Okay, here’s a long-form article about small-cap anaerobic digestion stocks, written in a casual English style, optimized for SEO, and without images.

—

# Unearthing Green Gold: Why Small Cap Anaerobic Digestion Stocks Could Be Your Next Big Bet

Hey there, eco-conscious investor! Ever heard of anaerobic digestion? It might sound a bit like a complicated science experiment, but trust me, it’s a fascinating and increasingly vital part of our journey towards a greener future. And what’s even more exciting is that it’s opening up some intriguing opportunities in the stock market, especially within the small-cap arena. We’re talking about companies that are turning waste into valuable resources, cleaning up the environment, and potentially offering some serious growth potential.

Now, I know what you might be thinking: “Small cap? Isn’t that risky?” And you’re not wrong – small-cap stocks can be more volatile than their larger counterparts. But with higher risk often comes the potential for higher rewards. In the world of anaerobic digestion, we’re seeing innovation and growth, and some of these smaller players might just be the hidden gems that explode onto the scene as the world shifts further towards sustainable energy and waste management.

So, let’s dive into the nitty-gritty of anaerobic digestion, why it’s such a big deal for the planet, and what to look for when scouting out those promising small-cap stocks.

What Exactly is Anaerobic Digestion, Anyway?

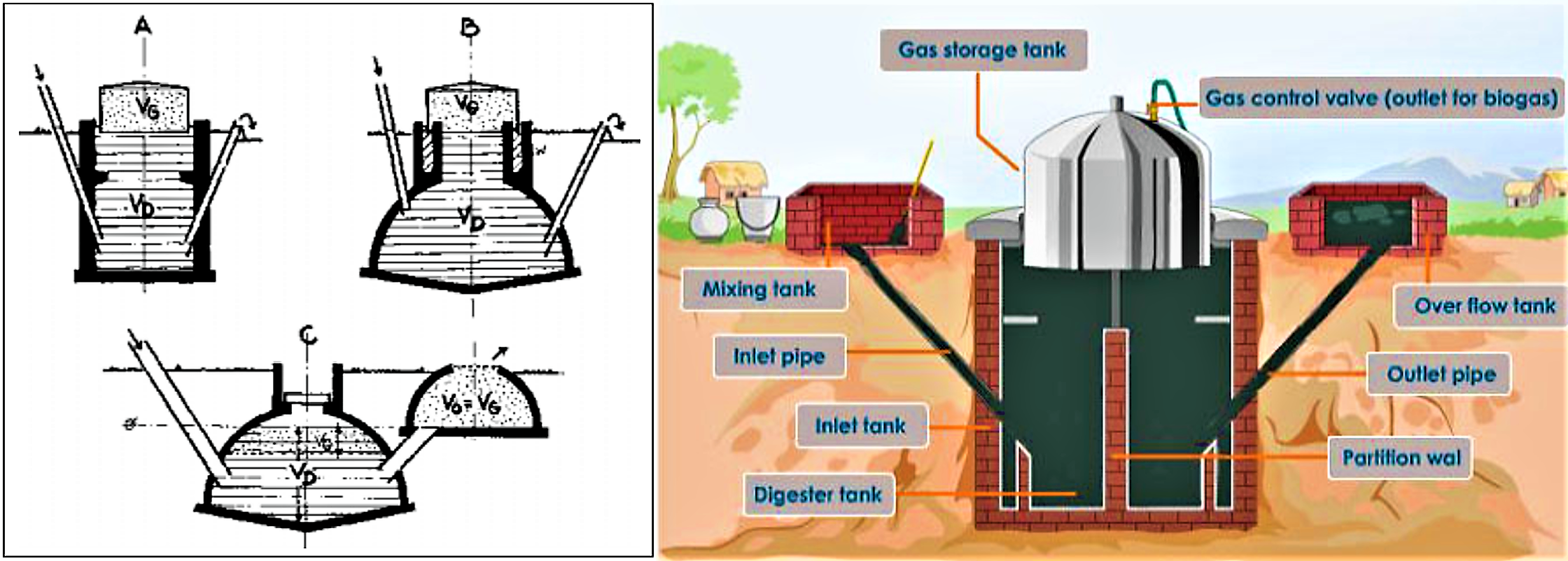

Before we get into the money-making potential, let’s quickly break down what anaerobic digestion (AD) actually is. Imagine a giant, sealed “stomach” where bacteria get to work on organic materials – things like food waste, animal manure, agricultural residues, and even sewage sludge. The key here is “anaerobic,” meaning without oxygen. In this oxygen-free environment, these clever little microbes break down the waste, and in doing so, they produce two main things:

Biogas: The Renewable Powerhouse

This is the star of the show. Biogas is primarily methane, which is the main component of natural gas. But unlike fossil natural gas, biogas is renewable. Once it’s produced, it can be captured and used in a bunch of different ways.

