Unearthing Gems: A Guide to Undervalued REITs with High Yield for the Savvy investor

Real Estate Investment Trusts, or REITs, have long been a favourite among income-seeking investors. These unique vehicles allow everyday folks to invest in large-scale, income-producing real estate – think towering office buildings, bustling shopping malls, cosy apartment complexes, and even the infrastructure that powers our digital world – without having to buy, manage, or maintain physical properties themselves. They’re like mutual funds for real estate, pooling money from many investors to acquire and operate a portfolio of properties. The magic of REITs lies in their structure: by law, they are required to distribute at least 90% of their taxable income to shareholders annually in the form of dividends. This makes them fantastic for consistent cash flow, often offering yields significantly higher than what you’d typically find from broad market indices.

However, like any investment, not all REITs are created equal. The real trick, especially in today’s dynamic market, is to unearth those undervalued gems – the REITs that are currently trading below their intrinsic value but boast robust fundamentals and, crucially, a high and sustainable dividend yield. This article will dive deep into the world of undervalued, high-yield REITs, helping you understand what makes them tick and how to spot the opportunities that could potentially boost your passive income and portfolio growth.

Understanding the Allure of REITs

Before we get into the nitty-gritty of finding undervalued opportunities, let’s briefly recap why REITs are such a compelling investment.

Access to Real Estate Without the Hassle

One of the most significant advantages of REITs is that they democratise real estate investment. Historically, investing in commercial real estate required substantial capital, a deep understanding of local markets, and a willingness to deal with the headaches of property management. REITs remove these barriers. By buying shares in a publicly traded REIT, you’re essentially owning a piece of a diversified portfolio of properties, managed by professionals, without the need for a huge down payment or hands-on involvement.

Steady Income Through High Dividends

As mentioned, the mandatory distribution of 90% of taxable income as dividends is a huge draw for income investors. This means REITs are designed to pay out a significant portion of their earnings directly to shareholders. This predictable income stream can be particularly appealing in times of market volatility, providing a cushion and helping to offset potential price fluctuations. Many investors use REIT dividends to generate passive income for retirement, supplement their regular earnings, or even reinvest for compounded growth.

Diversification Benefits

Adding REITs to your investment portfolio can offer valuable diversification. Real estate often behaves differently than other asset classes like stocks and bonds. This low correlation can help reduce overall portfolio risk, especially during periods when other sectors might be struggling. When you diversify across different types of REITs (e.g., residential, industrial, retail, healthcare), you further spread your risk within the real estate sector itself.

Potential for Capital Appreciation

While income is a primary driver, REITs also offer the potential for capital appreciation. As property values increase, or as the REIT expands its portfolio and improves its operational efficiency, the value of its shares can rise. This “two-way” return potential – a combination of healthy dividends and potential share price growth – makes them an attractive long-term investment.

Liquidity

Unlike direct property ownership, which can be highly illiquid, shares in publicly traded REITs can be bought and sold on major stock exchanges, just like any other stock. This liquidity provides investors with the flexibility to enter or exit positions relatively easily, making them a more accessible and manageable investment than owning physical real estate.

What Makes a REIT “Undervalued” and “High Yield”?

Now, let’s talk about the sweet spot: undervalued REITs with high yields. It’s not just about finding any REIT that pays a lot; it’s about finding those that are priced below what they’re truly worth and whose high dividends are sustainable, not a warning sign.

Defining Undervalued

Valuing REITs isn’t quite the same as valuing traditional companies. While metrics like earnings per share (EPS) are common for other stocks, REITs use different key performance indicators (KPIs) that better reflect their unique business model.

