Unearthing Hidden Gems: investing in Low-Competition Smart Lighting Stocks

The world is getting smarter, and our homes and cities are no exception. At the forefront of this revolution is smart lighting – a technology that goes far beyond simply turning lights on and off. We’re talking about intelligent systems that adapt to our needs, save energy, and even enhance our well-being. As the smart lighting market continues its impressive growth trajectory, savvy investors are on the lookout for opportunities. While big names dominate the headlines, there are often lesser-known, low-competition smart lighting stocks that could offer significant returns for those willing to do their homework. This in-depth article will delve into the nuances of finding these hidden gems, exploring the factors that make a smart lighting company a compelling investment, and highlighting the overlooked corners of this burgeoning industry.

The Lure of Smart Lighting

Smart lighting isn’t just a fancy gadget; it’s a fundamental shift in how we interact with our illuminated environments. The market is propelled by a confluence of powerful trends. Energy efficiency is a primary driver, as businesses and consumers alike seek to reduce their carbon footprint and save on electricity bills. Smart LEDs, with their remarkable longevity and low power consumption, are at the heart of this. Beyond simple savings, smart lighting offers enhanced convenience through automation, remote control, and integration with voice assistants and other smart home devices. Imagine lights that dim automatically as the sun sets, or outdoor lighting that brightens only when motion is detected. These features are no longer futuristic fantasies but everyday realities.

