Overlooked Consumer Staples Stocks: The Unsung Heroes of Your Portfolio

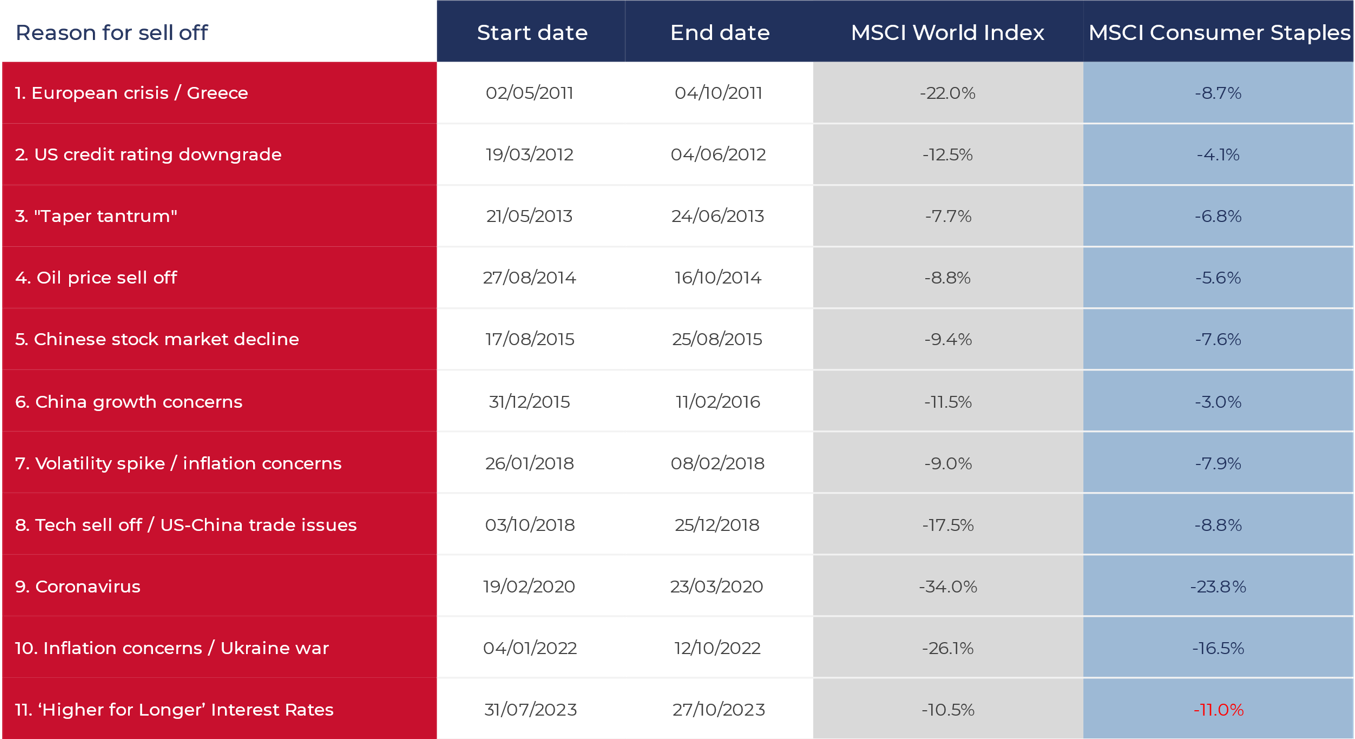

When the stock market gets choppy, many investors instinctively turn to “consumer staples.” These are the companies that sell us the everyday essentials we can’t really live without, no matter what the economy is doing. Think about it: you’ll always need food, toiletries, cleaning supplies, and maybe even a few guilty pleasures like chocolate or your favorite drink. This consistent demand, often called “inelastic,” is why consumer staples are known as defensive stocks – they tend to hold up better during economic downturns than companies selling “wants” (consumer discretionary goods).

However, within the vast ocean of consumer staples, some familiar giants often dominate the headlines. We hear about Procter & Gamble, Coca-Cola, and Unilever almost constantly. While these are certainly solid businesses, focusing solely on them might mean you’re overlooking some fantastic opportunities. There are many other, perhaps less glamorous, consumer staples companies that quietly go about their business, generating steady profits and often providing attractive dividends. These are the unsung heroes, the overlooked gems that could add significant stability and growth to your long-term investment portfolio.

