Unearthing Hidden Gems: Why Underfollowed Defense Tech Stocks Could Be Your Next Smart investment

The world of defense spending might seem dominated by household names like Lockheed Martin or RTX, companies with massive contracts and equally massive market caps. But beneath the surface of these industry giants lies a fascinating and often underfollowed segment: defense technology stocks. These are the companies, sometimes smaller, sometimes more specialised, that are innovating at the cutting edge, developing the next generation of solutions for national security. And for the savvy investor looking for growth potential beyond the obvious, these hidden gems could offer compelling opportunities.

Unlike the broader “defensive stocks” often highlighted for their stability during economic downturns (think consumer staples or utilities), defense tech stocks are about innovation and growth within a specific, high-stakes sector. Geopolitical tensions, evolving threats, and a global push towards modernising armed forces are creating a fertile ground for companies developing advanced technologies. While the headlines often focus on large-scale weapons systems, the real revolution is happening in areas like artificial intelligence, cybersecurity, autonomous systems, advanced materials, and niche specialisations that are critical to modern warfare and defense.

The Dynamics Driving Defense Tech Growth

Several powerful forces are converging to create a compelling environment for defense technology. Firstly, the escalating global security landscape is a primary driver. From regional conflicts to the rise of cyber warfare, nations are increasingly recognising the need to invest heavily in advanced capabilities to protect their interests and citizens. This isn’t just about traditional armaments; it’s about gaining a technological edge.

Secondly, the rapid pace of technological advancement is reshaping the battlefield. AI and machine learning are no longer theoretical concepts but integral components in everything from predictive analytics for intelligence gathering to autonomous drones for surveillance and even combat. Cybersecurity, once a niche concern, is now a foundational element of national defense, with states and private actors engaging in a continuous arms race in the digital realm. The development of unmanned systems, whether aerial, ground, or maritime, is transforming operational efficiency and reducing human risk. Moreover, breakthroughs in advanced materials are leading to lighter, stronger, and more resilient equipment, offering significant advantages in terms of performance and soldier protection.

Thirdly, governments worldwide are increasing their defense budgets. Major economies, including those in Europe and Asia, are committing significant resources to modernise their militaries and enhance their technological capabilities. This sustained investment creates a predictable demand for cutting-edge defense tech, providing a stable revenue stream for companies operating in this space. This long-term commitment offers a degree of insulation from broader economic fluctuations that might impact other sectors.

Finally, there’s a growing recognition among venture capital firms and private equity investors of the immense potential within defense tech. While traditionally a sector heavily reliant on government contracts, the infusion of private capital is accelerating innovation and fostering a more dynamic ecosystem. This influx of investment is allowing smaller, agile companies to scale their technologies and bring them to market faster, often bypassing the bureaucratic hurdles that can sometimes slow down larger, more established defense contractors.

Why “Underfollowed” Matters

So, why focus on “underfollowed” defense tech stocks? The answer lies in the potential for mispricing and overlooked value. Larger, well-known defense contractors are often efficiently priced by the market. Their growth prospects and existing contracts are widely analysed and factored into their stock prices. However, smaller companies, or those operating in highly specialised niches, may not attract the same level of institutional investor attention or analyst coverage. This lack of broad visibility can lead to their shares being undervalued relative to their true potential.

For a diligent investor, this presents an opportunity. By conducting thorough research into these less-covered companies, one can potentially identify businesses with strong intellectual property, unique technological advantages, and growing order books that the wider market has yet to fully appreciate. These companies might be at the forefront of developing solutions for emerging threats, or they might possess proprietary technologies that could become essential components in future defense systems.