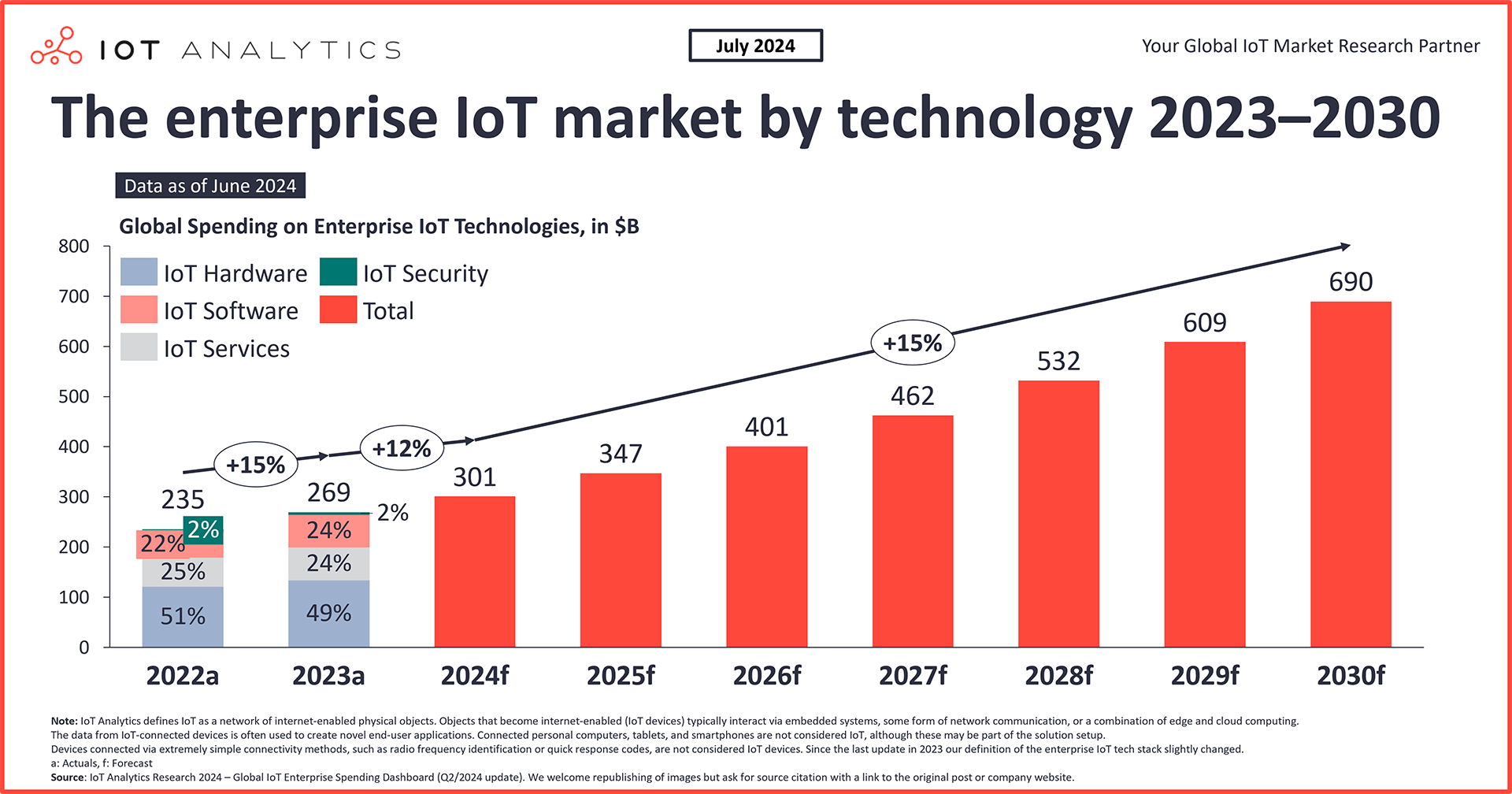

Furthermore, the concept of human-centric lighting (HCL) is gaining traction. HCL aims to mimic natural light cycles, positively impacting mood, productivity, and sleep patterns. This goes beyond mere illumination; it’s about creating healthier, more responsive environments. The growth of smart cities also plays a crucial role, with governments investing heavily in intelligent street lighting systems that can be remotely monitored and controlled, contributing to public safety and energy conservation. The Internet of Things (IoT) is the invisible thread connecting all these elements. Smart lighting fixtures are increasingly becoming nodes in a vast network, collecting data and interacting with other smart devices to create truly intelligent spaces. This interconnectedness unlocks new possibilities for data analysis, predictive maintenance, and personalized experiences, further cementing smart lighting’s place in our connected future.

Identifying Low-Competition Opportunities

When we talk about “low-competition” stocks, we’re generally referring to companies that might be undervalued, overlooked by institutional investors, or operating in niche segments of a larger market. In the smart lighting space, this doesn’t necessarily mean small, obscure startups with no track record. It could include established companies with a strong foothold in a specific smart lighting application, innovative technology providers, or firms with robust intellectual property in a less crowded area. The key is to look beyond the obvious market leaders like Signify (Philips Hue) or Acuity Brands.

One way to identify these opportunities is by examining the value chain of smart lighting. This includes manufacturers of specific components like advanced sensors, specialized LED drivers, or unique communication modules (e.g., Li-Fi components, if that technology gains more widespread adoption). Another avenue is to focus on niche applications. While residential smart lighting is a competitive space, areas like industrial smart lighting for factories and warehouses, horticultural lighting for indoor farming, or even specialized medical lighting could present less crowded investment opportunities. Companies specializing in “lighting as a service” (LaaS) models, where customers pay for lighting solutions and maintenance rather than purchasing equipment outright, might also be worth investigating. This subscription-based model can provide stable, recurring revenue streams.

Furthermore, consider geographical markets that are rapidly adopting smart lighting but haven’t yet attracted the same level of investment scrutiny as more mature markets. Asia Pacific, for instance, is experiencing significant growth in smart city initiatives and energy efficiency drives, making it a hotbed for potential investment. Companies with strong local partnerships or a deep understanding of regional market needs could have a distinct advantage. Regulatory tailwinds also play a crucial role. Governments worldwide are implementing policies and incentives that promote energy-efficient and smart lighting solutions. Companies that are well-positioned to benefit from these mandates, perhaps through specialized products or compliance expertise, could see accelerated growth.

