Unearthing Gems: A Casual Chat About Micro-Cap Growth Stocks Under $5

Hey there, fellow investors and curious minds! Let’s talk about something that gets a lot of buzz in the investment world but often remains a bit of a mystery for many: micro-cap growth stocks, especially those trading for less than five bucks a pop. Now, I know what you might be thinking – “penny stocks!” And while many micro-caps do fall into that category, the truth is, this corner of the market can be a treasure trove of incredible growth opportunities if you know where to look and what to consider. It’s like finding a tiny, dusty antique in a forgotten corner of a shop that, with a bit of polishing, turns out to be a priceless heirloom.

What Exactly Are Micro-Cap Growth Stocks?

First things first, let’s break down what we mean by “micro-cap.” These are publicly traded companies with a relatively small market capitalization, typically ranging from around $50 million to $300 million. Think of them as the new kids on the block, often smaller, less established, and less widely known than the big names you hear about on the news every day. They’re usually in their early growth stages, operating in niche industries, or pioneering new business models.

Now, add “growth” to that. A micro-cap growth stock is one that shows strong potential for significant expansion in its revenue, earnings, or market share. These aren’t your steady, dividend-paying giants; these are companies aiming to disrupt, innovate, and rapidly expand their footprint. And the “under $5” part? Well, that just means they’re often very affordable per share, making them accessible to a wider range of investors, even those with a smaller budget.

Why Even Bother with These Tiny Titans?

So, why would anyone want to put their hard-earned money into these seemingly small and risky ventures? Great question! The answer lies in their potential.

High Growth Potential

This is the big one. Because micro-cap companies are starting from a smaller base, even a moderate increase in their business can lead to massive percentage gains in their stock price. Imagine a company with a $100 million market cap that doubles its revenue – that’s a huge leap, and its stock price could skyrocket right along with it. Larger, more established companies just don’t have that same kind of explosive growth runway.

Undervalued Opportunities

Here’s a secret: many micro-cap stocks are often overlooked by major institutional investors and Wall Street analysts. They’re simply too small for the big players to bother with, which means less attention, less research, and potentially, less efficient pricing. This lack of coverage can create “market inefficiencies,” allowing savvy individual investors to discover truly undervalued gems before the crowd catches on. It’s like finding a limited-edition comic book at a garage sale for pennies before it becomes a collector’s item.

