Title: Gold vs. Silver: A Deep Dive into investment Returns and Market Dynamics

Introduction: The Timeless Allure of Precious Metals

For centuries, gold and silver have captivated humanity, not just for their beauty but for their role as a store of value. From ancient coinage to modern-day investment portfolios, these two precious metals have been seen as a hedge against economic uncertainty, a tangible asset in a world of digital currencies, and a way to preserve wealth across generations. But for the average person looking to put some money into the world of precious metals, a crucial question arises: which is the better investment?

It’s a debate as old as the metals themselves, and the answer is far from simple. It’s not just about looking at a chart and seeing which one went up more. It’s about understanding the unique characteristics, market forces, and historical patterns that drive the performance of each metal. This isn’t financial advice, but a comprehensive look at the fascinating world of gold and silver as investments, exploring their past, present, and potential future returns in a casual, easy-to-understand way. We’ll break down their roles in the global economy, their volatility, and the factors that make one a better choice over the other, depending on your individual goals and risk tolerance.

The Foundation: What Makes Gold and Silver Valuable?

Before we get into the nitty-gritty of returns, let’s understand why these metals are so special in the first place. Both gold and silver have a dual nature. They are commodities, meaning they have practical applications in various industries, and they are also monetary assets, often seen as a form of money or a store of value.

Gold’s primary value lies in its role as a monetary asset. It’s a classic safe haven. When geopolitical tensions rise, or the global economy looks shaky, people tend to flock to gold. Central banks hold massive reserves of it, and it’s a popular choice for investors looking to protect their wealth during times of crisis. Gold’s industrial use is relatively small compared to its overall market, making its price less dependent on the health of the global economy. This is a key distinction. When factories are humming and the economy is booming, gold’s price might be influenced, but it’s not directly tied to the demand for circuit boards or medical devices. Its value is more about investor sentiment, trust in government and currency, and fear of inflation.

Silver, on the other hand, is a bit more of a chameleon. It also has a history as a monetary asset, but its industrial applications are far more extensive. A significant portion of the world’s silver supply is consumed by industries like electronics, solar energy, and automotive manufacturing. This gives silver a fascinating dual identity. During a strong economy, industrial demand for silver goes up, pushing its price higher. But during a recession, when manufacturing slows down, that demand can dry up, putting downward pressure on its price. However, when economic uncertainty becomes a significant factor, silver can also act as a safe-haven asset, attracting investment demand just like gold. This push-pull between its industrial and investment roles is what makes silver’s price more volatile and, for some investors, more exciting.

A Look at Historical Returns: The Long-Term View

When comparing gold and silver, it’s crucial to look at their long-term performance. The data reveals some clear trends, but also a few surprising twists.

Over a very long period, like the past century, gold has demonstrably been the more stable and higher-performing asset. Its steady, upward trajectory has made it a reliable vehicle for preserving purchasing power. For example, looking at the compounded annual returns over a very long time, gold has a better track record than silver. This is due in part to gold’s role as a primary safe-haven asset and its larger market capitalization. The sheer size of the gold market, estimated to be many times larger than the silver market, provides a level of stability that silver simply can’t match. This makes gold less susceptible to sudden price swings caused by a small number of large trades or changes in industrial demand.