Delving Deeper: What to Look For in a Smart Lighting Stock

Beyond identifying a low-competition niche, a thorough due diligence process is essential. Here are some key factors to consider when evaluating smart lighting stocks:

Innovative Technology and IP

Does the company possess unique patents or proprietary technology that gives it a competitive edge? This could be in areas like advanced light control algorithms, highly efficient LED designs, novel sensor integration, or secure IoT platforms for lighting systems. A strong intellectual property portfolio can act as a significant barrier to entry for competitors.

Niche Market Focus

As discussed, a company that dominates a specific, less saturated segment of the smart lighting market can be more attractive than one vying for market share in a crowded general consumer space. This could be in areas like smart lighting for healthcare facilities, retail analytics using lighting, or even specialized outdoor architectural lighting.

Strong Financials and Growth Potential

Even in low-competition areas, financial health is paramount. Look for companies with consistent revenue growth, healthy profit margins, and a clear path to profitability. Evaluate their balance sheet for manageable debt and sufficient cash flow to fund future growth and innovation.

Management Team Expertise

A visionary and experienced management team is crucial. Look for leaders with a deep understanding of the lighting industry, a proven track record of innovation, and a clear strategic vision for the company’s future in the smart lighting landscape. Their ability to navigate technological shifts and market demands is vital.

Scalability of Operations

Can the company efficiently scale its production and distribution to meet increasing demand? This is particularly important for smaller companies looking to expand their market reach. Efficient supply chains and manufacturing processes are key indicators.

Partnerships and Collaborations

Strategic partnerships with other technology companies, smart home platforms, or even government entities can significantly boost a smart lighting company’s prospects. These collaborations can open new distribution channels, integrate products into larger ecosystems, and accelerate market adoption.

Recurring Revenue Models

Companies that offer “lighting as a service” (LaaS) or other subscription-based models can provide more predictable and stable revenue streams, which is attractive to investors. This model shifts the focus from one-time sales to long-term customer relationships and continuous service.

Regulatory Compliance and Certifications

Given the increasing focus on energy efficiency and smart city standards, companies with a strong track record of regulatory compliance and relevant certifications will have an advantage. This demonstrates their commitment to quality and adherence to industry best practices.

Customer Acquisition Strategy

How does the company plan to reach its target audience and convert them into customers? A clear and effective sales and marketing strategy, whether direct-to-consumer, B2B, or through strategic partnerships, is essential for sustainable growth.

Competitive Advantages Beyond Price

In a growing market, it’s easy for companies to compete on price. However, sustainable success often comes from other competitive advantages, such as superior product performance, exceptional customer service, a strong brand reputation within its niche, or proprietary technology that delivers unique benefits.

The Long Game: Patience and Due Diligence

Investing in low-competition stocks, especially in an emerging technology sector like smart lighting, often requires a long-term perspective. These companies may not experience explosive growth overnight, but their potential for sustained, significant returns can be substantial if they successfully execute their strategy. It’s about identifying companies that are building a solid foundation, innovating within their niche, and are poised to capture a larger share of the market as the smart lighting revolution continues to unfold.

Remember, the absence of widespread analyst coverage or media attention can be a double-edged sword. While it might indicate an overlooked opportunity, it also means that information may be harder to come by, necessitating more independent research. Don’t rely solely on online forums or casual recommendations. Dig into financial reports, investor presentations, and industry analyses. Consider the broader macroeconomic environment and how it might impact the smart lighting sector. Is there a shift towards more sustainable infrastructure? Are energy prices driving a greater need for efficiency? These larger trends can significantly influence the performance of smart lighting stocks.