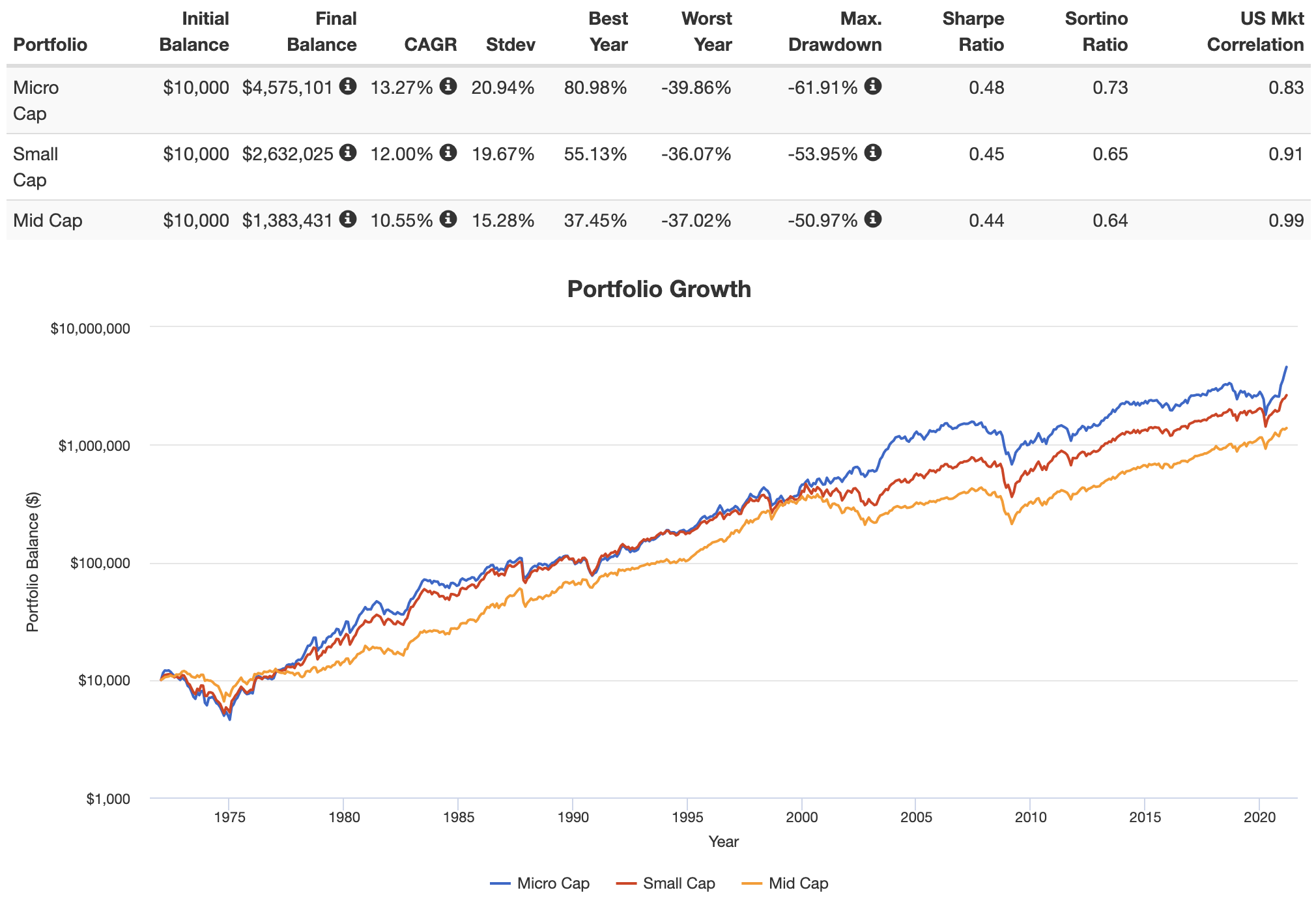

Diversification Benefits

Adding micro-cap stocks to your portfolio can offer diversification beyond just different industries or geographies. Their performance often has a lower correlation to large-cap stocks. This means that when the big guys are struggling, your micro-caps might be marching to the beat of their own drum, potentially helping to smooth out your overall portfolio returns.

Early Investment Advantage

Getting in on a promising company at the micro-cap stage means you’re investing early in its growth journey. If it succeeds, you’re along for the entire ride, potentially participating in multi-bagger returns (where your initial investment multiplies many times over). Think of being one of the first investors in a company like Amazon or Apple when they were just tiny startups.

But Hold On, There Are Risks (And We Need to Talk About Them)

Alright, now for the important part. It wouldn’t be a casual chat if we didn’t address the elephant in the room: risk. Micro-cap stocks, especially those under $5, are not for the faint of heart. They come with a higher degree of risk than investing in more established companies.

High Volatility

These stocks can swing wildly in price, sometimes experiencing massive gains or losses in a very short period. This volatility comes from their smaller market size, lower trading volumes, and often, a smaller investor base. A piece of news, good or bad, can have a disproportionately large impact on their share price.

Limited Liquidity

Since fewer shares might be traded, buying or selling micro-cap stocks quickly without affecting their price can be challenging. This “liquidity risk” means you might not always be able to get out of a position at your desired price, especially if many investors are trying to sell at once.

Lack of Information

Unlike larger companies, many micro-cap firms don’t have the same extensive financial reporting or analyst coverage. This lack of publicly available information can make it harder to thoroughly research a company and make informed decisions. It requires more legwork on your part.

Fraud and Manipulation Risk

Unfortunately, the micro-cap space can be more susceptible to fraudulent schemes, like “pump-and-dump” operations. This is where promoters artificially inflate a stock’s price with misleading information, only to sell off their shares once the price rises, leaving unsuspecting investors with heavy losses. Always be cautious of unsolicited advice or overly enthusiastic promotions for these types of stocks.

Unproven Business Models and Financial Stability

Many micro-cap companies are still in their early development stages, with unproven products, services, or business models. They might have limited financial resources, inconsistent revenue, or higher levels of debt. Investing in them is often a bet on their future success, which is inherently riskier.

How to Hunt for These Hidden Gems (Without Getting Burned)

So, with the risks laid out, how do you go about finding potentially promising micro-cap growth stocks under $5? It takes effort, patience, and a healthy dose of skepticism.

Do Your Homework (Seriously, All of It!)

This is non-negotiable. Before even thinking about investing, dig deep into the company’s financials. Look at their balance sheet, income statement, and cash flow. Are they burning through cash, or are they generating consistent revenue? Understand their business model inside and out. What do they do? How do they make money? Who are their competitors? What’s their competitive advantage?

Look for Strong Management Teams

A company is only as good as the people running it. Research the management team’s experience, track record, and integrity. Do they have a clear vision? Are they transparent with investors? A strong, experienced, and ethical management team is crucial for a young, growing company.

Identify a Clear Growth Catalyst

What’s going to drive this company’s growth? Is it a new product launch, entry into a new market, a disruptive technology, or a favourable industry trend? There should be a clear, identifiable reason why the company is expected to grow rapidly. Avoid companies with vague growth plans.

Focus on Niche Markets or Emerging Industries

Micro-caps often thrive in specialized niches or nascent industries where they can establish themselves before bigger players catch on. Look for companies addressing underserved markets or pioneering solutions in emerging sectors like clean energy, biotechnology, or artificial intelligence.

Check for Insider Ownership

When management and insiders own a significant portion of the company’s stock, it often aligns their interests with yours. They have skin in the game, which can be a good sign.

Scrutinize Debt Levels

High debt can be a red flag for small, growing companies, especially if they aren’t generating strong cash flow. Understand their debt structure and their ability to service it.