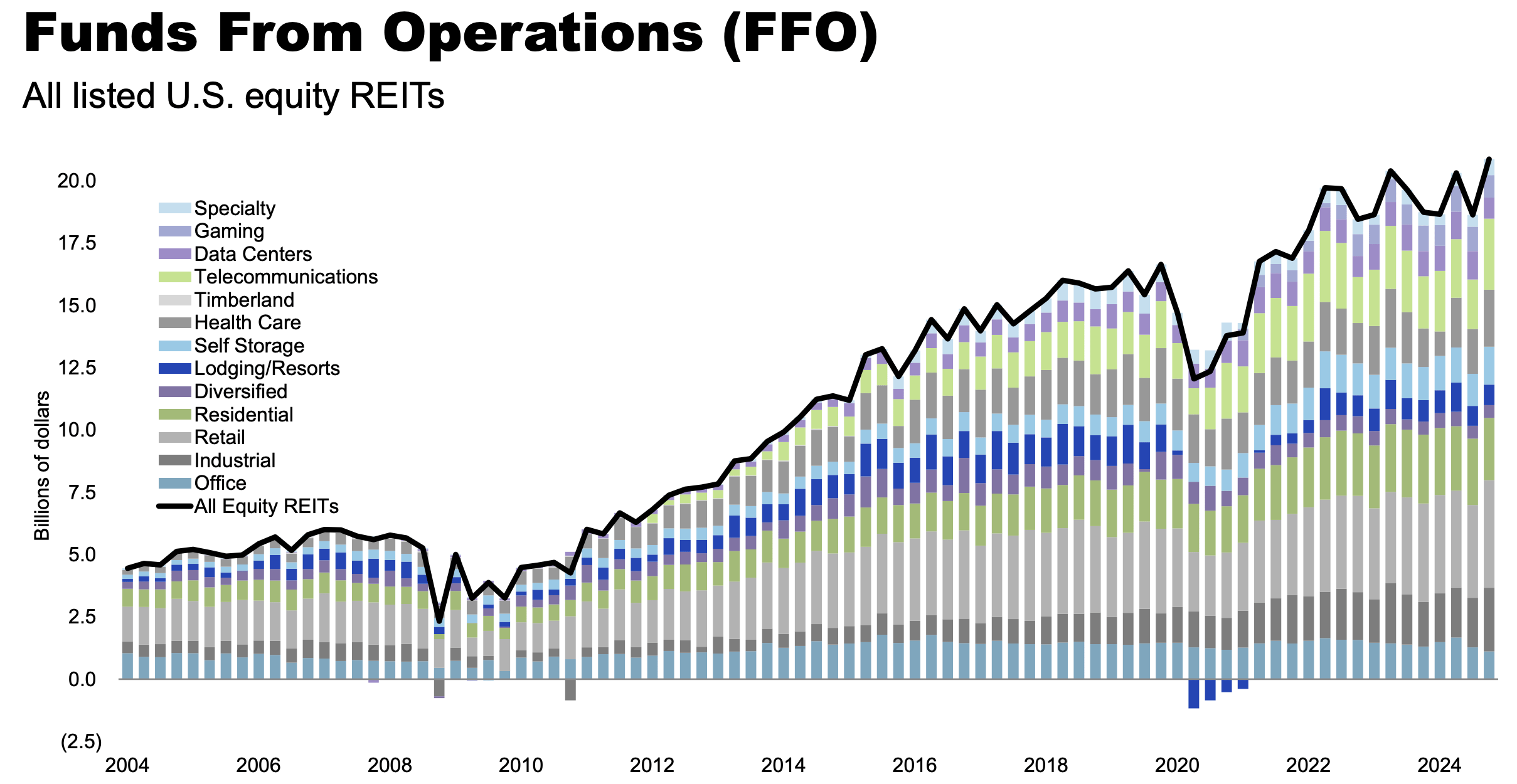

Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO)

Instead of EPS, REITs are typically evaluated using Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO). Here’s why:

Depreciation: Real estate properties depreciate on paper for accounting purposes, which reduces net income. However, real estate often appreciates in value over time. FFO adds back depreciation and amortisation to net income, giving a clearer picture of the cash flow generated by the REIT’s operations.

When a REIT’s stock price is low relative to its FFO or AFFO per share, it might indicate undervaluation. A low price-to-FFO (P/FFO) ratio or price-to-AFFO (P/AFFO) ratio compared to historical averages or industry peers can be a strong indicator that the market is currently underestimating the REIT’s true earning power.