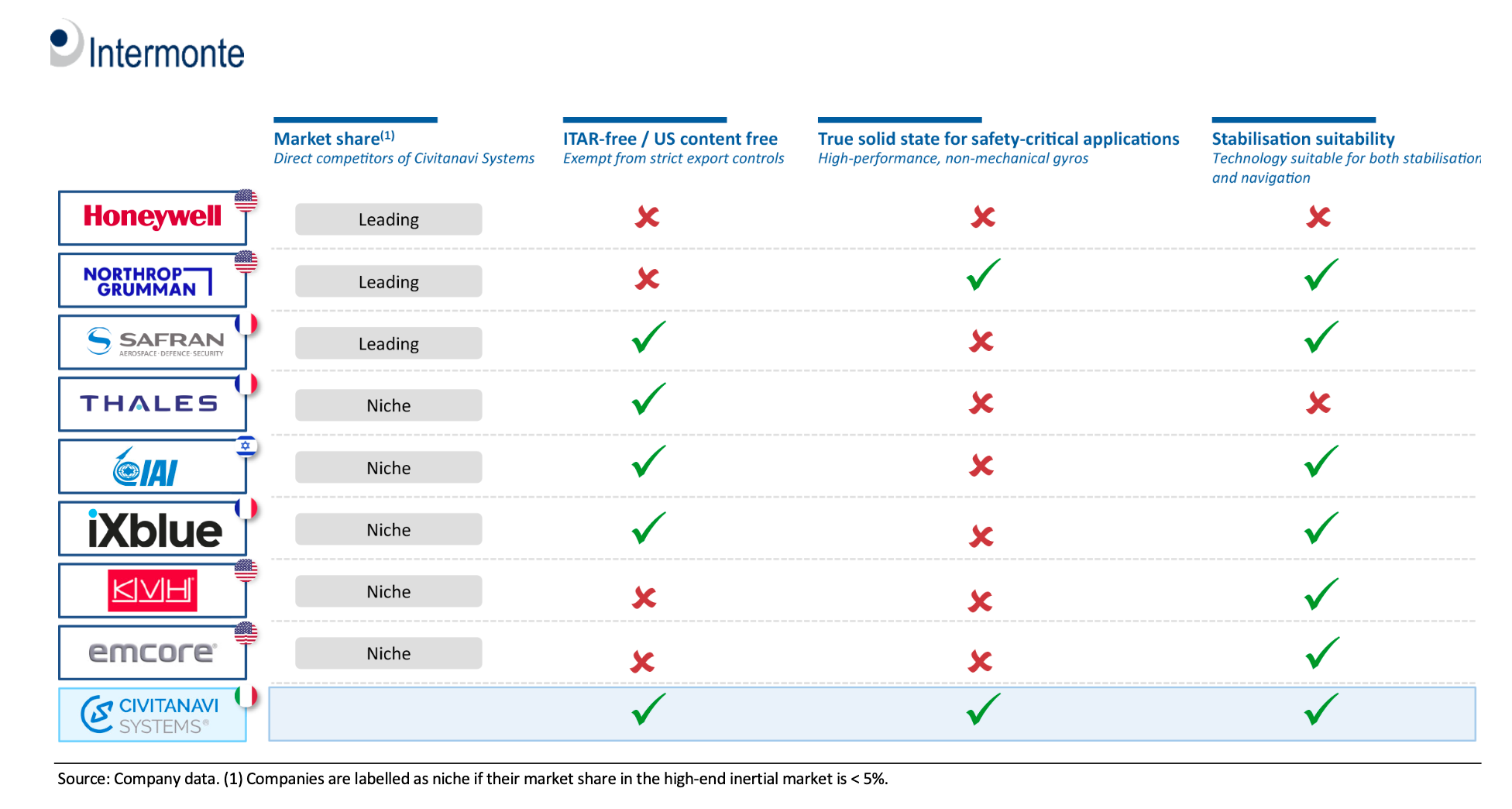

Identifying these underfollowed gems requires a deeper dive than simply looking at headlines. It involves understanding specific technological trends, analysing government procurement priorities, and assessing the competitive landscape within niche markets. It’s about looking for companies that are not just participating in the defense sector, but actively shaping its future through disruptive innovation.

Key Areas of Innovation to Watch

When hunting for underfollowed defense tech stocks, certain areas of innovation stand out. These are the fields where rapid advancements are happening and where future defense spending is likely to be concentrated.

Artificial Intelligence and Machine Learning in Defense

AI is no longer just for sci-fi movies; it’s becoming a cornerstone of modern defense. This isn’t about killer robots (yet!), but rather about leveraging data to make faster, more informed decisions. Companies working on AI for defense might be developing sophisticated algorithms for predictive maintenance of military equipment, allowing for proactive repairs and increased operational readiness. Others might be focused on AI-powered intelligence gathering and analysis, sifting through vast amounts of data to identify patterns and anticipate threats. Think about AI for target recognition, automated threat assessment, or even optimising logistics and supply chains within complex military operations. The potential for efficiency gains and strategic advantages is immense.

