Here is a long-form article about monthly dividend stocks, written in a casual, conversational tone and optimized for SEO.

The Secret to Steady Income: Unpacking the World of Monthly Dividend Stocks

Let’s be honest: who doesn’t love getting paid? For most of us, payday comes once or twice a month, and we plan our budgets and our lives around that schedule. Now, imagine if your investments could do the same for you. That’s the core appeal of monthly dividend stocks—they’re a way to create a more predictable, frequent stream of passive income.

While many of the most famous dividend-paying companies, like those in the S&P 500, pay out their profits every three months, a special class of stocks and funds has adopted a monthly schedule. This isn’t just a scheduling quirk; for a lot of investors, especially those nearing or in retirement, it’s a game-changer. It helps with cash flow, makes budgeting easier, and provides a tangible, regular reminder of your portfolio’s performance.

But let’s not get ahead of ourselves. Monthly dividend stocks, like any investment, require a careful approach. High-yield doesn’t always mean high-quality, and what looks great on paper can sometimes be a trap. In this comprehensive guide, we’ll dive deep into what monthly dividend stocks are, why they’re so popular, what to look for, and the potential pitfalls you need to avoid. We’ll break down the concepts in plain English so you can feel confident in your financial journey.

The Foundation: What Exactly Are Monthly Dividends?

To understand monthly dividends, we first need to understand what a dividend is. Think of it as a small slice of a company’s profit that is distributed to its shareholders. When a company is doing well and has more cash than it needs for operations, it often rewards its investors by paying a dividend. This is a common practice among mature, stable companies that are no longer focused on aggressive growth but rather on generating consistent earnings.

Historically, most dividends have been paid out quarterly. This aligns with a company’s financial reporting schedule. However, a growing number of companies and investment funds have shifted to a monthly payout. This can be particularly attractive for investors who are using their dividends to supplement their living expenses. A monthly check, even a small one, can make a significant difference in covering regular bills.

