The world of investing often shines a spotlight on the big players, the household names that dominate headlines and portfolios. But beneath the surface, especially in critical sectors like electrical infrastructure, lie numerous “underfollowed” gems – companies that might not boast multi-billion dollar market caps but are nevertheless integral to a functioning society and hold significant growth potential. One such fascinating corner is the electrical switchgear industry.

The Unsung Heroes of Electrical Grids: What is Switchgear?

Before we dive into the investment opportunities, let’s understand what exactly electrical switchgear is. Imagine the intricate network of wires, substations, and power plants that bring electricity to our homes and businesses. It’s a complex dance of high voltage and current, and without proper control and protection, it would be a chaotic, dangerous mess. That’s where switchgear comes in.

In simple terms, switchgear is a comprehensive system of electrical disconnect switches, fuses, or circuit breakers used to control, protect, and isolate electrical equipment. It’s like the traffic cop of the electrical grid, directing the flow of power, preventing overloads, and isolating faulty sections to keep the lights on safely. From massive power plants to your local substation, and even in large industrial facilities, switchgear is absolutely indispensable.

Why the Switchgear Sector is More Exciting Than You Think

While it might not have the glamour of AI or electric vehicles, the electrical switchgear market is far from stagnant. In fact, it’s undergoing significant evolution and experiencing robust growth, driven by several powerful, long-term trends:

Modernization of Aging Infrastructure

Many developed nations, including parts of Europe and North America, have aging electrical grids that are decades old. These older systems are less efficient, more prone to outages, and lack the digital capabilities required for modern energy management. The need to upgrade and replace this legacy infrastructure is a massive, ongoing undertaking that directly fuels demand for new, advanced switchgear. Think of it as a rolling renovation project for the backbone of our power supply.

The Global Energy Transition and Renewable Integration

This is perhaps the biggest tailwind for the switchgear industry. As the world shifts towards renewable energy sources like solar, wind, and hydro, the electrical grid becomes more complex. Intermittent energy sources require sophisticated switchgear to manage fluctuations, integrate seamlessly with existing grids, and ensure stable power delivery. Every new solar farm or wind turbine installation requires new switchgear to connect to the grid, and existing grids need upgrades to handle bidirectional power flow. This isn’t a temporary fad; it’s a fundamental reshaping of how we generate and distribute electricity.

Rapid Urbanization and Industrialization in Emerging Economies

Countries in Asia Pacific, Africa, and South America are experiencing unprecedented rates of urbanization and industrial growth. This translates directly into a skyrocketing demand for electricity. To meet this demand, these regions are rapidly building out new power generation plants, transmission lines, and distribution networks – all of which require vast amounts of switchgear. The sheer scale of development in these regions presents a massive market opportunity.

The Rise of Smart Grids and Digitalization

The traditional electrical grid is becoming “smart.” This means integrating digital technologies, IoT (Internet of Things) sensors, and even artificial intelligence (AI) into the system for real-time monitoring, predictive maintenance, and automated control. Smart switchgear, equipped with these capabilities, can detect faults before they cause outages, optimize power flow, and enhance overall grid efficiency and reliability. This technological leap is creating demand for a new generation of sophisticated switchgear products.

Increased Focus on Energy Efficiency and Sustainability

Beyond just managing power, there’s a growing emphasis on making electrical systems more energy-efficient and environmentally friendly. This drives innovation in switchgear, leading to the development of greener insulation materials (moving away from SF6 gas, a potent greenhouse gas), more compact designs, and solutions that reduce energy losses. Companies at the forefront of these sustainable innovations are well-positioned for future growth.

Hunting for Underfollowed Switchgear Stocks: What to Look For

Identifying underfollowed stocks isn’t about chasing headlines; it’s about deep diving into companies that might be overlooked by the broader market but possess strong fundamentals and compelling growth narratives. When considering electrical switchgear companies, here are a few characteristics to keep an eye out for:

Specialization in Niche or High-Growth Areas

While large conglomerates offer a broad range of switchgear, smaller, underfollowed companies might specialize in a particular niche. This could be high-voltage DC switchgear for renewable energy projects, smart grid components, or solutions for specific industrial applications like data centers or electric vehicle charging infrastructure. Specialization can lead to higher margins and a stronger competitive position within that niche.

Strong Order Books and Project Pipelines

A healthy order book is a clear indicator of future revenue. Companies winning significant contracts for grid modernization, renewable energy projects, or new industrial facilities demonstrate strong demand for their products and services. Look for consistent growth in their backlog and announcements of new project wins.

