When considering undervalued e-commerce stocks, it’s crucial to remember that the market is dynamic. What’s undervalued today might not be tomorrow, and “casual English” for SEO often means clear, concise, and easy to understand language that Google’s algorithms (and human readers) appreciate. This article will explore some areas to look for undervalued e-commerce opportunities, but it’s important to do your own thorough research before making any investment decisions.

The Shifting Sands of E-commerce

The e-commerce landscape has been a rollercoaster. During the pandemic, online shopping boomed as people stayed home. This led to massive valuations for many e-commerce companies. However, as economies reopened, some of that growth normalized, and investors started looking at profitability more closely. This shift has created a situation where some previously high-flying stocks have come back down to Earth, potentially offering opportunities for those looking for value.

Why Are Some E-commerce Stocks Undervalued?

Several factors can lead to an e-commerce stock being undervalued.

Post-Pandemic Normalization: As mentioned, the rapid growth seen during the pandemic was unsustainable for some. Companies that were priced for perpetual hyper-growth might now be trading at lower multiples as their growth rates return to more realistic levels. This isn’t necessarily a bad thing; it just means the market is recalibrating expectations.

Where to Look for Undervalued E-commerce Gems

Finding undervalued stocks requires a bit of digging beyond the headlines. Here are some areas to consider when searching for potential e-commerce opportunities:

Niche E-commerce Players

While the big general retailers get a lot of attention, there are countless niche e-commerce businesses serving specific markets. These might include:

Specialty Goods: Think companies selling unique crafts, specific types of clothing, rare collectibles, or highly specialized tools. These businesses often have a dedicated customer base and less direct competition from the e-commerce giants.

Companies with Strong Fundamentals but Temporary Headwinds

Sometimes, a good company faces a temporary setback that drives its stock price down. This could be due to:

A Bad Earnings Report: A single disappointing quarter doesn’t necessarily mean the company is failing. It could be due to one-off expenses, supply chain issues that are being resolved, or a temporary dip in consumer spending. Look for companies with a history of strong performance that have experienced a short-term blip.

E-commerce Enablers and Infrastructure

Don’t just think about the companies selling directly to consumers. The entire e-commerce ecosystem relies on a complex web of services. Consider companies that:

Provide E-commerce Software: Platforms like Shopify enable countless businesses to sell online. While Shopify itself might not be “undervalued” at all times, there are many other software providers for various aspects of e-commerce, from inventory management to customer relationship management.

Key Metrics to Consider When Assessing Value

When evaluating an e-commerce stock for potential undervaluation, look beyond just the stock price. Here are some key metrics to consider:

Price-to-Earnings (P/E) Ratio

This is a classic valuation metric. A lower P/E ratio relative to industry peers or the company’s historical average can suggest undervaluation. However, for high-growth companies, a higher P/E might be justified if future earnings are expected to grow significantly.

