When it comes to building wealth and securing your financial future, one of the most powerful tools at your disposal is investing. But for many, the world of stocks, bonds, and mutual funds can seem like a confusing and intimidating maze. Where do you even begin? The good news is that you don’t need a finance degree to start. The secret to a successful investing journey often lies in the foundational knowledge you gain from a few key sources. And in a world filled with endless information, sometimes the most reliable and enduring wisdom comes from the pages of a well-written book.

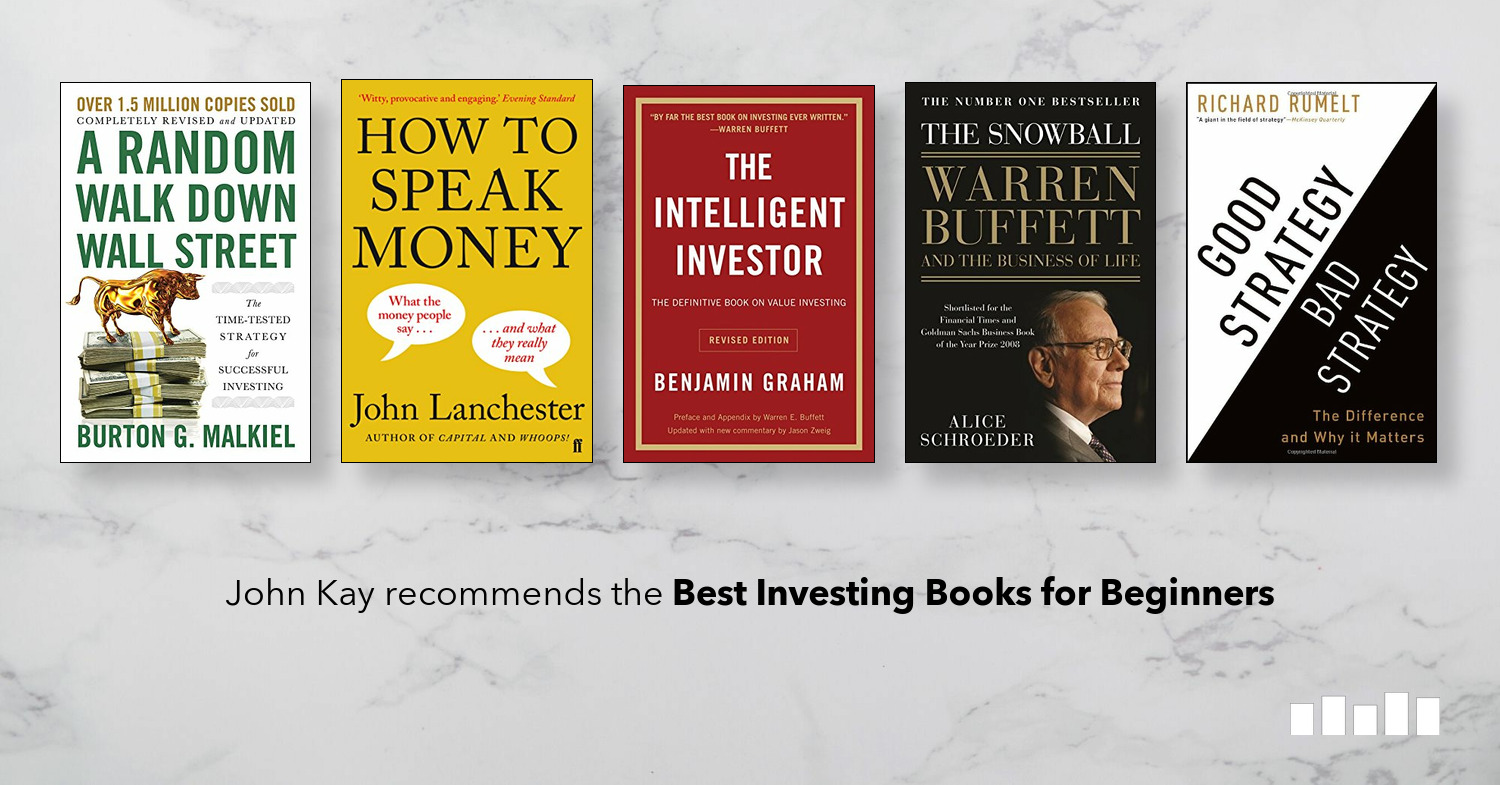

This article is your guide to the most essential books for anyone who is a beginner investor. We’ll delve into a curated list of titles that demystify the market, explain core concepts in plain English, and provide a solid framework for making smart, long-term financial decisions. From the timeless principles of value investing to the common-sense approach of index funds, we’ll explore the works that have shaped the minds of the world’s most successful investors and continue to serve as the go-to resources for newcomers.