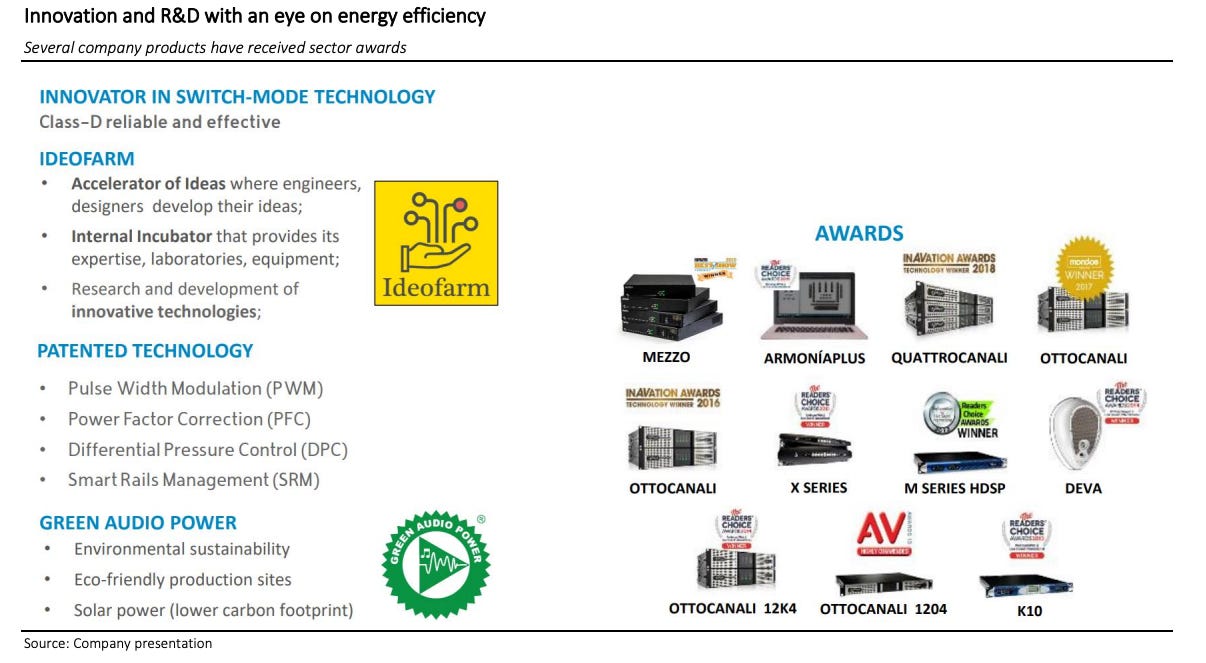

Investment in Research and Development (R&D)

The switchgear industry is evolving, particularly with the advent of smart technologies and sustainable solutions. Companies that are actively investing in R&D to develop innovative, future-proof products are more likely to capture market share and maintain a competitive edge. This could include advancements in digitalization, eco-friendly materials, or miniaturization.

Regional Dominance or Export Potential

Some underfollowed companies might have a dominant position in a specific geographic region with high growth potential, like emerging markets in Asia or Africa. Others might have developed a strong export business, allowing them to tap into diverse global markets and reduce reliance on any single economy.

Healthy Financials and Management

Even if a company is underfollowed, solid financial health is paramount. Look for consistent revenue growth, healthy profit margins, manageable debt levels, and strong cash flow. Furthermore, a transparent and experienced management team with a clear vision for the company’s future is a significant plus. Their ability to navigate market shifts and execute on growth strategies is crucial.

Potential Underfollowed Players (Examples for Illustrative Purposes Only – Not Investment Advice)

It’s important to reiterate that this is not financial advice, and any investment decisions should be made after thorough personal research and consultation with a financial advisor. The companies mentioned below are examples of types of firms that could be considered underfollowed in the broader market, based on their size, specialization, or regional focus, but their specific investment merits would require much deeper investigation.

Companies Focused on Medium and Low Voltage Switchgear for Infrastructure Development

Many smaller firms specialize in the design and manufacturing of medium and low voltage switchgear, which are essential for commercial buildings, residential complexes, and local distribution networks. As urbanization continues globally, the demand for these foundational components remains robust. These companies might not be involved in the massive high-voltage transmission projects but are crucial for the “last mile” of electricity delivery. Look for companies with strong relationships with local utilities and contractors.

Specialists in Renewable Energy Integration Switchgear

With the surge in solar and wind power, there’s a growing need for specialized switchgear that can handle the unique challenges of renewable energy integration, such as grid stability and bidirectional power flow. Some smaller companies are focusing specifically on these solutions, offering compact, intelligent switchgear designed for renewable energy plants and battery storage systems. They might be overlooked by investors who focus on the larger renewable energy developers.

