The world of renewable energy is constantly buzzing, and while solar photovoltaic (PV) panels often grab the headlines, there’s a quieter, yet incredibly important, corner of the market: solar thermal. This isn’t about generating electricity directly, but about harnessing the sun’s heat for things like hot water, industrial processes, and even concentrated solar power (CSP) plants that do produce electricity. It’s a niche, yes, but a vital one, and for savvy investors, it presents some interesting opportunities.

For those looking to diversify their clean energy portfolio beyond the usual suspects, solar thermal stocks can offer a unique angle. These companies often operate with different technological approaches, market drivers, and even geographical focuses compared to their PV counterparts. This means they might react differently to market fluctuations, offering a degree of insulation or complementary growth.

Understanding Solar Thermal Beyond the Basics

Before we dive into specific companies, let’s get a clearer picture of what solar thermal actually entails. It’s a broad category, but the core idea is simple: capture sunlight, convert it to heat, and use that heat.

Solar Water Heating (SWH)

This is probably the most common and accessible form of solar thermal. Think of those panels you see on rooftops, often used to heat water for homes or commercial buildings. These systems use collectors – usually flat plate or evacuated tube designs – to absorb solar radiation and transfer that heat to a fluid, which then heats water in a storage tank. The market for SWH is mature in many regions, but still growing in developing countries and for specific applications like large-scale residential complexes or industrial hot water needs.