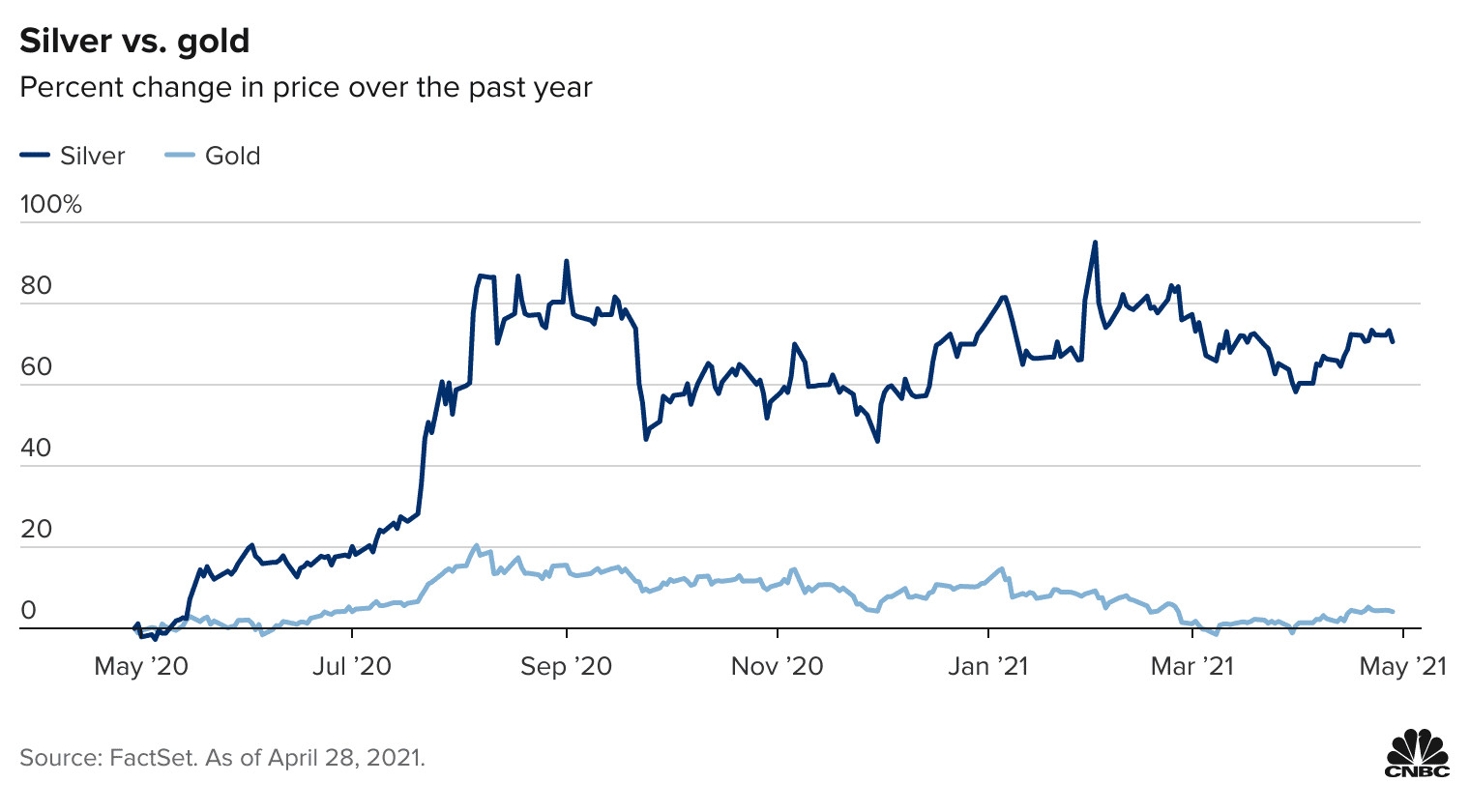

However, a long-term chart doesn’t tell the whole story. While gold has been the more consistent performer, silver has had periods of explosive growth that have left gold in the dust. These periods are often tied to specific economic cycles or moments in history.

The High-Stakes Game of Volatility: Silver’s Wild Swings

This is where the conversation gets interesting. Silver is known for being significantly more volatile than gold. Its price can swing wildly in both directions, offering a higher potential for returns but also a much greater risk.

Think of it this way: if gold is the reliable, steady ship sailing through a storm, silver is the speedboat. It can get you to your destination faster, but it’s a much bumpier ride. Silver’s price can move as much as 1.5 to 2 times more dramatically than gold’s, both on the way up and on the way down.