Manufacturers of Eco-Friendly and Smart Switchgear Solutions

The move away from SF6 gas and towards more sustainable, digitally-enabled switchgear creates opportunities for innovative smaller companies. These firms might be developing vacuum switchgear for higher voltage applications or incorporating advanced IoT and AI capabilities into their products. Their smaller size might allow them to be more agile in adopting new technologies.

Companies with Strong Regional Footprints in Emerging Markets

While the big global players are present everywhere, some regional companies have built strong market share and expertise in fast-growing emerging economies. These companies might benefit from local government initiatives to expand electrification and industrialization, and their understanding of regional market dynamics can give them an edge. However, investing in these regions also carries specific risks that need to be carefully evaluated.

The Long Game: Why Patience is a Virtue

Investing in underfollowed stocks, especially in an industrial sector like switchgear, often requires a long-term perspective. These aren’t typically “get rich quick” plays. Instead, their value tends to appreciate as their underlying markets grow, their innovations gain traction, and their financial performance improves over time. Patience allows you to ride out short-term market fluctuations and benefit from the compounding effect of their consistent growth.

Furthermore, being underfollowed can sometimes mean that these stocks are undervalued by the market. As their performance becomes more apparent, or as the broader market starts to recognize the importance of the switchgear sector, these companies could see a re-rating of their valuations.

Navigating the Challenges

Of course, no investment comes without its challenges. For underfollowed switchgear stocks, some considerations include:

Liquidity:

Smaller companies might have lower trading volumes, making it harder to buy or sell shares quickly without impacting the price.

Information Availability:

There might be less analyst coverage and publicly available information compared to larger, more widely followed companies, requiring more independent research.

Competition from Giants:

The switchgear market does have large, established players. Underfollowed companies need a clear competitive advantage, whether it’s through specialization, cost efficiency, or superior technology.

Economic Sensitivity:

The demand for switchgear is tied to infrastructure spending and industrial activity, which can be sensitive to economic cycles.

Conclusion

The electrical switchgear industry, though often out of the mainstream investment spotlight, is a vital and growing sector propelled by global megatrends like grid modernization, renewable energy integration, and urbanization. Within this crucial industry, underfollowed companies, often specializing in specific niches or serving high-growth regions, represent compelling long-term investment opportunities for those willing to do their homework. By focusing on strong fundamentals, innovative products, and strategic market positioning, investors can potentially uncover the unsung heroes of the electrical grid and power their portfolios with a steady current of growth. While patience and thorough due diligence are key, the future looks bright for the companies that are quite literally keeping the lights on in a rapidly evolving world.

5 Unique FAQs After The Conclusion

How does the development of smart cities impact the demand for electrical switchgear?

The development of smart cities significantly boosts the demand for advanced electrical switchgear. Smart cities rely heavily on interconnected, intelligent grids to manage power efficiently, integrate renewable sources, and ensure reliability. This necessitates switchgear with integrated sensors, real-time monitoring capabilities, and automated control systems, moving beyond traditional mechanical switchgear to highly digitized solutions that support dynamic energy management and predictive maintenance.

What role do government regulations and incentives play in the growth of the underfollowed switchgear market?

Government regulations and incentives play a crucial role. Policies promoting renewable energy adoption, smart grid development, and infrastructure modernization directly stimulate demand for new and upgraded switchgear. Additionally, regulations focused on environmental sustainability, such as phasing out harmful gases like SF6, drive innovation towards greener switchgear technologies, creating opportunities for companies that are agile in developing and adopting these compliant solutions.

Are there specific technological innovations within switchgear that could create disproportionate growth for smaller companies?

Absolutely. Miniaturization of switchgear components, advancements in vacuum interrupter technology (as an alternative to gas-insulated systems), and the deeper integration of IoT and AI for enhanced diagnostics and remote operation are key areas. Smaller, agile companies that can rapidly innovate and specialize in these cutting-edge solutions, perhaps offering more flexible or custom designs, might find themselves with a significant competitive edge over larger, slower-moving incumbents.

What are the primary risks associated with investing in smaller, underfollowed electrical switchgear companies compared to industry giants?

The primary risks include lower liquidity, which can make it challenging to enter or exit positions quickly without affecting the stock price. There’s also often less analyst coverage and publicly available information, requiring more intensive independent research. Additionally, smaller companies might have less diversified revenue streams, making them more vulnerable to shifts in specific market segments or competition from larger players with greater resources.

Beyond revenue and profit, what non-financial metrics should investors consider when evaluating underfollowed switchgear stocks?

Beyond financial metrics, investors should consider the company’s patent portfolio and R&D pipeline, indicating their commitment to innovation. The strength of their customer relationships, particularly with utilities or major industrial clients, is also important. Assessing their environmental, social, and governance (ESG) practices, especially concerning sustainable manufacturing and eco-friendly products, can also be a long-term value driver as global focus on sustainability increases.