always look at the sustainability of the dividend through metrics like the payout ratio and the company’s overall financial health. A company that’s struggling might cut or even eliminate its dividend, which can lead to a sharp decline in its stock price.

Sector Concentration

Many low volatility dividend stocks tend to be concentrated in a few specific sectors, such as utilities, consumer staples, and real estate. While these sectors offer stability, over-concentrating your portfolio in them can expose you to sector-specific risks. Diversification across different industries, even within the low volatility theme, is important.

Conclusion

Low volatility dividend stocks offer a compelling investment strategy for those seeking a more stable and income-focused approach to building wealth. By focusing on financially sound companies with a history of consistent dividend payments and less dramatic price swings, investors can potentially enjoy a smoother investment journey, benefit from regular income, and harness the powerful effects of compounding. While not without their own considerations, for many, these “boring” stocks can be the bedrock of a resilient and rewarding portfolio.

5 Unique FAQs After The Conclusion

1. Are low volatility dividend stocks suitable for young investors with a long time horizon?

While low volatility dividend stocks are often associated with retirees or those seeking income, they can absolutely be suitable for younger investors too. The consistent income stream, when reinvested, can significantly boost long-term compounding. Plus, the reduced volatility can help young investors stay disciplined and avoid emotional decisions during market downturns, fostering good investing habits early on.

2. How do economic recessions typically impact low volatility dividend stocks?

Low volatility dividend stocks generally tend to be more resilient during economic recessions compared to the broader market. This is because they often belong to sectors that provide essential goods and services, which consumers continue to demand even during tough times. While their prices might still decline, the drop is typically less severe, and the consistent dividend payments can provide a valuable income buffer.

3. Is there a specific dividend yield percentage that indicates a “good” low volatility dividend stock?

There isn’t a hard and fast rule for a “good” dividend yield percentage. It really depends on the industry, the company’s growth prospects, and the overall economic environment. Instead of chasing the highest yield, focus on the sustainability of the dividend. A moderate, growing dividend yield from a financially strong company is generally much more desirable than a very high yield from a struggling business. Looking at the dividend payout ratio is often more important than just the yield itself.

4. Can I find low volatility dividend stocks in emerging markets?

Yes, it’s possible, but it requires more careful research. Emerging markets tend to be inherently more volatile than developed markets. However, within emerging markets, there might be established companies with stable business models and consistent dividend payments that exhibit lower volatility relative to their local markets. It’s crucial to thoroughly research the specific company and the regulatory environment in the country before investing.

5. What’s the difference between a “dividend aristocrat” and a “dividend king”?

Both “Dividend Aristocrats” and “Dividend Kings” are terms used to describe companies with a long history of increasing their dividends, but the distinction lies in the length of that history. A “Dividend Aristocrat” is typically a company in the S&P 500 Index that has increased its dividend for at least 25 consecutive years. A “Dividend King” is an even more exclusive club, reserved for companies that have increased their dividends for at least 50 consecutive years. These titles signify exceptional financial strength and commitment to returning value to shareholders.