This volatility is a direct result of its smaller market size and its dual nature. During a bull market for precious metals, where both are rising, silver can often see a much larger percentage gain. This is because its market is smaller, and a large influx of investment capital can have a more pronounced effect on its price.

Conversely, during a bear market, when prices are falling, silver can take a much harder hit. A combination of decreased investment demand and a slowdown in industrial consumption can create a perfect storm, causing its price to plummet more sharply than gold’s.

The Gold-Silver Ratio: A Key Indicator for Savvy Investors

A critical tool for anyone interested in this debate is the gold-silver ratio. This is simply the number of ounces of silver it takes to buy one ounce of gold. It’s a powerful metric because it reflects the relative strength of each metal.

Historically, this ratio has fluctuated widely. In ancient times, the ratio was often fixed by governments, sometimes around 12:1 or 15:1. Today, it’s a free-market indicator that can provide valuable insight.

– High Ratio: When the ratio is high, it means gold is relatively more expensive than silver. Many investors see this as a sign that silver is undervalued and may be a good buying opportunity. The idea is that the ratio will eventually “revert to the mean” and silver will catch up.

– Low Ratio: When the ratio is low, silver is relatively more expensive. This could suggest that silver has had a strong run and might be due for a correction, or that gold is undervalued.

Tracking this ratio is a classic strategy for contrarian investors who like to buy assets that are out of favor. They might sell some of their gold to buy silver when the ratio is high, and then do the reverse when the ratio is low.

The Economic Drivers: Inflation, Stagflation, and Growth

Understanding the macroeconomic environment is essential for predicting how gold and silver might perform. They don’t react to every economic event in the same way.

Investment Vehicles: How to Buy Gold and Silver

The article is about the investment returns, so it’s important to briefly touch upon how you can actually get exposure to these metals. The decision of which metal to buy is separate from the method of buying it.

– Physical Bullion: This is the most traditional way to invest. You buy physical gold or silver in the form of bars and coins. The appeal here is the tangible nature of the asset; you can hold it in your hand. The downsides are the hassle of storage, insurance, and the potential for higher transaction costs.

– Exchange Traded Funds (ETFs): For most investors, this is the easiest and most liquid way to invest in gold and silver. ETFs that are backed by physical metal allow you to get exposure to the price movements without the complexities of physical ownership. They trade just like a stock on an exchange.

– Mining Stocks: You can also invest in the companies that mine the metals. This is a more speculative play, as you’re not just betting on the price of the metal but also on the management, operational efficiency, and profitability of the company itself. Mining stocks can offer leveraged returns on the price of the underlying commodity, but they come with their own set of risks.

Conclusion: Which One is Right for You?

So, after all this, which is the better investment? The truth is, there’s no single right answer. It entirely depends on your investment goals, your risk tolerance, and your personal outlook on the economy.

– Choose Gold if… You are a conservative investor focused on wealth preservation. You want a stable, reliable hedge against inflation and economic uncertainty. You’re looking for a safe-haven asset that central banks and large institutions trust. You prioritize stability over the potential for explosive gains.

– Choose Silver if… You have a higher risk tolerance and are looking for greater growth potential. You believe in the future of green technology and industrial applications. You’re willing to stomach more volatility for the chance of bigger returns during a precious metals bull market or an economic recovery. You want to use the gold-silver ratio as a tactical tool to make contrarian investment decisions.

Many investors find that a balanced approach is best, holding a mix of both gold and silver in their portfolio. Gold provides the stable foundation and the ultimate hedge, while silver adds an element of speculative growth and the potential for outsized returns. Think of it as a diversified precious metals portfolio.

The world of gold and silver investing is complex and dynamic. It’s a world where ancient history meets modern technology, and where the wisdom of the past informs the decisions of the future. By understanding the fundamental differences between these two precious metals, you can make a more informed choice about how they fit into your own financial journey.

:max_bytes(150000):strip_icc()/Riskofinvestinginartandcollectibles-final-2d29aa4b64b143fdbc43aa92b3b2a702.png?resize=200,135&ssl=1)