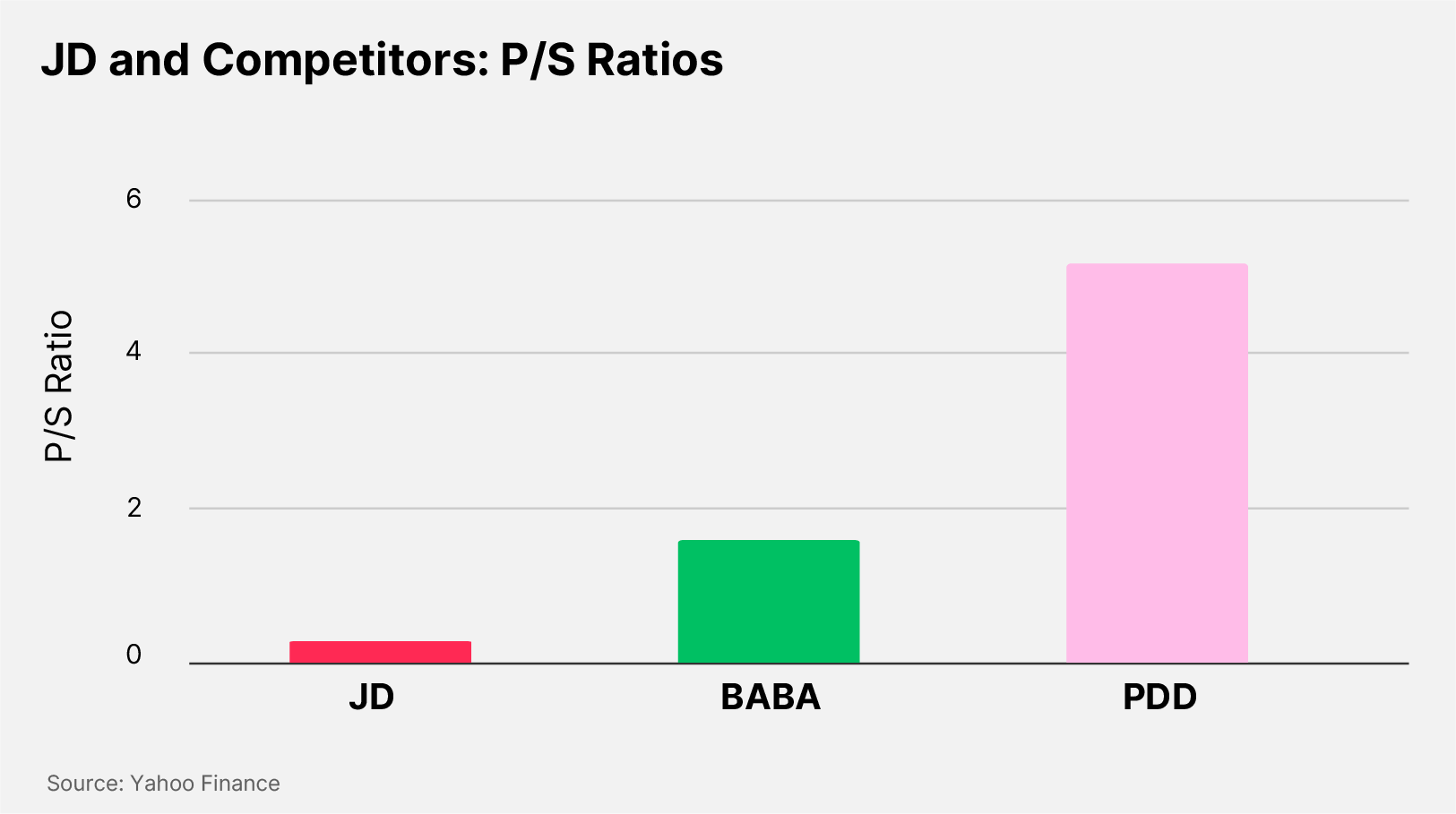

Price-to-Sales (P/S) Ratio

For companies that are not yet profitable, or for those in early stages of growth, the P/S ratio can be more useful. A lower P/S relative to similar companies might indicate undervaluation.

Enterprise Value to EBITDA (EV/EBITDA)

This metric accounts for debt and cash, giving a more comprehensive view of a company’s total value relative to its operating profitability before non-cash expenses. It’s often used for comparing companies with different capital structures.

Gross Margin and Profit Margin Trends

Are the company’s margins improving or declining? Sustainable e-commerce businesses need healthy margins to be profitable in the long run. Look for companies that are demonstrating an ability to control costs and increase profitability.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

For e-commerce, understanding how much it costs to acquire a new customer versus how much revenue that customer generates over their lifetime is crucial. A low CAC relative to LTV indicates an efficient and sustainable business model.

Debt Levels

High levels of debt can be a red flag, especially in a rising interest rate environment. Look for companies with manageable debt and a strong balance sheet.

Cash Flow from Operations

Positive and growing cash flow from operations indicates a healthy business that can fund its growth internally without relying excessively on external financing.

The Importance of Due Diligence

Even with all this information, finding truly undervalued e-commerce stocks is not a simple task. It requires:

Thorough Research

Don’t just rely on headlines or tips. Dig into a company’s financial statements, investor presentations, and competitive landscape. Understand their business model inside and out.