The Appeal of Consumer Staples

Before we dive into the overlooked, let’s quickly recap why consumer staples are so appealing in the first place. Their key characteristic is their resilience. When recessions hit, people might cut back on new cars or fancy holidays, but they’ll still buy toothpaste, bread, and toilet paper. This predictability in demand translates into stable revenues and earnings, making these companies less volatile than many other sectors.

Furthermore, many consumer staples companies are dividend aristocrats, meaning they have a long history of consistently increasing their dividends. This makes them attractive to income-focused investors who are looking for a reliable stream of passive income. The compounding power of reinvested dividends from these stable businesses can lead to substantial wealth creation over time, often outperforming more exciting, but riskier, growth stocks in the long run.

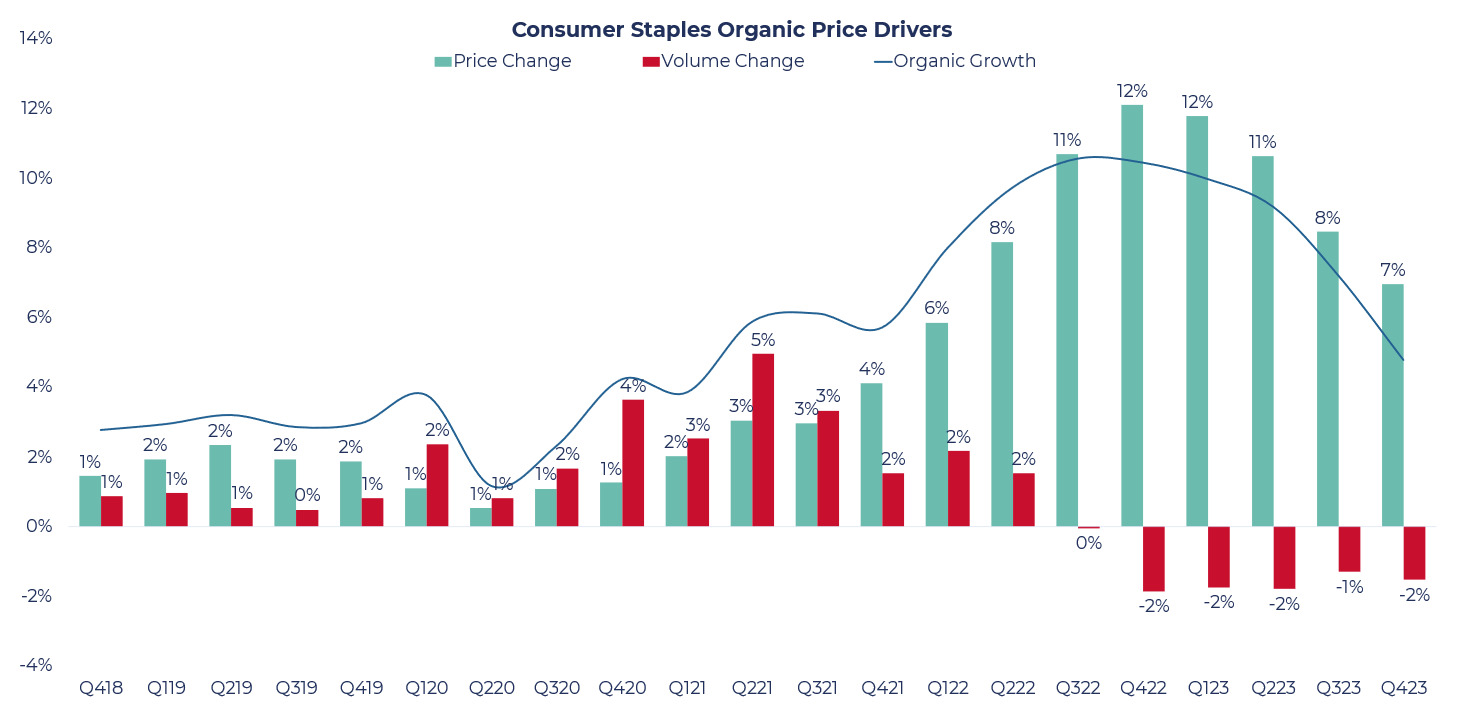

Finally, many consumer staples companies boast strong brand recognition and wide distribution networks. Their products are deeply ingrained in our daily lives, and consumers often exhibit significant brand loyalty. This creates a “moat” around their businesses, making it difficult for new entrants to compete. Even in the face of rising commodity costs, many of these companies have the pricing power to pass on at least some of these increases to consumers, protecting their profit margins.