The Future is Bright (and Smart)

The smart lighting market is undoubtedly a growth industry, with projections consistently pointing towards significant expansion over the coming years. As urbanization continues, smart city initiatives accelerate, and the demand for energy-efficient, responsive, and human-centric environments grows, the underlying drivers for smart lighting remain incredibly strong. While the dominant players will undoubtedly capture a large share of this growth, the fragmented nature of the market and the constant innovation within the space create fertile ground for smaller, more agile companies to carve out their own valuable niches. By focusing on low-competition segments, innovative technologies, and strong fundamentals, investors can position themselves to potentially benefit from the illuminating future of smart lighting.

Conclusion

The smart lighting market, while boasting some prominent players, still offers fertile ground for investors seeking low-competition opportunities. By looking beyond the obvious, focusing on niche applications, innovative technologies, and strong operational fundamentals, it’s possible to unearth companies with significant growth potential. The key lies in thorough research, a long-term perspective, and a keen understanding of the specific value propositions these lesser-known entities bring to the evolving world of intelligent illumination. As the global push for energy efficiency and smarter infrastructure continues, the light will only grow brighter for these hidden gems in the smart lighting sector.

5 Unique FAQs After The Conclusion

1. How does the concept of “Human-Centric Lighting” (HCL) specifically create low-competition investment opportunities, compared to general smart lighting?

HCL goes beyond basic automation; it focuses on lighting systems designed to improve human well-being, mood, and productivity by mimicking natural light cycles. This requires specialized research, advanced controls, and often, more complex integration. Companies excelling in HCL solutions might operate in a more exclusive, less crowded segment compared to those offering standard smart bulbs, focusing on B2B applications in offices, healthcare, or educational institutions where the benefits of HCL are highly valued and the customer base is more discerning and willing to invest in premium solutions.

2. Besides Asia Pacific, are there other overlooked geographical regions that might offer low-competition smart lighting stock opportunities due to unique regulatory or market conditions?

While Asia Pacific is indeed a significant growth area, other regions could offer niche opportunities. Emerging markets in Latin America or Africa, where infrastructure development is accelerating and there’s a strong emphasis on sustainable growth, might have local smart lighting companies that are well-positioned but not yet on the global investment radar. Additionally, specific regions within developed markets that are leading in specific smart city initiatives or have unique energy efficiency mandates could foster localized, low-competition players with specialized expertise.

3. What role do open standards and interoperability play in identifying “low-competition” smart lighting stocks, and could a company focusing on proprietary systems still be a good investment?

Open standards (like Zigbee, Thread, or Matter) promote wider adoption and interoperability, which is generally positive for the market as a whole. However, a company with a highly innovative, proprietary system that delivers unique and superior performance in a specific niche (e.g., ultra-secure lighting for critical infrastructure, or highly specialized horticultural lighting) could still be a strong investment, especially if its technology creates a significant competitive moat and its target market is willing to invest in a closed ecosystem for superior results. The key is evaluating if the proprietary advantages outweigh the potential limitations of non-interoperability.

4. Given the rapid pace of technological change in IoT and AI, how can investors assess the longevity and adaptability of a small smart lighting company’s technology to remain “low-competition” in the long run?

Assessing longevity requires a deep dive into the company’s R&D pipeline, its approach to intellectual property, and its strategic partnerships. Look for evidence of continuous innovation, investment in future-proof technologies (like quantum dot LEDs or advanced Li-Fi research), and a clear strategy for integrating new advancements. A company’s ability to adapt its core technology to new applications or market demands, rather than relying on a single product, is also a strong indicator of long-term viability in a fast-evolving tech landscape.

5. What are some indirect or tangential industries that, if invested in, could benefit from the growth of low-competition smart lighting companies, even without directly investing in the lighting companies themselves?

Indirect investment opportunities could exist in several areas. This includes companies that manufacture specialized sensors or microchips essential for smart lighting systems, providers of secure cloud platforms for IoT device management, firms developing AI and data analytics solutions that optimize smart lighting performance, or even companies specializing in advanced materials used in next-generation LED manufacturing. Investing in the foundational technologies that enable smart lighting, rather than the end-product manufacturers, can offer a diversified approach to capitalizing on this growing market.