Understanding Industry Trends

Keep abreast of broader e-commerce trends, technological advancements, and consumer behavior shifts. These can significantly impact the long-term prospects of e-commerce companies.

Risk Assessment

Every investment carries risk. Understand the potential downsides and what could go wrong. Diversify your portfolio to mitigate risk.

A Long-Term Perspective

Undervalued stocks often take time to be recognized by the market. Be prepared to hold your investments for the long term and resist the urge to react to short-term market fluctuations.

Conclusion

The hunt for undervalued e-commerce stocks is an ongoing process that demands careful analysis and a deep understanding of market dynamics. While the e-commerce sector has seen its share of ups and downs, opportunities for long-term growth certainly exist. By focusing on niche players, companies facing temporary headwinds, and those providing essential e-commerce infrastructure, investors can unearth promising candidates. Remember to scrutinize key financial metrics, understand the competitive landscape, and always conduct thorough due diligence before making any investment decisions. The e-commerce revolution is still unfolding, and for the discerning investor, finding those overlooked gems can lead to significant rewards.

5 Unique FAQs After The Conclusion

H2: FAQ 1: How do I know if an e-commerce stock’s “temporary headwinds” are truly temporary and not a sign of fundamental decline?

To distinguish temporary headwinds from fundamental decline, you need to dig into the root cause of the issue. Look for clear, explainable, and ideally one-off events like specific supply chain disruptions that are being resolved, a temporary dip in consumer spending due to an economic cycle, or a one-time investment that will yield future returns. A fundamental decline, on the other hand, might show up as consistently declining market share, persistent negative cash flow, a broken business model, or an inability to adapt to changing consumer preferences or technological advancements. Reviewing past performance during similar difficult periods can also offer clues about management’s ability to navigate challenges.

H2: FAQ 2: Besides financial metrics, what non-financial factors are important when evaluating an undervalued e-commerce company?

Beyond financial metrics, crucial non-financial factors include the strength of the company’s brand and customer loyalty, the effectiveness of its management team and their vision, the innovativeness of its technology platform, the size and growth potential of its target market, and its competitive moat (what makes it unique and hard for competitors to replicate). Also, consider customer reviews and social media sentiment to gauge customer satisfaction and brand perception.

H3: FAQ 3: Is it better to invest in well-known, large-cap e-commerce companies or smaller, emerging ones when looking for undervaluation?

Both large-cap and smaller, emerging e-commerce companies can offer undervaluation opportunities, but they come with different risk/reward profiles. Large-cap companies might be undervalued due to broad market downturns or temporary dips, offering more stability but potentially less explosive growth. Smaller, emerging companies, while riskier, can offer higher growth potential if they successfully capture market share or innovate. Their undervaluation might stem from being overlooked by institutional investors or being in an early stage of growth. Your choice depends on your risk tolerance and investment goals.

H3: FAQ 4: How does inflation specifically impact the valuation of e-commerce stocks, and what should I look for to mitigate this risk?

Inflation can negatively impact e-commerce stock valuations in several ways. Rising costs for goods, shipping, and labor can compress profit margins. Consumers, facing higher prices themselves, might reduce discretionary spending, impacting sales. Additionally, central banks typically raise interest rates to combat inflation, which makes future earnings less valuable (discounted more heavily) and can make borrowing more expensive for companies. To mitigate this risk, look for e-commerce companies with strong pricing power, efficient supply chains, low operating costs, and diversified revenue streams that can withstand inflationary pressures. Companies with recurring revenue models or those selling essential goods might also be more resilient.

H3: FAQ 5: What role does international expansion play in identifying undervalued e-commerce stocks?

International expansion can be a significant growth driver for e-commerce companies, but it also presents unique challenges. When considering an undervalued e-commerce stock with international ambitions, assess the company’s strategy for entering new markets, their understanding of local consumer preferences and regulations, and their ability to localize their operations and marketing. Companies that have a clear, well-executed international expansion plan, especially into fast-growing emerging markets, might be undervalued if the market hasn’t fully priced in this future growth potential. Conversely, companies with poorly executed international ventures could be a red flag.