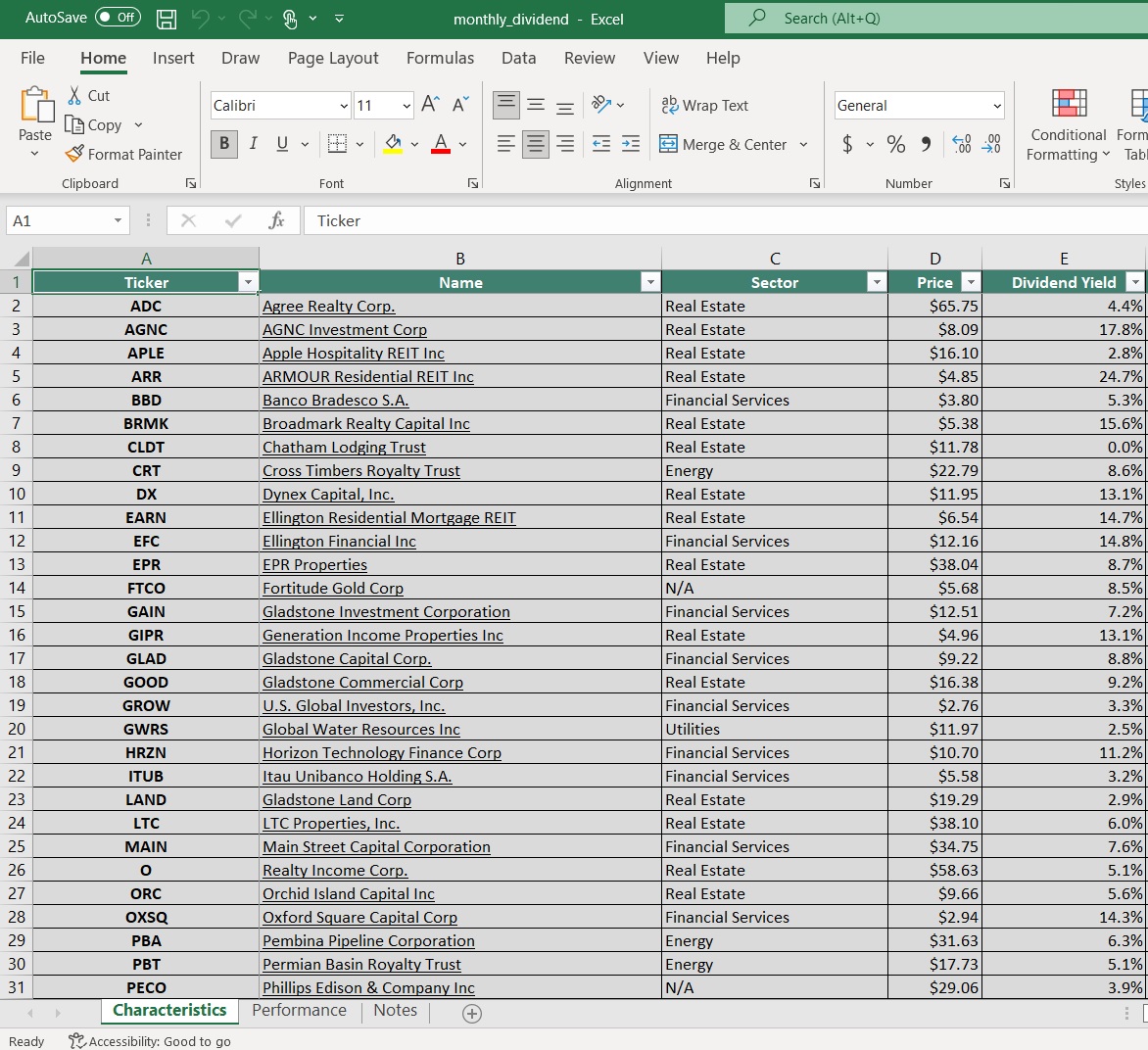

The types of companies that typically pay monthly dividends are often a bit different from your standard blue-chip stock. Real Estate Investment Trusts (REITs) are a prime example. By law, REITs have to pay out a huge chunk of their taxable income to shareholders as dividends. Since they often have a predictable stream of income from rent, it’s a natural fit for them to pay out monthly. You’ll also find monthly payers among certain Closed-End Funds (CEFs) and Business Development Companies (BDCs).

The Big Draw: Why Monthly Dividends Matter for Investors

There are several compelling reasons why investors are so drawn to monthly dividend stocks. It’s not just about the frequency; it’s about the financial and psychological benefits that a steady income stream provides.

The Cautionary Tale: What to Look Out for with Monthly Dividend Stocks

It’s easy to get excited about the idea of a monthly paycheck from your stocks. However, it’s absolutely crucial to approach these investments with a healthy dose of skepticism and a diligent research process. Not all monthly dividend stocks are created equal, and some can be outright dangerous for your portfolio.

Building Your Own Monthly Dividend Portfolio

So, how do you start building a portfolio that pays you every single month? The good news is, you don’t have to find 12 different stocks that all pay in different months. You can simply find a collection of high-quality monthly payers.

When you’re building a monthly dividend portfolio, think about diversification. Don’t put all your eggs in one basket. Spread your investments across different sectors and industries. For example, you might have:

A few industrial REITs that own warehouses and distribution centers.

This approach helps you mitigate risk. If one sector experiences a downturn, the others can help pick up the slack, keeping your monthly income stream stable.

The Fine Print: Taxes and Other Considerations

It’s important to remember that dividends are a form of income, and income is typically taxable. The good news is that most dividends are considered “qualified dividends,” which are taxed at a lower capital gains rate. However, some dividends, especially from REITs, may be considered “non-qualified,” which are taxed at your ordinary income tax rate. It’s always a good idea to consult a tax professional to understand how your specific investments will affect your tax situation.

Another factor to consider is the amount of capital needed to generate a meaningful monthly income. While the idea of a passive income stream is great, it takes a significant amount of money to get there. For example, to generate $1,000 per month from a portfolio with an average 4% dividend yield, you would need to have a portfolio worth around $300,000. This is a long-term goal, not a get-rich-quick scheme.

Final Thoughts: A Marathon, Not a Sprint

Monthly dividend stocks are not a magic bullet. They are a tool, and like any tool, they must be used wisely. The goal isn’t simply to collect a bunch of stocks that pay every month; the goal is to build a diversified portfolio of high-quality, fundamentally sound businesses that provide a reliable and growing stream of income over the long term.

Focus on the fundamentals. Look for companies with a history of sustainable dividends, a healthy business model, and a strong balance sheet. Don’t be seduced by an absurdly high yield, and always remember that a company’s total return is what truly matters.

By taking a thoughtful, long-term approach, you can use monthly dividend stocks to create a powerful and predictable source of passive income that can help you achieve your financial goals and provide a little extra peace of mind, one month at a time. Happy investing!