Net Asset Value (NAV)

Another crucial valuation metric for REITs is Net Asset Value (NAV). This represents the estimated market value of a REIT’s properties minus its liabilities, divided by the number of outstanding shares. Think of it as the “book value” if the properties were to be sold at their current market price. If a REIT’s stock price is trading significantly below its NAV per share, it suggests that the market is assigning a discount to the underlying real estate assets, making it potentially undervalued.

Defining High Yield

A high yield is straightforward: it means the annual dividend payment divided by the current share price results in a high percentage. However, the critical distinction is between a genuinely high and sustainable yield and a dangerously high one.

Sustainability of the Dividend

A high yield is only attractive if it’s sustainable. A company paying out an unsustainably high dividend might be doing so by depleting its cash reserves, taking on excessive debt, or selling off assets. These are all red flags. To assess dividend sustainability, look at the REIT’s payout ratio relative to its FFO or AFFO. A payout ratio (dividends per share / FFO or AFFO per share) that is consistently above 80-90% might signal that the dividend is stretched thin and at risk of a cut. A lower, more conservative payout ratio gives the REIT more flexibility to reinvest in its properties, reduce debt, and weather economic downturns.

Dividend Growth

While a high current yield is good, a growing dividend is even better. Look for REITs that have a history of consistently increasing their dividends over time. This indicates healthy cash flow generation, strong management, and confidence in future prospects. Dividend growth also helps your income keep pace with inflation.

Key Factors to Consider When Hunting for Undervalued, High-Yield REITs

Finding truly undervalued, high-yield REITs requires more than just glancing at a spreadsheet. It involves digging into the company’s fundamentals, understanding the broader economic landscape, and assessing management’s capabilities.

Sector-Specific Outlook

The performance of different REIT sectors can vary significantly depending on economic conditions and evolving consumer and business trends. For example, during a recession, retail and hotel REITs might struggle due to reduced consumer spending and travel, while industrial (warehouses, logistics centres) or data centre REITs might remain resilient or even thrive due to increasing e-commerce and digital demand. Understanding the long-term outlook for the specific real estate sector a REIT operates in is paramount. Are there headwinds or tailwinds impacting that particular property type?

Quality of Management

A strong and experienced management team is crucial for any company, and REITs are no exception. Look for management teams with a proven track record of successful property acquisitions, efficient operations, wise capital allocation, and transparent communication with shareholders. Their ability to navigate market cycles and make shrewd strategic decisions directly impacts the REIT’s long-term performance and dividend sustainability.

Balance Sheet Strength and Debt Levels

REITs, by nature, often carry significant debt to finance their property portfolios. However, too much debt can be a serious risk, especially in a rising interest rate environment. Examine the REIT’s debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) ratio, interest coverage ratio, and debt maturity schedule. A healthy balance sheet with manageable debt levels and ample liquidity is essential for dividend stability and long-term viability.

Occupancy Rates and Lease Terms

High occupancy rates indicate strong demand for the REIT’s properties and a consistent rental income stream. Low or declining occupancy can signal problems. Also, consider the average lease terms. Long-term leases with creditworthy tenants provide more predictable income, while short-term leases can offer more flexibility for rent increases in an inflationary environment, but also expose the REIT to higher vacancy risk.

Geographic Diversification

A REIT with properties spread across diverse geographic regions can mitigate risks associated with downturns in any single market. A local economic slump in one area might be offset by strength in another.

Tenant Quality

The financial health and diversity of a REIT’s tenants are vital. Relying too heavily on a few struggling tenants can be a major risk. A diversified tenant base, particularly with strong, financially stable companies, provides a more secure income stream.

Potential Undervalued REIT Sectors for 2025

While it’s impossible to predict the future with certainty, several REIT sectors could present undervalued opportunities with high yield potential in 2025, based on current economic trends and projections.

Healthcare REITs

The aging global population and increasing demand for healthcare services continue to drive growth in this sector. Healthcare REITs own properties like hospitals, medical office buildings, skilled nursing facilities, and senior living communities. While some segments like senior living faced challenges during the pandemic, the long-term demographic trends remain highly favourable. Look for REITs with diversified portfolios across different healthcare sub-sectors and strong relationships with reputable healthcare operators. Any temporary market downturns or specific company-related issues that cause a dip in price could present a buying opportunity for a long-term play.