Cybersecurity and Secure Communications

In an increasingly interconnected world, cyber warfare is a constant and evolving threat. Nation-states, terrorist groups, and even individual actors are constantly attempting to breach defense networks, steal sensitive information, or disrupt critical infrastructure. This makes cybersecurity an absolutely critical component of national security. Underfollowed companies in this space might be developing highly specialised encryption technologies, advanced threat detection and response systems, or innovative solutions for securing command and control networks from sophisticated cyberattacks. The demand for robust, resilient, and cutting-edge cybersecurity solutions will only continue to grow as the digital battlefield expands.

Autonomous Systems and Robotics

Drones, unmanned ground vehicles (UGVs), and autonomous underwater vehicles (AUVs) are revolutionising reconnaissance, surveillance, and even combat. These systems can operate in dangerous environments, reduce human casualties, and collect data with unprecedented efficiency. Look for companies that are not just building the hardware, but also developing the sophisticated software and AI that enable these systems to operate autonomously, make complex decisions, and even swarm cooperatively. This includes companies creating advanced navigation systems, remote sensing technologies, and secure communication links for autonomous platforms.

Advanced Materials and Manufacturing

The physical components of defense systems are also undergoing a quiet revolution thanks to advanced materials. Lighter, stronger composites, self-healing materials, and novel alloys are leading to more durable, fuel-efficient, and effective military hardware. Companies in this niche might be developing new armour solutions, materials for stealth technology, or components for hypersonic weapons. Furthermore, advancements in additive manufacturing (3D printing) are allowing for rapid prototyping and even on-demand production of complex parts in the field, reducing logistical burdens and improving responsiveness.

Niche Specialisations and Disruptive Technologies

Beyond these broader categories, there are numerous highly specialised areas within defense tech that can offer significant growth. This could include companies developing advanced optics and optronics for surveillance and targeting, next-generation sensor technologies, electronic warfare capabilities, or even innovative power generation and storage solutions for remote military operations. The key is to look for companies that are solving specific, high-value problems for the defense sector with truly disruptive technologies. These might be smaller firms with a laser focus on a particular problem, allowing them to gain a competitive edge.

Researching Underfollowed Opportunities

Finding these underfollowed defense tech stocks requires a proactive and diligent approach. It’s not about jumping on the latest trend, but rather about fundamental research.

Firstly, delve into government defense spending reports and procurement plans. These documents often highlight key areas of future investment and identify technologies that are deemed strategically important. Understanding where the money is flowing can guide your research.

Secondly, look beyond the major defense conferences and trade shows. Explore smaller industry events, academic papers, and specialised technology publications that might feature up-and-coming companies and groundbreaking research. Often, the early stages of disruptive technologies are showcased in these more niche forums.

Thirdly, analyse the customer base. Do these companies have contracts with multiple government agencies or allied nations? A diversified customer base can indicate broader market acceptance and reduce reliance on a single major contract. Look for recurring revenue streams and long-term contracts that provide stability.

Fourthly, scrutinise financial statements with a keen eye. Since these companies might be smaller, their financials might not be as robust as established giants. However, look for healthy balance sheets, manageable debt levels, and evidence of increasing R&D investment. Positive cash flow and a clear path to profitability are crucial. Pay attention to metrics like price-to-earnings (P/E), price-to-book (P/B), and debt-to-equity ratios, comparing them to industry averages and the company’s historical performance to identify potential undervaluation.

Finally, consider the management team. Does the leadership have a strong track record in both technology development and navigating the complexities of the defense contracting world? Experienced management can be a significant differentiator for smaller firms. Look for signs of clear vision, strategic partnerships, and an ability to execute on their business plans.

The Risks and Rewards

Investing in underfollowed defense tech stocks, like any investment, comes with its own set of risks and rewards. The rewards can be substantial. If you identify a company early that goes on to develop a critical technology or secures significant contracts, the upside potential can be considerable. These companies often have higher growth rates than their larger, more mature counterparts.