Forget the get-rich-quick schemes and the flashy headlines. We’re focusing on the literature that teaches you how to think like a disciplined investor, not a gambler. These books will empower you to take control of your financial destiny, build a robust portfolio, and navigate the inevitable ups and downs of the market with confidence. So, grab a cup of coffee, settle in, and get ready to transform your financial perspective, one chapter at a time.

Why Reading Books is the Best Way to Start Investing

In an age of instant gratification, many people turn to quick online searches, social media influencers, or fast-paced articles for financial advice. While these sources can offer some value, they often lack the depth, context, and rigorous research that a good book provides. A comprehensive book forces you to slow down and absorb complex ideas in a structured way. It allows you to build a cohesive mental model of how the financial world works, rather than just collecting a jumble of disconnected tips and tricks.

Moreover, the best investing books are often written by people who have spent their lives in the industry—economists, fund managers, and legendary investors who have a track record of success. They provide a historical perspective, a philosophical foundation, and a psychological understanding of the market that you simply can’t find in a five-minute video. They teach you not just what to do, but why you’re doing it, which is crucial for staying the course when the market gets volatile.

Another key benefit is that these books help you filter out the noise. The investing world is full of fear-mongering, hype, and contradictory advice. By reading a foundational text, you can develop a core set of principles that act as your compass, allowing you to ignore the distractions and focus on your long-term goals. They provide a timeless wisdom that transcends market cycles and fleeting trends.

Foundational Texts for Every Beginner

This section is dedicated to the absolute must-reads—the books that are almost universally recommended for new investors. These titles cover the core philosophies that have guided successful investors for decades.

# 1. The Intelligent Investor by Benjamin Graham

Often called the “Bible of investing,” this book is the cornerstone of value investing and a must-read for anyone serious about the topic. Benjamin Graham was Warren Buffett’s professor and mentor, and his teachings form the bedrock of Buffett’s investment philosophy.

# 2. A Random Walk Down Wall Street by Burton Malkiel

If Graham is the godfather of value investing, Burton Malkiel is a leading proponent of a different, but equally powerful, approach: passive investing. Malkiel, a renowned economist, argues that over the long run, it is extremely difficult for even professional investors to consistently “beat the market.”

His book explores the concept of the “random walk” theory, which posits that stock market prices move in an unpredictable way, making it impossible to forecast their future direction. The conclusion? A beginner investor’s best bet is often to invest in low-cost, broadly diversified index funds. A Random Walk Down Wall Street is a fantastic reality check for anyone who thinks they can outsmart the market. It provides a compelling and well-researched case for a simple, disciplined, and low-cost approach that has proven to be incredibly effective for countless investors.

# 3. The Little Book of Common Sense Investing by John C. Bogle

John Bogle, the founder of Vanguard, created the first index mutual fund for individual investors, changing the face of the financial industry forever. This book is a straightforward and accessible guide to his philosophy.

Bogle’s message is simple and powerful: the less you pay in fees and the broader your diversification, the more you get to keep of your investment returns. He meticulously breaks down the mathematics of how costs and fees, even seemingly small ones, can erode your wealth over time. This book is a passionate defense of the “simple path to wealth” that involves buying and holding a low-cost index fund that tracks the entire market. It’s an essential read for anyone who wants to avoid the common pitfalls of active trading and high-fee funds. Bogle’s wisdom is not just about making money, but about keeping it.

Books That Shape Your Investing Mindset

Beyond the foundational texts, some books are less about specific strategies and more about the psychological and behavioral aspects of investing. They help you understand yourself and the market better.

# 4. The Psychology of Money by Morgan Housel

This book is a modern classic that everyone, not just investors, should read. Morgan Housel, a partner at The Collaborative Fund, uses a series of short stories to illustrate how people think about and interact with money.