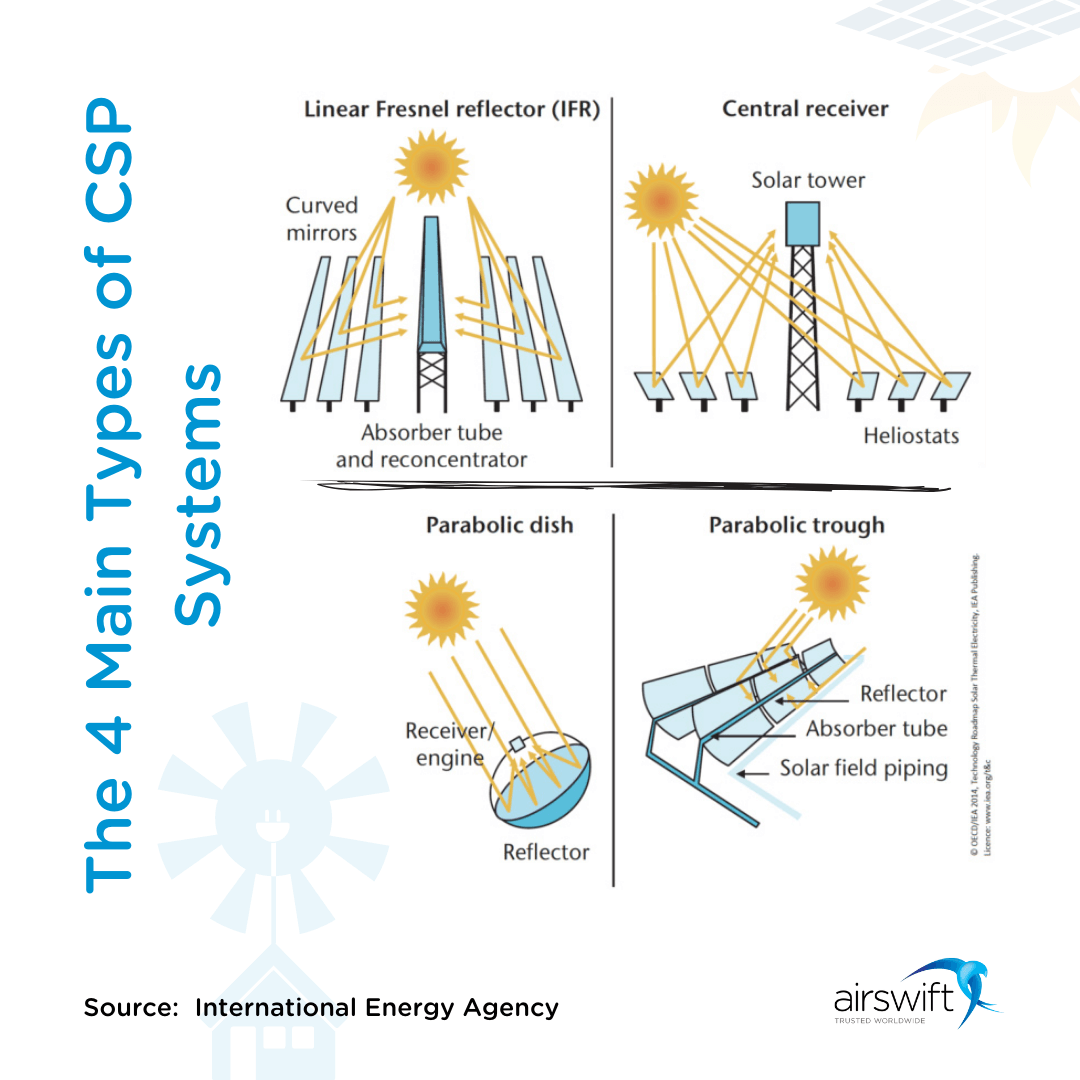

Concentrated Solar Power (CSP)

This is where solar thermal gets really interesting from a utility-scale perspective. CSP plants use mirrors to concentrate sunlight onto a small area, generating extremely high temperatures. This heat is then used to create steam, which drives a turbine to produce electricity. The key differentiator for CSP, and a major selling point, is the ability to store this heat, often using molten salt, allowing for electricity generation even after the sun goes down. This makes CSP a “dispatchable” form of renewable energy, much like a traditional power plant, offering greater grid stability than intermittent sources like standard PV.

Industrial Process Heat (IPH)

Many industries, from food processing to textiles, require significant amounts of heat for their operations. Solar thermal systems can be designed to provide this industrial process heat, offering a clean alternative to burning fossil fuels. This is a growing niche, driven by corporate sustainability goals and the increasing cost of conventional fuels. While still in its early stages compared to other solar applications, the potential here is massive.

Why Consider Niche Solar Thermal Stocks?

Now that we’ve got the tech down, let’s talk about why you might want to consider these less-talked-about solar stocks.

Diversification in a Growing Sector

The renewable energy sector is booming, and it’s attracting a lot of investment. However, most of the spotlight is on solar PV and wind. By looking at solar thermal, you’re stepping into a segment that, while smaller, has unique growth drivers. It’s like finding a gem in a lesser-explored part of a booming market. This diversification can help balance your portfolio, as solar thermal companies might not be as directly impacted by the same supply chain issues or policy shifts that heavily influence PV manufacturers.

Technological Innovation and Specialization

Many niche solar thermal companies are highly specialised, focusing on specific technologies or applications. This can lead to greater expertise and potentially stronger competitive advantages within their particular segment. For example, a company excelling in molten salt storage for CSP might have a significant edge over generalist renewable energy firms. These innovations are often aimed at increasing efficiency, reducing costs, and expanding the applicability of solar thermal solutions.

Addressing Specific Energy Needs

Solar thermal isn’t just about electricity; it’s about heat. This makes it crucial for industrial processes, district heating, and even desalination, areas where traditional PV isn’t always the most efficient solution. As the world seeks to decarbonize every aspect of energy consumption, solar thermal’s ability to provide direct heat without combustion becomes incredibly valuable. Companies serving these specific needs are tapping into markets with significant, often overlooked, demand.

Potential for Undervaluation

Because they often fly under the radar compared to larger, more visible solar PV companies, some niche solar thermal stocks might be undervalued. This can present opportunities for investors who are willing to do their homework and uncover these hidden gems before they catch the mainstream eye. Lower valuation doesn’t necessarily mean lower potential; it often means less market attention.

Resilience to Certain Market Pressures

While no sector is immune to market pressures, some solar thermal applications, particularly those focused on industrial heat or specific utility-scale projects with long-term contracts, might be less susceptible to the volatile swings seen in the consumer-driven PV market. This can offer a degree of stability for investors.