However, the risks are also present. Smaller companies can be more volatile and susceptible to economic downturns or changes in government spending priorities. They might also face intense competition from larger players or struggle with scaling their operations. Regulatory hurdles and the long sales cycles inherent in government contracting can also pose challenges. Furthermore, the ethical considerations of investing in the defense sector are a personal decision that each investor must weigh for themselves.

Diversification is key. Instead of putting all your eggs in one basket, consider building a diversified portfolio of several underfollowed defense tech stocks across different technological areas. This can help mitigate the risk associated with any single company. Remember, patience is a virtue in this space. These are often long-term investments, and it may take time for the market to recognise their true value.

Conclusion

The defense technology sector is a dynamic and evolving landscape, constantly pushed forward by geopolitical realities and technological breakthroughs. While the major players often grab the headlines, a compelling opportunity exists in the underfollowed defense tech stocks. These companies, innovating in areas like AI, cybersecurity, autonomous systems, and advanced materials, are poised to play a crucial role in shaping the future of national security. By diligently researching and understanding the unique dynamics of this niche, investors can potentially uncover hidden gems that offer significant growth potential for their portfolios. However, as with any investment, a thorough understanding of the risks and a long-term perspective are essential for navigating this exciting but complex sector.

5 Unique FAQs After The Conclusion

1. How do geopolitical events directly impact the valuation of underfollowed defense tech stocks, and what specific events should investors monitor?

Geopolitical events, from regional conflicts to shifts in alliances, have a profound and direct impact on defense tech stock valuations. Escalations in tensions often lead to increased defense spending, which directly benefits these companies. Investors should closely monitor events like ongoing conflicts (e.g., in Ukraine, the Middle East), major shifts in national security doctrines (e.g., increased focus on cyber warfare or AI defense by major powers), and new defense agreements or collaborations between countries. These can signal increased demand for specific technologies, such as advanced missile defense systems, drone technology, or sophisticated cybersecurity solutions, driving up the value of companies specialising in those areas. Conversely, de-escalation or significant disarmament treaties could negatively impact the sector, though the current global outlook suggests sustained demand.

2. Are there ethical considerations when investing in defense tech, particularly for smaller, less-known companies, and how might these impact investor sentiment or ESG ratings?

Yes, ethical considerations are significant when investing in the defense sector, regardless of company size. While larger companies face more public scrutiny, smaller, underfollowed defense tech firms can still be subject to ethical debates concerning the nature of their products (e.g., autonomous weapons, surveillance technologies). For investors focused on Environmental, Social, and Governance (ESG) criteria, these investments can pose a dilemma. Some ESG funds or investors might strictly avoid the entire defense sector, while others might differentiate between “defensive” technologies (e.g., cybersecurity, intelligence) and “offensive” ones. Negative public sentiment or increased regulatory scrutiny due to ethical concerns, even for smaller firms, could impact their ability to attract talent, secure financing, or even affect their long-term growth prospects, potentially leading to lower valuations or exclusion from certain investment portfolios.

3. What are the typical challenges faced by underfollowed defense tech companies in securing government contracts compared to larger, established players, and how do they overcome them?

Underfollowed defense tech companies often face significant challenges in securing government contracts due to their smaller scale, limited track record, and less established relationships within the bureaucracy. Larger players often have dedicated lobbying efforts and existing frameworks for navigating complex procurement processes. Smaller firms typically overcome these by focusing on niche technologies where larger players may lack expertise, demonstrating superior technological innovation and cost-effectiveness. They often leverage strong R&D capabilities, participate in government-backed innovation programs, and build strategic partnerships with larger contractors (who might need their specialised tech) or academic institutions. Furthermore, showcasing successful pilot programs or securing initial smaller contracts can build credibility and open doors for larger opportunities.

4. How can a retail investor effectively perform due diligence on an underfollowed defense tech stock, given potentially limited public information and analyst coverage?

Performing due diligence on underfollowed defense tech stocks requires more effort from retail investors due to limited public information and analyst coverage. Key strategies include:

5. Beyond direct stock investment, are there other ways for investors to gain exposure to the underfollowed defense tech sector, such as through specialised ETFs or venture capital funds?

Yes, beyond direct stock investment, there are alternative avenues to gain exposure to the underfollowed defense tech sector, which can offer diversification and potentially lower risk for retail investors.