Industrial REITs

The explosion of e-commerce has been a massive tailwind for industrial REITs, which own warehouses, distribution centres, and logistics facilities. While some growth has likely been priced in, continued expansion of online retail, supply chain reconfigurations, and the increasing need for last-mile delivery facilities suggest ongoing strong demand. Any slight dip in this sector due to broader market corrections could offer a chance to grab these resilient income producers at a better price. Their long-term leases and mission-critical nature for businesses contribute to stable cash flows.

Net Lease REITs

Net lease REITs own properties where the tenant is responsible for most or all property expenses, including taxes, insurance, and maintenance. This “triple net” structure results in highly predictable and stable cash flows for the REIT, as their expenses are minimal. Many net lease REITs have long-term leases with built-in rent escalators, providing consistent dividend growth. If rising interest rates temporarily impact their cost of capital and depress their share prices, they could become undervalued relative to their stable income streams. Focus on those with a diversified tenant base across various industries.

Data Center REITs

With the increasing reliance on cloud computing, artificial intelligence, and the Internet of Things, the demand for data storage and processing power is soaring. Data centre REITs own the facilities that house critical IT infrastructure. This sector benefits from secular growth trends and often has long-term leases with major tech companies. While this sector has seen significant growth, market corrections or concerns about capital expenditure needs could occasionally create opportunities to acquire these high-growth, high-yield assets at a more attractive valuation.

Residential REITs (Specific Sub-Sectors)

While the broader residential market can be cyclical, certain niches within residential REITs might offer value. For instance, manufactured housing REITs or single-family rental REITs can be less sensitive to economic downturns than traditional apartment REITs, as they often cater to more affordable housing needs. These can offer stable occupancy and strong cash flows, making them interesting for income investors when they’re trading at a discount.

The Cautious Investor’s Approach: Due Diligence is King

Even with promising sectors identified, thorough due diligence on individual REITs is non-negotiable.

Analyse Financial Statements

Go beyond just FFO and AFFO. Look at the balance sheet for debt levels, liquidity, and maturity schedules. Scrutinise the income statement for revenue growth, operating expenses, and net income. Review the cash flow statement to understand how the REIT is generating and using its cash.

Evaluate Dividend History and Sustainability

A consistent track record of paying and growing dividends is a positive sign. Critically examine the FFO/AFFO payout ratio to ensure the dividend is well-covered by operating cash flow. Be wary of exceptionally high yields that seem too good to be true, as they often are.

Research Management and Corporate Governance

Investigate the management team’s experience, their strategic vision, and their alignment with shareholder interests. Look for transparency in their reporting and any recent changes in leadership. Strong corporate governance practices inspire investor confidence.

Understand the Property Portfolio

Get a clear picture of the types of properties the REIT owns, their geographical locations, occupancy rates, and the quality and diversity of its tenant base. Are the properties in growing markets? Are the tenants financially strong?

Consider Macroeconomic Factors

Interest rates play a significant role in REIT performance. Rising rates can increase borrowing costs for REITs and make their dividends less attractive compared to fixed-income alternatives. However, some REITs are better positioned to handle rising rates due to conservative debt management or their ability to pass on higher costs through rent increases. Inflation can also impact REITs; while higher property values can be a benefit, rising operating costs can be a challenge. Understanding these macro trends is crucial for informed decision-making.

Use Valuation Multiples Wisely

While P/FFO and P/AFFO are good starting points, compare them to the REIT’s historical averages and to its direct competitors within the same sector. A REIT might appear “undervalued” based on an industry average, but still be fairly priced if its growth prospects are lower or its risks are higher than its peers.

Conclusion

Investing in undervalued REITs with high yields can be a powerful strategy for generating consistent income and achieving long-term capital appreciation. The key lies in a disciplined approach, moving beyond surface-level metrics to uncover the true value and sustainability of a REIT’s dividend. By focusing on robust FFO and AFFO, manageable debt levels, strong management, and favourable sector tailwinds, investors can identify opportunities that the broader market might be overlooking. While the allure of high income is undeniable, remember that a truly valuable REIT offers not just a high yield today, but a sustainable and potentially growing income stream for years to come. Do your homework, understand the nuances of real estate investing, and you might just unearth some hidden gems for your portfolio.