Generating Electricity and Heat: Many AD plants use the biogas to fuel combined heat and power (CHP) units. This means they’re producing both electricity and heat simultaneously, making them super efficient. This green energy can then be fed into national grids or used directly on-site.

Digestate: The Super Soil Improver

After the bacteria have done their magic, what’s left behind is called digestate. This isn’t just some messy byproduct; it’s a nutrient-rich material, often separated into liquid and solid portions. And guess what? It’s fantastic for agriculture!

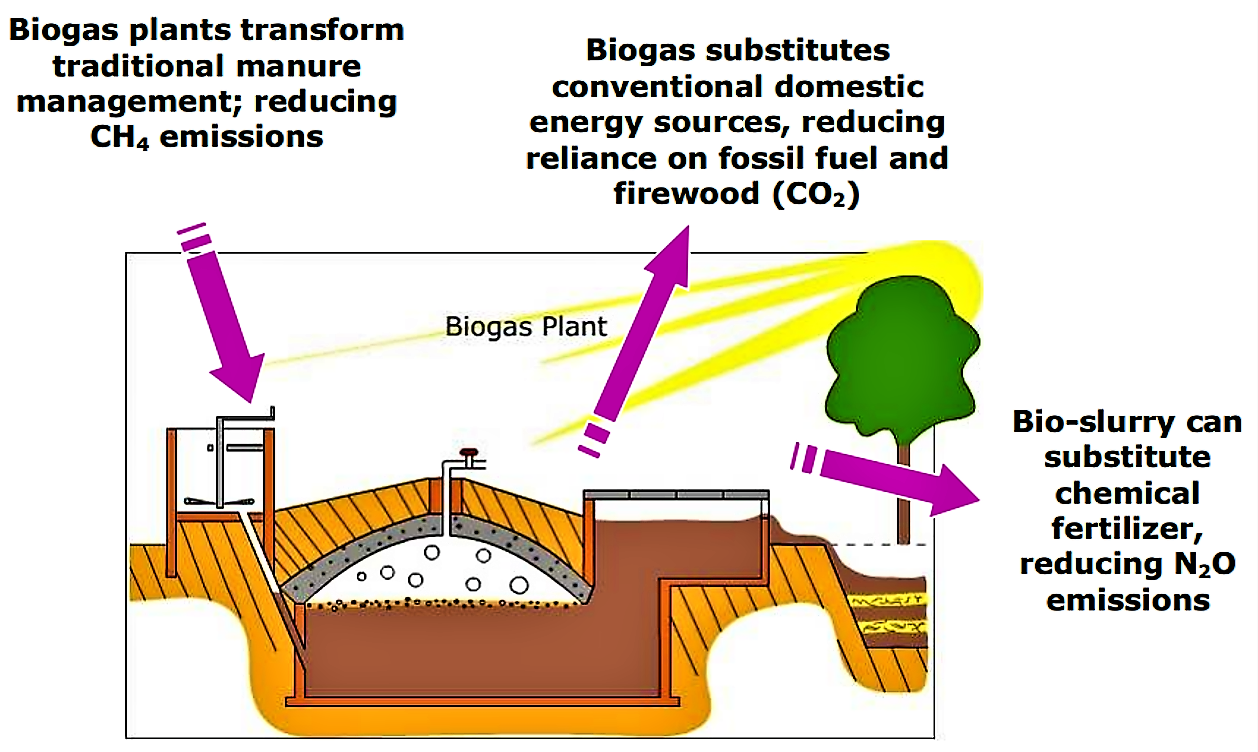

Natural Fertiliser: Digestate is packed with nutrients like nitrogen, phosphorus, and potassium, making it an excellent natural fertiliser. Farmers can use it to enrich their soil, reducing the need for chemical fertilisers and closing the loop on nutrient cycles. It’s a win-win for both the environment and agricultural productivity.

So, in a nutshell, anaerobic digestion is like a magic trick that takes our organic waste, prevents it from emitting harmful greenhouse gases in landfills, and transforms it into clean energy and valuable fertiliser. Pretty neat, right?