Consider Trading Volume and Liquidity

Even if a stock looks promising, very low trading volume can be a problem. It might be difficult to buy or sell shares when you want to, and bid-ask spreads can be wide, meaning you pay more to buy and get less to sell.

Patience is a Virtue (Especially with Micro-Caps)

Investing in micro-cap growth stocks isn’t about getting rich overnight. It’s a long-term game. These companies can take time to execute their plans and for their growth to be reflected in their stock price. Be prepared to hold these investments for several years, riding out the inevitable ups and downs. Don’t check the stock price every day; focus on the company’s fundamental progress.

Building a Diversified Micro-Cap Portfolio (Yes, Even Here)

Even within the micro-cap space, diversification is key. Don’t put all your eggs in one basket. Instead of betting on just one or two companies, consider building a portfolio of several promising micro-caps across different industries. This helps mitigate the risk if one of your picks doesn’t pan out. Remember, not every micro-cap will be a winner, and some will inevitably fail. The goal is for your winners to significantly outweigh your losers.

The Bottom Line: High Risk, High Reward

Investing in micro-cap growth stocks under $5 is a high-risk, high-reward strategy. It’s not suitable for everyone, especially those with a low tolerance for risk or who need quick returns. However, for investors willing to put in the time for thorough research, accept the inherent volatility, and take a long-term view, this segment of the market can offer the potential for truly exceptional returns. It’s where the next big thing might be hiding, waiting for astute investors to discover it. Just remember to proceed with caution, armed with knowledge, and always, always do your own diligent research. Good luck on your treasure hunt!

Conclusion

Navigating the world of micro-cap growth stocks under $5 can be an exhilarating yet challenging journey. While the allure of uncovering the next market-beating company is undeniable, it’s crucial to approach this sector with a clear understanding of both its immense potential and its significant risks. These small, often overlooked companies offer a unique opportunity for substantial returns due to their high growth capacity and potential for undervaluation, but they demand rigorous research, a long-term perspective, and a strong stomach for volatility. By focusing on robust business models, capable management, clear growth catalysts, and exercising careful due diligence, investors can increase their chances of transforming these penny-priced prospects into valuable assets.

5 Unique FAQs After The Conclusion

1. How do I typically buy micro-cap stocks, given they’re often not on major exchanges?

Micro-cap stocks are typically traded on over-the-counter (OTC) markets, rather than major exchanges like the NYSE or Nasdaq. You can usually access these through online brokerage platforms that provide access to OTC Markets Group (OTC Pink, OTCQB, OTCQX) or the OTC Bulletin Board (OTCBB). It’s important to choose a broker that offers access to these markets and to understand any associated trading fees, which can sometimes be higher for OTC securities. Always confirm the specific trading platform and fees with your chosen broker.

2. What’s the biggest mistake a new investor can make when looking at micro-cap growth stocks under $5?

The biggest mistake is often falling victim to “pump-and-dump” schemes or investing based on hype and emotion rather than fundamental analysis. New investors might be tempted by unrealistic promises of quick riches without doing their own thorough research into the company’s financials, management, and business model. This can lead to significant losses if the stock price collapses after being artificially inflated. Always remember: if it sounds too good to be true, it probably is.

3. How much of my overall portfolio should I consider allocating to micro-cap stocks?

Given the high-risk nature of micro-cap stocks, most financial advisors recommend allocating only a small percentage of your overall investment portfolio to them – typically no more than 5-10%, and often less for conservative investors. This allows you to participate in the potential upside without jeopardizing your entire financial well-being if these speculative investments don’t pan out. Your personal risk tolerance and financial goals should ultimately guide this decision.

4. Are there any specific financial metrics I should prioritize when evaluating a micro-cap growth stock, besides just revenue growth?

Absolutely! While revenue growth is crucial for growth stocks, for micro-caps, you should also heavily scrutinize their cash flow from operations. Many early-stage growth companies might be unprofitable, but positive and growing operating cash flow indicates they are generating money from their core business, which is a sign of financial health. Additionally, look at their debt-to-equity ratio to assess their leverage, and gross margins to understand their core profitability before operating expenses. Consistent positive trends in these areas, even if profits are still elusive, can be very telling.

5. What’s the difference between a “growth stock” and a “value stock” when it comes to micro-caps?

A growth micro-cap stock is typically a company in an early stage that is expected to grow its earnings and revenue at a much faster rate than the overall market or its industry peers. These companies often reinvest most of their profits back into the business for expansion and may not pay dividends. Their valuation might seem high based on current earnings, as investors are buying into future potential.

A value micro-cap stock, on the other hand, is a company that is currently undervalued by the market relative to its intrinsic worth. It might be trading at a low price-to-earnings (P/E) ratio or price-to-book (P/B) ratio, possibly due to temporary setbacks, market oversights, or being in an out-of-favour industry. Value investors seek to buy these companies when they are cheap, expecting the market to eventually recognize their true value. While our discussion focuses on growth, it’s good to understand the distinction, as both types can exist in the micro-cap space.