Why Some Staples Get Overlooked

So, why do some consumer staples companies fly under the radar? Often, it’s simply because they’re not as “sexy” as tech giants or fast-growing startups. Their growth might be slower, steadier, and less prone to dramatic swings. Media attention tends to gravitate towards companies with exciting new products or disruptive technologies. This can lead to a situation where well-established, profitable, and reliable consumer staples businesses are simply not discussed as frequently by financial news outlets or on investment forums.

Another reason could be their market capitalization. While many overlooked staples are still large companies, they might not be mega-caps like some of the household names. This can mean they have less institutional coverage, which in turn leads to less retail investor awareness. Additionally, some companies might operate in niche segments of the consumer staples market that aren’t as widely understood or glamorous as, say, global beverage giants.

Finally, sometimes a company might be facing temporary headwinds, such as rising input costs or a slight dip in sales due to changing consumer preferences. While these challenges can certainly impact a stock’s short-term performance and make it less appealing to momentum investors, they can also present an opportunity for long-term investors to pick up quality businesses at a more attractive valuation. The market often overreacts to short-term issues, creating a chance to invest in fundamentally sound companies while they’re out of favor.

Delving into Overlooked Opportunities

It’s important to remember that “overlooked” doesn’t mean “bad.” It often means “undervalued” or “underappreciated.” Finding these hidden gems requires a bit more research than simply buying the most popular names. Here are a few categories and examples of where you might find these overlooked opportunities:

Niche Food & Beverage Producers

While the global food and beverage giants get all the attention, there are smaller, yet highly profitable, companies that specialize in specific food segments or regional markets. These companies might not have the same scale as a Nestlé or PepsiCo, but they often have strong brand loyalty within their niches and consistent demand for their products. They might focus on specialty ingredients, regional delicacies, or even cater to growing trends like organic or plant-based foods. Look for companies with strong local or national distribution and a history of consistent profitability.

Household & Personal Care Specialists

Beyond the ubiquitous brands of P&G and Unilever, there are many companies producing essential household and personal care items. These could be manufacturers of specific cleaning products, personal hygiene items, or even pet care essentials. Often, these companies have carved out strong positions in their respective segments through product innovation, effective marketing to a targeted audience, and efficient supply chains. They might not have dozens of brands under their umbrella, but the few they do have could be highly profitable and resilient.

Packaging and Container Companies

This might seem a bit indirect, but think about it: every single consumer staple product needs packaging. From food wraps to beverage bottles to personal care containers, packaging is an indispensable part of the consumer staples ecosystem. Companies that manufacture these essential items often benefit from the consistent demand for consumer goods without being directly exposed to the same brand-level competition. They can also benefit from trends like sustainable packaging, offering a growth angle to an otherwise stable business. These companies might not be consumer-facing, but their role in the supply chain makes them an essential, and often overlooked, part of the sector.

Agricultural Input Providers

Again, a slightly indirect play, but equally vital. Companies that provide agricultural inputs – think seeds, fertilizers, crop protection products, or even specialized farming equipment – are foundational to the entire food production chain. As long as people need to eat, farmers will need these inputs. These businesses are often less cyclical than other industrial sectors because demand for food is constant. While they might be impacted by commodity price fluctuations for inputs, the underlying demand for their products remains strong.

Discount Retailers Focusing on Staples

While many large supermarkets are well-known, there are often regional or national discount retailers that focus heavily on providing essential consumer staples at competitive prices. In times of economic uncertainty, consumers often gravitate towards these retailers, increasing their sales and profitability. These companies might not have the same high-end appeal as some grocery chains, but their focus on value makes them resilient and their stock can often be overlooked by investors chasing higher-growth narratives.

Researching Overlooked Opportunities

To find these diamonds in the rough, a deeper dive into financial statements and industry trends is necessary. Don’t just look at revenue growth; pay close attention to profit margins, free cash flow generation, and debt levels. Strong balance sheets are a hallmark of resilient consumer staples companies. Also, investigate their dividend history – a long track record of consistent dividend payments and increases is a strong indicator of a financially healthy and shareholder-friendly business.