Why Anaerobic Digestion is a Big Deal for Our Planet (and Your Portfolio)

The world is waking up to the urgent need for sustainable solutions, and anaerobic digestion ticks a lot of crucial boxes. This isn’t just a niche technology; it’s a fundamental part of building a circular economy and tackling climate change.

Tackling Climate Change Head-On

One of the biggest reasons AD is gaining traction is its role in reducing greenhouse gas emissions. When organic waste goes to landfills, it decomposes anaerobically anyway, but it releases uncontrolled methane into the atmosphere. Methane is a potent greenhouse gas, far more impactful than carbon dioxide in the short term. By capturing this methane in AD plants, we prevent it from escaping and instead put it to good use as renewable energy. It’s a double whammy: reducing emissions from waste and displacing fossil fuel consumption.

Waste Management Solutions

Let’s face it, we generate a lot of waste. Landfills are filling up, and the environmental impact of traditional waste disposal methods is significant. AD offers a smarter, more sustainable way to manage organic waste, diverting it from landfills and turning a problem into a resource. This isn’t just about environmental responsibility; it’s also about creating valuable by-products from what was once considered rubbish.

Energy Security and Decentralisation

Reliance on fossil fuels comes with a lot of baggage – price volatility, geopolitical instability, and environmental damage. Renewable energy sources like biogas offer a more stable and locally produced alternative. AD plants can be built closer to the sources of waste, reducing transportation costs and creating a more decentralised energy system. This means communities can generate their own clean energy, boosting energy independence and resilience.

Government Support and Policy Drives Growth

Governments worldwide, including in the UK, are increasingly recognising the importance of anaerobic digestion. Support schemes, grants, and renewable energy targets are all helping to accelerate the development of AD infrastructure. For investors, this creates a favourable environment, as policy stability and financial incentives can reduce risk and encourage investment in the sector. The Green Gas Support Scheme (GGSS) in the UK, for example, provides tariff support for biomethane injected into the gas grid, making these projects more financially viable.

Hunting for Small-Cap Anaerobic Digestion Stocks: What to Look For

Now that you’re hopefully convinced that anaerobic digestion is a promising sector, let’s talk about how to spot those potential small-cap winners. Remember, “small cap” means these companies generally have a market capitalization between £50 million and £1 billion (or similar ranges depending on the market). They might not be household names yet, but that’s where the opportunity often lies.

Strong Management Team with Proven Experience

In any small company, the management team is absolutely critical. In a relatively new and evolving sector like AD, you want to see leaders with a deep understanding of the technology, a track record of successful project development, and the ability to navigate regulatory landscapes. Look for teams with experience in engineering, project finance, waste management, and renewable energy. A visionary leader who can adapt to challenges and seize opportunities is invaluable.

Robust Project Pipeline and Scalability

A company might have a great idea, but if they can’t scale it up, the growth potential is limited. Look for small-cap AD companies that have a clear and ambitious project pipeline. Are they actively acquiring new sites, developing new plants, or expanding existing ones? Do they have the ability to replicate their success in different locations or with different feedstocks? Scalability indicates future revenue growth and market penetration.

Diverse Feedstock Strategy

Relying on a single type of organic waste can be risky. Companies that have a diverse feedstock strategy – meaning they can process various types of waste like food waste, agricultural residues, and industrial effluents – tend to be more resilient. This diversification reduces their dependence on any one source and allows them to adapt to changing waste streams and market conditions. It also often means they’re tapping into a wider range of potential revenue streams.

Offtake Agreements and Revenue Stability

For an AD plant to be successful, it needs a guaranteed market for its outputs: biogas (or biomethane/electricity) and digestate. Look for companies that have solid offtake agreements in place with energy companies, utilities, or agricultural businesses. These long-term contracts provide revenue stability and predictability, which is crucial for a small company that might still be proving its business model. Without a clear pathway to sell their products, even the most efficient AD plant won’t be profitable.

Technological Innovation and Efficiency

While the basic principles of AD are well-established, there’s always room for innovation. Some small-cap companies might be developing new technologies to improve efficiency, reduce operational costs, or extract more value from the waste. This could involve advanced digester designs, improved gas clean-up processes, or novel uses for digestate. Keep an eye out for companies that are investing in R&D and have a competitive edge in their technology.

Favourable Regulatory Environment and Government Support

As mentioned earlier, government policies play a huge role in the success of renewable energy projects. Before investing, research the regulatory landscape in the regions where the company operates. Are there strong incentives for renewable energy generation? Are waste management policies supportive of AD? Companies that can effectively leverage government support and navigate regulatory complexities will have a significant advantage.