Navigating the Niche: What to Look For

Investing in niche markets requires a bit more digging. Here’s what to keep in mind when looking at solar thermal stocks:

Company Specialization and Technology

CSP Focus: Is the company a pure-play CSP developer or a component supplier? Companies like BrightSource Energy and Abengoa Solar have been key players in the CSP space, known for their large-scale projects and innovative use of technologies like molten salt storage. Their focus on dispatchable power differentiates them.

Project Pipeline and Contracts

For CSP and IPH companies, a strong project pipeline and long-term contracts are crucial indicators of future revenue. Utility-scale projects often involve multi-year development and construction phases, so understanding their backlog and secured projects is key. For SWH companies, consistent sales and distribution networks are important.

Financial Health and Scalability

As with any investment, dive into the company’s financials. Look at revenue growth, profitability, debt levels, and cash flow. For niche players, sometimes profitability might be elusive in the early stages as they scale up, but strong funding and a clear path to profitability are essential. Also, consider the scalability of their technology – can it be replicated and deployed efficiently across different markets?

Geographical Focus and Market Dynamics

Some solar thermal markets are more developed in certain regions due to specific solar resources, energy policies, or industrial landscapes. For instance, countries with high direct normal irradiance (DNI) are ideal for CSP. Understanding a company’s geographical focus and the market dynamics within those regions is vital. Are they operating in stable markets with supportive policies, or are they venturing into riskier, emerging territories?

Research and Development (R&D)

Given the evolving nature of renewable energy technologies, a commitment to R&D is a good sign. Companies that are continuously innovating to improve efficiency, reduce costs, and expand the applications of their solar thermal solutions are likely to have a more sustainable competitive advantage. This could involve advancements in materials, storage solutions, or integration with existing energy systems.

Challenges to Consider

It’s not all sunshine and roses, of course. There are challenges specific to the solar thermal niche:

Competition from PV

The rapid decline in the cost of solar PV has made it the dominant force in solar electricity generation. CSP, while offering dispatchable power, has historically struggled to compete on price with PV. However, as grid stability becomes more critical and the value of stored energy increases, CSP’s competitive edge may sharpen.

Niche Market Size

While growing, the overall market for solar thermal, especially CSP and IPH, is still smaller than for PV. This means fewer publicly traded pure-play companies and potentially lower liquidity for their stocks.

Capital Intensive Projects

Utility-scale solar thermal projects, particularly CSP plants, are often very capital-intensive, requiring significant upfront investment. This can make financing challenging and expose companies to higher risks during construction.

Policy and Regulatory Support

Like all renewable energy technologies, solar thermal benefits from supportive government policies, incentives, and renewable energy mandates. Changes in these policies can significantly impact a company’s prospects.

A Few Companies to Keep an Eye On (Not Investment Advice!)

While specific investment advice is beyond the scope of this article, here are a few types of companies and examples that generally operate in or contribute to the niche solar thermal space. Remember, thorough due diligence is absolutely essential before any investment decision.

Abengoa Solar (Spain)

Historically, a major player in CSP, though they have faced financial challenges in recent years. They’ve been involved in some of the most iconic CSP projects globally, known for their molten salt energy storage capabilities. Keep an eye on their restructuring and any new project announcements as they could represent a turnaround story in the CSP space.

BrightSource Energy (USA)

Known for their power tower technology and significant projects like the Ivanpah Solar Electric Generating System. They focus on utility-scale CSP with thermal energy storage, providing dispatchable power. Their technological advancements in high-temperature steam cycles are noteworthy.

GlassPoint (USA)

This company is a fascinating case of a comeback story, pivoting from oil recovery to industrial process heat for mining. Their focus on “steam-as-a-service” and long-term contracts for industrial customers makes them a unique and potentially stable player in the IPH segment. Their large-scale projects, like Ma’aden Solar I, demonstrate significant ambition.

Naked Energy (UK)

A smaller, innovative company focusing on hybrid PV-T technology with their “Virtu” tubes. These panels generate both electricity and hot water, offering a compact and efficient solution, particularly for commercial buildings or space-constrained applications. While not a large-cap stock, they represent the innovative edge of the niche.