5 Unique FAQs After The Conclusion

1. How do rising interest rates specifically impact undervalued REITs, and what makes some more resilient than others?

Rising interest rates can pose a dual challenge for REITs. Firstly, they increase the cost of borrowing for new acquisitions and refinancing existing debt, which can squeeze profit margins and slow down growth. Secondly, higher rates make fixed-income investments like bonds more attractive, potentially drawing investors away from REITs and causing their share prices to dip. However, some undervalued REITs are more resilient. Those with conservative debt-to-EBITDA ratios and well-staggered debt maturity schedules are less exposed to immediate refinancing risks. Additionally, REITs operating in sectors with strong pricing power, such as certain industrial or healthcare segments with long-term leases and built-in rent escalators, can pass on increased costs to tenants, offsetting the impact of higher interest rates.

2. What role does “external management” versus “internal management” play in assessing an undervalued REIT’s long-term potential and dividend reliability?

The management structure of a REIT can significantly influence its long-term potential and dividend reliability. Internally managed REITs have their management team as direct employees, aligning their incentives more closely with shareholders. This typically leads to lower operating costs and a greater focus on long-term value creation. Externally managed REITs, on the other hand, pay an external advisory firm a fee to manage their assets, which can sometimes lead to conflicts of interest (e.g., fees based on asset size rather than performance) and potentially higher costs. When evaluating an undervalued REIT, an internally managed structure is often preferred as it generally points to better governance and a more direct commitment to shareholder returns and dividend sustainability.

3. Besides FFO and AFFO, what other non-financial metrics should I consider to identify truly undervalued REITs in niche sectors?

Beyond the standard financial metrics, several non-financial metrics can offer insights into an undervalued REIT, especially in niche sectors. For data center REITs, consider power usage effectiveness (PUE), connectivity options, and the diversity of their cloud provider tenants. For healthcare REITs, look at healthcare reform impacts, the demographic trends of the aging population, and regulatory changes affecting their operators. For industrial REITs, examine e-commerce penetration rates, global supply chain shifts, and infrastructure spending in their operational regions. These specific operational indicators provide a deeper understanding of the underlying business strength and future growth drivers that might not be immediately obvious from financial statements alone.

4. How can I differentiate between a temporary dip in a REIT’s price that signals undervaluation and a more permanent decline due to structural issues?

Differentiating between a temporary dip and a permanent decline requires careful analysis. A temporary dip often stems from broader market sentiment (e.g., interest rate concerns, general economic slowdowns) or short-term company-specific news (e.g., a single tenant default, a slightly lower-than-expected earnings report). The underlying fundamentals of the REIT – strong FFO/AFFO, low payout ratio, healthy balance sheet, and a resilient sector – would generally remain intact. A permanent decline, however, often points to structural issues. This could be a sustained downturn in the specific real estate sector (e.g., obsolescence of a property type), chronic mismanagement, unsustainable debt levels, or a significant loss of key tenants without a clear recovery path. Thorough research into industry trends, management quality, and consistent monitoring of key financial health indicators can help you make this crucial distinction.

5. Are there any tax implications specific to REIT dividends that income investors should be aware of, especially when seeking high yields?

Yes, there are important tax implications for REIT dividends. Unlike qualified dividends from many other corporations, REIT dividends are generally not eligible for the preferential lower tax rates (which are typically taxed at long-term capital gains rates in many jurisdictions). Instead, they are usually taxed as ordinary income. This means that high-yield REIT dividends can be subject to your regular income tax rate, which might be higher. It’s crucial for income investors to consider this tax treatment when evaluating the net return from high-yield REITs. Investing in REITs within tax-advantaged accounts, such as an ISA (Individual Savings Account) in the UK or a Roth IRA/401(k) in the US, can help mitigate these tax liabilities, allowing you to enjoy the full benefit of their generous distributions. Always consult with a tax advisor for personalized guidance.