Financial Health and Funding

Even with all the potential in the world, a company needs sound financials. Look at their balance sheet, revenue growth, and profitability (or clear path to profitability). Do they have enough cash to fund their expansion plans, or are they overly reliant on debt? While small-cap companies might not be raking in huge profits yet, you want to see a responsible approach to financial management and a clear strategy for securing future funding.

Environmental, Social, and Governance (ESG) Focus

For many investors today, ESG factors are just as important as financial performance. Anaerobic digestion by its very nature is an environmentally friendly process. However, look deeper into a company’s overall ESG practices. Are they committed to sustainability beyond just their core business? Do they have good labour practices? Is their governance transparent? A strong ESG focus can not only attract more investors but also indicate a well-run and forward-thinking company.

Understanding the Risks

It’s important to reiterate that small-cap stocks come with inherent risks. The AD sector, while promising, is still subject to:

Technology Risk: While proven, there can be operational challenges or unforeseen technical issues with new plant designs.

Do your due diligence, spread your investments, and only invest what you’re comfortable losing.

The Future is Green, and Small Caps are Leading the Charge

The global push towards a more sustainable future isn’t just a trend; it’s a fundamental shift. Anaerobic digestion is at the forefront of this transition, offering practical and impactful solutions for waste management and renewable energy production. While large corporations are certainly involved, it’s often the nimble and innovative small-cap companies that drive significant advancements and offer the most explosive growth potential for early investors.

As an investor, getting in on the ground floor with promising small-cap anaerobic digestion stocks could be an exciting way to align your financial goals with your values. These aren’t just companies; they’re part of a movement to clean up our planet, one pile of organic waste at a time. So, do your research, stay informed, and who knows, you might just unearth some green gold in the world of anaerobic digestion. The future is looking bright, and it smells a lot like opportunity (and maybe a little bit of biomethane).

Conclusion

Anaerobic digestion is a powerful and essential technology that transforms organic waste into valuable renewable energy and nutrient-rich fertiliser. This sustainable process plays a crucial role in mitigating climate change, improving waste management, and enhancing energy security. For investors, the small-cap anaerobic digestion sector offers a compelling opportunity for growth, driven by increasing environmental awareness, supportive government policies, and ongoing technological advancements. While inherently riskier than larger investments, careful due diligence focusing on management expertise, project pipeline, diverse feedstock strategies, robust offtake agreements, and financial health can help identify promising companies poised for significant expansion in this vital green industry. Investing in small-cap AD stocks isn’t just about potential financial returns; it’s about backing innovative solutions that are actively building a more sustainable and resilient future for us all.

5 Unique FAQs After The Conclusion

How does anaerobic digestion compare to other renewable energy sources in terms of environmental impact?

Anaerobic digestion stands out because it not only produces renewable energy (biogas) but also actively addresses a major environmental problem: organic waste. Unlike solar or wind power, which are purely energy generation technologies, AD effectively manages waste that would otherwise release harmful methane in landfills, while simultaneously creating a valuable natural fertiliser. This dual benefit makes its environmental impact particularly significant.

Are there any specific types of organic waste that are more suitable for anaerobic digestion?

While a wide variety of organic materials can be digested, some are more efficient than others. High-energy feedstocks like food waste and certain energy crops tend to produce more biogas. However, the most sustainable approach often involves using readily available agricultural wastes (like animal manure and crop residues) and industrial by-products, as this prevents them from becoming environmental liabilities and closes nutrient loops.

What are the main challenges facing small-cap anaerobic digestion companies?

Small-cap AD companies face challenges such as securing sufficient funding for large infrastructure projects, navigating complex and sometimes changing regulatory frameworks, ensuring a consistent supply of feedstock, and finding reliable markets for both biogas and digestate. Operational efficiency and optimising the biological process within the digesters also require specialised expertise.

How does the digestate byproduct contribute to the circular economy?

The digestate is a fantastic example of the circular economy in action. Instead of being disposed of, it’s returned to the land as a nutrient-rich fertiliser, reducing the need for synthetic fertilisers and improving soil health. This closes the loop on nutrient cycles, minimises waste, and contributes to more sustainable agricultural practices, highlighting the “waste to resource” philosophy of the circular economy.

What advancements are being made in anaerobic digestion technology that could benefit small-cap companies?

Recent advancements include more efficient digester designs that can handle a wider range of feedstocks, improved biogas upgrading technologies to produce higher-quality renewable natural gas, and better methods for optimising the biological process for maximum gas yield. There’s also innovation in how digestate is processed and utilised, adding further value and revenue streams for AD plant operators.