The central theme is that doing well with money has less to do with how smart you are and more to do with how you behave. He tackles big ideas like greed, fear, and the importance of a long-term perspective in a way that is both engaging and profound. Housel’s insights on compounding, luck, and the difference between being rich and being wealthy will change the way you think about your finances. This book is a powerful reminder that the best investment you can make is in your own behavior.

# 5. The Simple Path to Wealth by JL Collins

JL Collins’s book began as a series of letters to his daughter, and its conversational, no-nonsense tone makes it one of the most approachable and practical guides on this list.

Collins distills the world of investing into a simple, actionable plan. He champions the power of a “FI Fund” (Financial Independence Fund) and provides a clear, step-by-step roadmap for building wealth through index funds. The book covers everything from the dangers of debt to the importance of a high savings rate, and it does so in a way that feels like a wise friend is giving you advice. The Simple Path to Wealth is perfect for beginners who want a clear, no-frills plan to achieve financial freedom.

For Those Who Want to Go a Step Deeper

Once you have a solid understanding of the basics, you might be curious about more specific strategies. These books introduce you to more nuanced ideas, but they’re still digestible for a beginner.

# 6. One Up On Wall Street by Peter Lynch

Peter Lynch is a legendary fund manager who famously beat the market for years while running the Fidelity Magellan Fund. His book is a lively and accessible guide to his investment philosophy.

Lynch’s core idea is that the average investor has a powerful advantage over professional investors: they can find great investment ideas in their everyday lives. He encourages readers to invest in “what they know”—companies whose products or services they understand and admire. This book is a fantastic blend of practical advice and engaging storytelling. It teaches you how to conduct basic research, what to look for in a company, and how to spot a “tenbagger” (a stock that returns ten times your initial investment). It’s a fun and empowering read that proves you don’t need to be a Wall Street insider to find success.

# 7. The Little Book That Still Beats the Market by Joel Greenblatt

Joel Greenblatt is a successful hedge fund manager and a professor at Columbia Business School. His book, a quick and easy read, presents a “magic formula” for successful stock picking.

The formula is based on two simple metrics: a company’s earnings yield and its return on capital. Greenblatt explains, in a surprisingly simple way, how to find good companies at bargain prices. The book’s charm lies in its use of humor and a clear, logical progression that makes a seemingly complex topic feel approachable. While it’s not a foolproof system, it’s an excellent way to learn about the fundamental principles of value investing in a low-stakes and engaging format.

Classic and Enduring Wisdom

Some books have a timeless quality that makes them relevant no matter how much the market changes. They offer a different perspective and a historical context that is invaluable.

# 8. The Richest Man in Babylon by George S. Clason

This book, written in the form of parables set in ancient Babylon, is a surprisingly effective guide to personal finance. It’s not strictly an investing book, but its lessons are the perfect foundation for anyone’s financial journey.

The parables teach timeless principles like paying yourself first, living within your means, and making your money work for you. It’s an easy and enjoyable read that provides a powerful framework for building wealth. The book’s focus on saving and a simple, disciplined approach to managing money is the perfect starting point before you even think about buying your first stock.

# 9. Security Analysis by Benjamin Graham and David Dodd

For those who are truly committed to understanding the mechanics of value investing, this is the deep dive. This is the more advanced, more technical companion to The Intelligent Investor.

While not a book for every beginner, it is the definitive text on fundamental analysis. It’s a comprehensive guide to understanding financial statements, evaluating a company’s health, and calculating its intrinsic value. This book is a serious undertaking, but for those who want to build a deep expertise in value investing, there is no better source. It’s a book that you’ll return to again and again as your knowledge and experience grow.

How to Apply These Lessons

Reading these books is just the first step. The real magic happens when you apply their wisdom to your own life. Here are a few key takeaways to help you get started:

Start Saving and Investing Early: The most powerful force in investing is compounding. The sooner you start, the more time your money has to grow.

A Final Thought

The world of investing can seem overwhelming, but it’s a skill that can be learned and a habit that can be built. The books on this list are more than just guides; they are mentors that will teach you the enduring principles of financial success. They provide the knowledge and the confidence to take control of your money, avoid common mistakes, and build a secure financial future for yourself and your family. So, choose one that resonates with you, crack it open, and start your journey today. Your future self will thank you for it.