Solimpeks (Turkey)

A company that manufactures a range of solar thermal collectors, including hybrid PV-T panels. They’re a good example of a component supplier in the solar thermal ecosystem, providing critical hardware for various applications. Their focus on both electrical and thermal output from a single unit is a key differentiator.

Acciona (Spain)

While a broader renewable energy company, Acciona has a significant footprint in solar thermal, with notable CSP projects like the Kathu Solar Park. They are a more diversified play if you want exposure to solar thermal within a larger, more established renewable energy firm.

Conclusion

The niche of solar thermal stocks, while perhaps not as flashy as their PV counterparts, offers a compelling avenue for investors seeking diversification, exposure to specialised technologies, and a role in decarbonising heat-intensive industries. From solar water heating to utility-scale concentrated solar power and industrial process heat, this sector addresses crucial energy needs often overlooked in mainstream discussions. While challenges like capital intensity and competition exist, ongoing innovation, the growing demand for dispatchable renewables, and the imperative to decarbonize industrial heat sources suggest a promising future. For those willing to dig a little deeper, understanding the specific technologies, project pipelines, and financial health of these specialized companies can unlock unique opportunities in the ever-expanding world of clean energy.

5 Unique FAQs After The Conclusion

1. How does solar thermal energy specifically contribute to grid stability compared to traditional solar PV?

Solar thermal energy, particularly Concentrated Solar Power (CSP) with thermal energy storage, contributes to grid stability by being dispatchable. Unlike traditional solar PV, which only generates electricity when the sun is shining, CSP plants can store heat (often in molten salt) and use it to generate electricity even after sunset or during cloudy periods. This allows grid operators to schedule electricity production from CSP plants, making them a more reliable and predictable power source that can help balance the intermittent nature of other renewables like wind and standard PV.

2. What are the primary industries currently benefiting most from Solar Thermal for Industrial Process Heat (IPH)?

The primary industries currently benefiting most from Solar Thermal for Industrial Process Heat (IPH) are those requiring significant amounts of low to medium-temperature heat. This includes the food and beverage industry (for pasteurization, drying, and washing), textiles (for dyeing and drying), chemical processing, mining (for processes like enhanced oil recovery and mineral extraction), and even some agricultural applications (like greenhouse heating and crop drying). These industries often rely heavily on fossil fuels for heat, making solar thermal an attractive option for decarbonization and reducing operational costs.

3. Are there any emerging solar thermal technologies that could significantly disrupt the market in the next decade?

Yes, several emerging solar thermal technologies could significantly disrupt the market. Advanced molten salt storage systems that can operate at even higher temperatures, improving efficiency and cost-effectiveness, are one area. Another is the development of next-generation concentrating collectors, such as advanced parabolic troughs or power towers with more efficient heat transfer fluids. Furthermore, hybrid PV-T (photovoltaic-thermal) systems that efficiently co-generate both electricity and heat from a single module are gaining traction for niche applications, and direct solar thermal to hydrogen production could also be a game-changer.

4. What role do government incentives and policy frameworks play in the growth and viability of niche solar thermal companies?

Government incentives and policy frameworks play a crucial role in the growth and viability of niche solar thermal companies. Like most renewable energy technologies, solar thermal often benefits from supportive policies such as feed-in tariffs, tax credits, grants for research and development, and renewable energy mandates (Renewable Portfolio Standards). These policies help reduce upfront costs, improve economic viability, and create a stable market for investment. Without robust policy support, capital-intensive solar thermal projects can struggle to compete with established fossil fuel technologies or even lower-cost PV.

5. How do the water consumption requirements of large-scale CSP plants compare to other energy generation methods, and is this a significant concern for their long-term sustainability?

Water consumption requirements for large-scale CSP plants, particularly those using wet cooling systems, can be a significant concern, especially in arid regions where solar resources are abundant. CSP plants generally use more water than typical solar PV farms (which use very little water for cooling) but can be comparable to or even less than traditional fossil fuel power plants, depending on the cooling technology used. However, advancements in CSP technology, such as the increasing adoption of dry cooling systems or hybrid cooling solutions, are actively working to reduce water usage. While a concern, the industry is addressing it to enhance the long-term sustainability and deployability of CSP projects in water-stressed areas.