Consider their competitive landscape. Do they have a niche that protects them from larger competitors? Are they innovating within their segment? Even in seemingly mature industries, there’s always room for product improvements or new distribution strategies. Look for companies that are adapting to changing consumer preferences, whether it’s through sustainable practices, e-commerce expansion, or catering to specific dietary needs.

Furthermore, investigate management teams. Are they experienced and have they demonstrated a history of prudent capital allocation? A strong management team can navigate challenging market conditions and ensure long-term success. Read investor presentations and earnings call transcripts to get a sense of their strategy and outlook.

Finally, don’t be afraid to think globally. Many excellent consumer staples companies are based outside of the most commonly discussed markets. Expanding your search internationally can open up a whole new world of potential opportunities in overlooked corners of the consumer staples sector. Be mindful of currency risks and geopolitical factors, but don’t let geographical boundaries limit your investment universe.

The Long-Term Play

Investing in overlooked consumer staples stocks is rarely about quick gains. It’s a long-term strategy focused on capital preservation, steady income, and compounding returns. These are the companies that tend to perform well when the broader market is volatile, acting as a defensive anchor for your portfolio. They might not generate headlines, but they often generate consistent returns for patient investors.

The true value of these overlooked gems often becomes apparent during challenging economic periods. While growth stocks might tumble, these businesses continue to hum along, providing essential goods and services, and often continuing to pay out dividends. This stability can be incredibly reassuring and can help smooth out the overall performance of your investment portfolio.

By dedicating time to research and looking beyond the usual suspects, you can uncover compelling investment opportunities in the overlooked corners of the consumer staples sector. These unheralded champions can be a powerful force in building lasting wealth, proving that sometimes, the best investments are the ones no one else is talking about.

Conclusion

Investing in consumer staples is a time-tested strategy for building a resilient portfolio, but focusing solely on the most popular names can mean missing out on significant opportunities. Overlooked consumer staples stocks, often operating in niche segments or simply receiving less media fanfare, can offer compelling value, stable returns, and attractive dividend yields. By conducting thorough research into their financials, competitive advantages, and management, investors can uncover these unsung heroes that provide essential goods and services, ensuring consistent demand regardless of the economic climate. These quiet achievers are often the steady anchors that can help you navigate market volatility and compound your wealth over the long term, proving that sometimes, the greatest treasures are found where few others bother to look.

5 Unique FAQs After The Conclusion

What makes a consumer staples stock “overlooked” compared to a well-known one?

A consumer staples stock is often considered “overlooked” if it receives less media coverage, has a smaller market capitalization compared to industry giants, operates in a niche segment, or is temporarily out of favor due to short-term market headwinds, despite having strong fundamentals and a consistent business model.

Can overlooked consumer staples stocks offer better returns than popular ones?

While there’s no guarantee, overlooked consumer staples stocks can potentially offer better risk-adjusted returns or more attractive valuations than popular ones. Their “overlooked” status can mean they are undervalued, providing an opportunity for capital appreciation as the market eventually recognizes their intrinsic worth. They may also offer higher dividend yields relative to their price.

How do you identify a truly “overlooked” consumer staples stock and not just a struggling company?

Distinguishing between an overlooked gem and a struggling company requires thorough due diligence. Look for strong, consistent profitability, healthy free cash flow, a solid balance sheet with manageable debt, a history of reliable dividend payments (if applicable), and a clear competitive advantage in its niche. A struggling company will often show deteriorating financials, a weak competitive position, and inconsistent or declining dividends.

Are there specific sub-sectors within consumer staples where overlooked opportunities are more common?

Overlooked opportunities can often be found in more specialized or less glamorous sub-sectors. These might include niche food and beverage producers, specialized household and personal care manufacturers, packaging and container companies, agricultural input providers, or even regional discount retailers with a strong focus on staples.

What role do dividends play when considering overlooked consumer staples stocks?

Dividends are a significant factor. Many overlooked consumer staples companies are mature, cash-generative businesses that return profits to shareholders through dividends. A history of consistent and growing dividends is a strong indicator of financial health and management’s confidence in future earnings, providing both income and a potential signal of an undervalued asset.